(Bloomberg) — Japanese stocks rose along with US equity futures after the Federal Reserve cut interest rates by half a percentage point and signaled further easing in the months ahead.

Most Read from Bloomberg

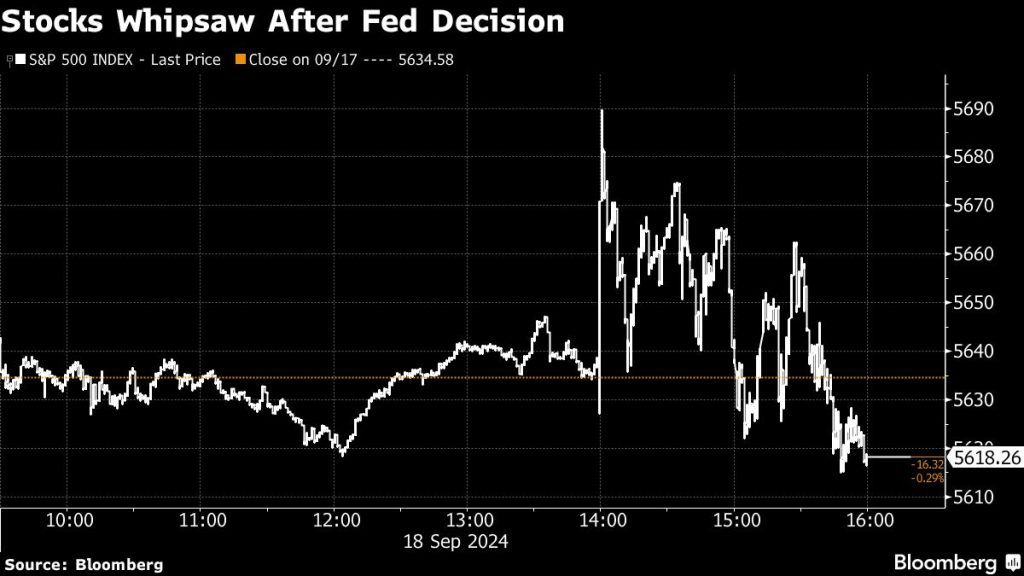

Japan’s Topix and Nikkei 225 indexes rallied as the yen slumped over 1% against the dollar. US stock futures advanced after the S&P 500 initially touched a record before closing 0.3% lower. Chinese and Australian equities traded in a narrow range.

“Asian stock markets are gaining on the immediate benefit of the rate cut,” Naomi Fink, chief global strategist for Nikko Asset Management, said on Bloomberg Television. She warned about the growing risks to markets as US equities reflect strong earnings growth, while the bond market expects economic weakness to justify further Fed cuts. “You can’t have both.”

The Fed’s first cut in more than four years was accompanied by projections indicating an additional 50 basis points of cuts across the remaining two policy meetings this year. While Fed Chair Jerome Powell cautioned against assuming big rate cuts would continue, the reduction means regional central banks can also start to ease without worrying about exchange rate pressures.

“The initial phase of the Fed’s normalization cycle has been more assertive than expected, as the central bank recalibrated its policy focus to address labor market conditions,” said Manish Bhargava, chief executive officer at Straits Investment Management. “While inflation remains a key concern, recent softening in employment metrics has prompted the Fed to adjust its strategy, emphasizing support for the job market in the near term.”

An index of dollar strength climbed on Thursday, while the yen weakened to hover near 144 per greenback. Treasury 10-year yields rose, with their Australian and New Zealand counterparts echoing the move.

The greenback’s gains weighed on emerging Asian currencies, with the Thai baht, Malaysian ringgit and Chinese yuan all registering declines.

“Price action post-Fed was a mild position flush and perhaps there will be more US dollar buying in Asia, particularly against the yen, won and yuan,” said Brad Bechtel, global head of foreign exchange at Jefferies. “Traders may take profits following the rallies in rupiah, ringgit and baht.

Over in South Korea, shares of SK Hynix Inc. plunged, leading peers lower, after Morgan Stanley cut its rating on the memory chipmaker two notches on its fading pricing power.

Fed Cut Positive for Asian Stocks, Risk Currencies, Analysts Say

In the US, equities, especially those of economically sensitive companies, briefly surged Wednesday, driving the S&P 500 up as much as 1%. From stocks to Treasuries, corporate bonds to commodities, every major asset was down Wednesday. While the scale of the declines were minor, a concerted pullback like that hadn’t followed a Fed policy decision since June 2021.

Gold was steady following a tumultuous session in which it touched a record high after the Fed rate cut. Oil slipped for a second session.

In Asia, the Hong Kong Monetary Authority cut its base interest rate for the first time since 2020 following the Fed’s cut, while New Zealand’s economy shrank in the second quarter. Data set for release in the region includes unemployment for Hong Kong, trade figures for Malaysia and an interest rate decision in Taiwan.

Bank of Korea Governor Rhee Chang-yong said Thursday the Fed’s cuts reduced pressure on the foreign exchange market and allow the central bank to focus on domestic factors in setting policy.

Elsewhere, the Bank of England is likely to refrain for cutting rates for a second consecutive meeting.

Treasuries, which are set for a fifth straight month of gains in September, slipped after the Fed’s decision and Powell’s remarks. Officials’ updated quarterly forecasts showed the median projections were for the funds rate to fall by year’s end to 4.375% — representing a further half-point of total reductions this year. By the end of 2025 and 2026, the median forecasts are for 3.375% and 2.875%, respectively.

“It now will be a battle between market expectations and the Fed, with employment data — not inflation data — determining which side is right,” said Jack McIntyre at Brandywine Global. “Now, everyone is back to data dependency.”

Key events this week:

-

UK rate decision, Thursday

-

US Conf. Board leading index, initial jobless claims, existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Eurozone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.5% as of 9:46 a.m. Tokyo time

-

Japan’s Topix rose 2%

-

Australia’s S&P/ASX 200 rose 0.2%

-

Euro Stoxx 50 futures rose 0.7%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro fell 0.2% to $1.1099

-

The Japanese yen fell 0.7% to 143.29 per dollar

-

The offshore yuan fell 0.1% to 7.1041 per dollar

Cryptocurrencies

-

Bitcoin rose 3.3% to $62,244.63

-

Ether rose 2.8% to $2,391.69

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.72%

-

Japan’s 10-year yield advanced 2.5 basis points to 0.850%

-

Australia’s 10-year yield advanced five basis points to 3.92%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu and Yasutaka Tamura.

(An earlier version of this story was corrected to correct the attribution to a quote)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.