In the U.S., where cities can be spread out and require long-distance drives, car ownership is a part of life. However, cars can be vehicles for debt as well, just as they can be vehicles for transportation.

Consider This: Would Warren Buffett Finance a New Car? Here’s What He’d Say About a Big Auto Purchase

Explore More: Warren Buffett: 10 Things Poor People Waste Money On

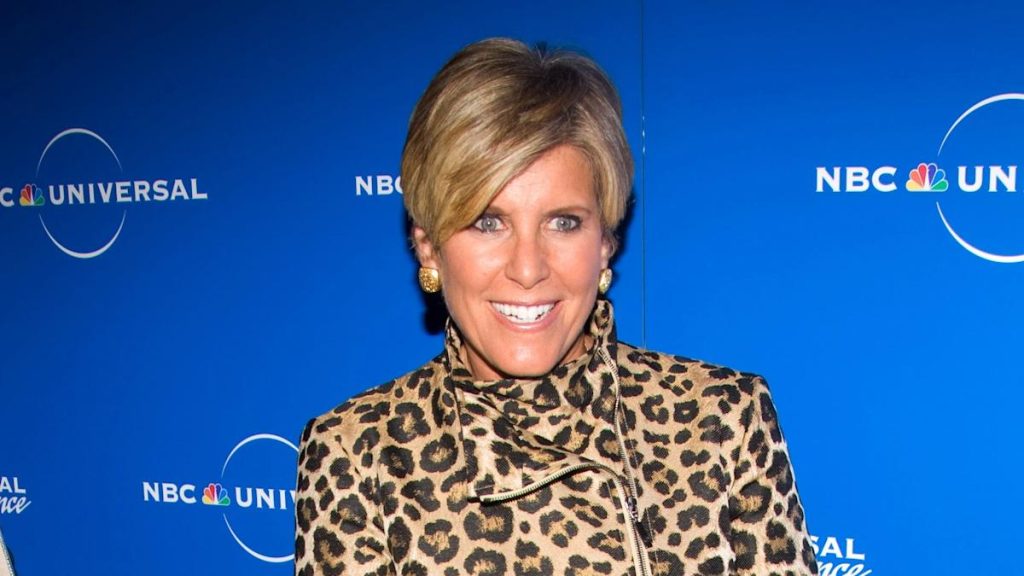

American personal finance expert, author and podcaster Suze Orman knows this and has some helpful considerations for prospective car buyers.

In most situations, cars are not great financial investments on their own. Cars quickly depreciate after you drive them off the lot. According to the American Automobile Association (AAA), new cars lose about 20% of their value after year one and 60% by year five. On average, these vehicles lose $4,680 in value per year.

Social pressure may convince you to get a new car, even if you don’t really need one, but Orman advocates against it in most cases. People are often dishonest with themselves about their financial situation and believe the flashiness of the vehicle will be worth it. Even if you can afford the payments on a new car, that doesn’t mean it’s the best choice. Putting that money toward paying off your debt, padding your retirement funds or buying a home will likely pay off much better than buying a new car.

Advertisement: High Yield Savings Offers

Read Next: I’m a Car Expert — 6 Affordable and Reliable SUVs for Families of 4 or More

Orman also points out that upside-down auto loans are at an all-time high. When someone is upside down on a loan, it means their vehicle has depreciated so much that they owe more on the initial loan than their actual car is worth. For example, if you buy a car for $35,000 with a loan and it depreciates by 20% after the first year, the car itself will be worth $28,000. However, depending on the interest you need to pay, you might still owe $32,000 after that first year. This means even if you sell your car for its full value one year later, you’ll still owe an additional $4,000, without anything to show for it.

According to Edmunds, 24.9% of trade-ins for new cars are underwater, which is up from 20.4% in the previous year. On top of that, a quarter of those upside-down loans have more than $10,000 remaining on the balance. This type of negative equity can catapult you into bad financial territory in a hurry, which is why Orman thinks you shouldn’t purchase a car unless you absolutely need to.

For many, of course, having a car is an essential part of life. You may live in a rural area with limited public transportation, need to drive long distances for work or have family responsibilities that involve a lot of driving. Whatever the reason, Orman knows that for many, saying no to a car isn’t an option.