U.S. stock futures fell on Tuesday after a stellar rally on Monday. Futures of major benchmark indices were trading lower in premarket.

Tech, consumer discretionary, and communication services led Monday’s rally as stocks surged on the tariff truce with China.

President Donald Trump signed an executive order Monday, seeking to slash U.S. drug prices, fulfilling a social media pledge to achieve cuts of at least 59%.

Meanwhile, the 10-year Treasury bond yielded 4.45% and the two-year bond was at 3.98%. The CME Group’s FedWatch tool‘s projections show markets pricing a 91.8% likelihood of the Federal Reserve keeping the current interest rates unchanged in its June meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.20% |

| S&P 500 | -0.44% |

| Nasdaq 100 | -0.54% |

| Russell 2000 | -0.25% |

The SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust ETF QQQ, which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 0.42% to $580.57, while the QQQ declined 0.50% to $505.29, according to Benzinga Pro data.

Cues From Last Session:

Information technology, consumer discretionary, and communication services sectors saw the biggest gains on Monday. The Dow Jones index soared over 1,100 points as the U.S. and China agreed to a 90-day tariff truce, effective May 14.

This, along with the Trump administration’s progress to further formal trade talks amid growing economic pressures, fueled the market optimism.

However, this positive Monday followed a down week for major U.S. indices, with the S&P 500, Nasdaq, and Dow all closing lower on Friday.

In stock-specific news, NRG Energy Inc. NRG reported strong first-quarter results, while Kindly MD Inc.‘s KDLY shares skyrocketed following a Bitcoin BTC/USD treasury strategy merger.

Meanwhile, utility stocks moved against the broader market trend, closing lower.

After Monday, all the indices were out of the correction zone. The S&P 500 index was down 4.93% from its record high of 6,147.43 points, scaled on Feb. 19. Dow Jones was 5.91% lower than its 52-week high of 45,073.63 points, and Nasdaq 100 was 6.09% lower than its previous high of 22,222.61 points.

The Dow Jones index declined 119 points or 0.29% to 41,249.38, whereas the S&P 500 index fell 0.071% to 5,659.91. Nasdaq Composite ended 0.004% higher at 17,928.92, and the small-cap gauge, Russell 2000, dropped 0.16% to 2,023.07.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 4.35% | 18,708.34 |

| S&P 500 | 3.26% | 5,844.19 |

| Dow Jones | 2.81% | 42,410.10 |

| Russell 2000 | 3.42% | 2,092.20 |

Insights From Analysts:

Ryan Detrick from Carson Research highlighted in an X post that more than 55% of the S&P 500 components made a new 20-day high on Monday.

According to the historical data presented by him, the S&P 500 index ended 16.3% higher on average following days with such fresh 20-day highs. Out of the 30 times this has happened, the index has closed the year on a positive note 29 times.

“This is yet another clue the lows are likely in and better times are coming,” Detrick wrote in an X post.

The S&P 500 index has a year-to-date performance low of 15.3%. Detrick highlighted that “Only three times in history has the S&P 500 been down at least 15% YTD and moved back to positive by the end of the year.”

Despite having only three such instances historically, he added that 2025 could be the fourth such year.

“Call me crazy, but this year will be number four,” he said.

After the 90-day tariff pause between the U.S. and China, John Murillo, chief dealing officer of B2BROKER, a global fintech solutions provider, said that the news triggered an immediate positive market response.

“Stocks and oil prices have rebounded – apparently, in reaction to the news, which can lead to lower costs for businesses and consumers,” Murillo noted.

Despite the initial positive action following the announcement, Murillo emphasized the temporary nature of the agreement. “Now, while the 90-day pause is a big step towards easing tensions, it’s crucial to remember that it doesn’t guarantee a complete resolution of the trade war.”

Meanwhile, Ed Yardeni, the President of Yardeni Research, has lowered his U.S. recession probability to 25% while raising his S&P 500 target to 6,500 points for this year, following the trade deal with China. —

See Also: How to Trade Futures

Upcoming Economic Data

Here’s what investors will keep an eye on Tuesday:

- April’s NFIB optimism index will be out by 6:00 a.m., whereas headline and core CPI data for April will be released by 8:30 a.m. ET.

Stocks In Focus:

- Under Armour Inc. UAA rose 1.45% in premarket on Tuesday as it is expected to report earnings before the opening bell. Analysts expect a quarterly earnings of 8 cents per share on the revenue of $1.16 billion.

- Cyberark Software Ltd. CYBR was up 0.94% as Wall Street expects it to report earnings of 79 cents per share on revenue of $305.23 billion before the opening bell.

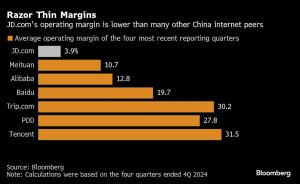

- JD.com Inc. JD was 1% lower ahead of its earnings. Analysts expect earnings of $1.02 per share on revenue of $37.91 billion.

- Acadia Healthcare Company Inc. ACHC jumped 4.99% after reporting better-than-expected first-quarter financial results after the closing bell on Monday. The company posted adjusted earnings of 40 cents per share, with revenue of $770.50 million.

- Coinbase Global Inc. COIN surged 8.98% after the announcement that the company will join the S&P 500, effective before the opening of trading on Monday, May 19.

- Sangamo Therapeutics Inc. SGMO dropped 31.51% after reporting a quarterly loss of $0.14 per share versus the Zacks Consensus Estimate of a loss of $0.11.

- Accelerate Diagnostics Inc. AXDX slumped 17.97% after it filed for Chapter 11 bankruptcy, leading to a delisting notice from Nasdaq due to non-compliance with listing requirements.

- Microvision Inc. MVIS tumbled 13.22% after reporting a 40% decline in first-quarter revenue, falling to $0.6 million.

- OPTIMIZERx Corp. OPRX zoomed 24.89% after it reported strong first-quarter financial results with revenue increasing 11% year-over-year to $21.9 million.

Commodities, Gold, And Global Equity Markets:

Crude oil futures were trading higher in the early New York session by 0.45% to hover around $62.23 per barrel.

Gold Spot US Dollar rose 0.61% to hover around $3,254.39 per ounce. Its last record high stood at $3,500.33 per ounce. The U.S. Dollar Index spot was lower by 0.18% at the 101.6080 level.

Asian markets ended on a mixed note on Tuesday as India’s S&P BSE Sensex and Hong Kong’s Hang Seng index fell. While South Korea’s Kospi, China’s CSI 300, Japan’s Nikkei 225, and Australia’s ASX 200 indices advanced. European markets were also mixed in early trade.

Read Next:

Photo courtesy: Shutterstock