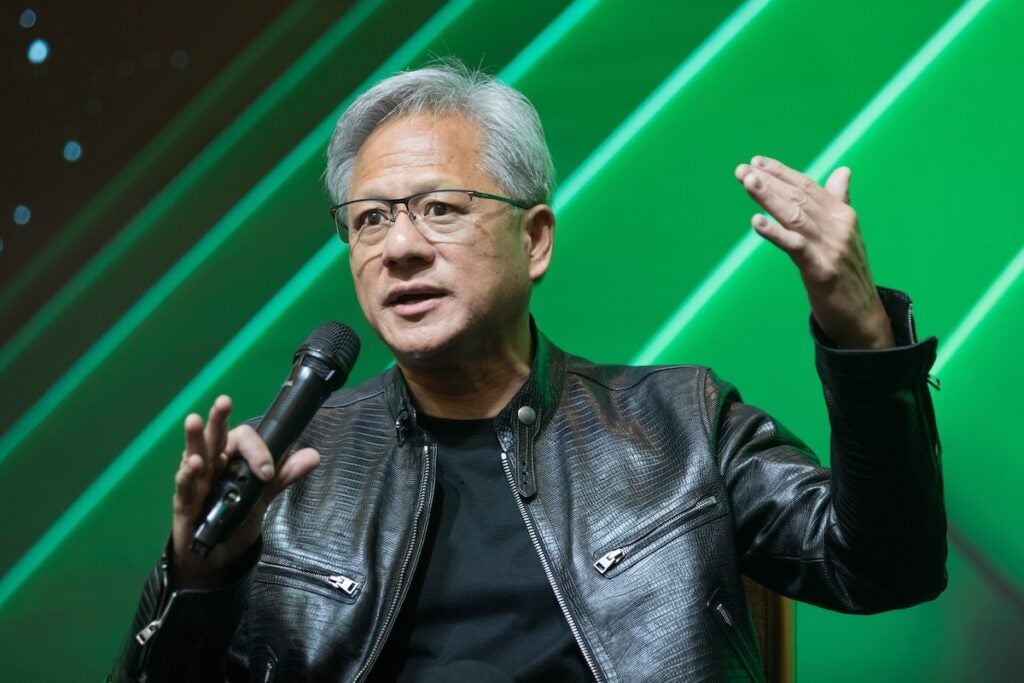

As tensions rise over U.S. chip restrictions, Nvidia Corporation NVDA CEO Jensen Huang warns that cutting off access to China’s booming AI market could hurt not just the company, but American jobs and innovation.

What Happened: Speaking with CNBC on Tuesday, Huang addressed the company’s $5.5 billion write-off tied to U.S. restrictions on chip sales to China, a critical market for artificial intelligence.

“The world’s dynamic today. You’ve just got to stay agile,” Huang said.

He went on to add that China is projected to become a $50 billion AI market within the next two to three years and represents a huge opportunity.

“It would be a tremendous loss not to be able to address it as an American company. It’s going to bring back revenues. It’s going to bring back taxes. It’s going to create lots of jobs here in the United States,” the Nvidia CEO stated.

Huang then said that the company will remain flexible and responsive to government policies, stating that it will support whatever is in the nation’s best interest. “We’ll stay agile and keep moving on.”

Why It’s Important: Last week, it was reported that Nvidia notified key Chinese clients — including Alibaba Group BABA, ByteDance, and Tencent Holdings TCEHY — that it is developing new AI chip models specifically designed to meet U.S. export requirements.

Huang has also warned U.S. lawmakers that export restrictions on AI chips could be giving Huawei Technologies a competitive advantage in the global AI race.

Nvidia also criticized AI startup Anthropic for pushing for tougher U.S. export limits on AI chips to China.

Price Action: On Tuesday, Nvidia shares slipped 0.25% during the regular hours, closing at $113.54. In the after-hours trading, it gained 0.85%, reaching $114.50, according to Benzinga Pro.

Nvidia also earned a strong growth score of 94.67% from Benzinga Edge Stock Rankings. Click here to see how it stacks up against other top tech players like Alibaba and Tencent.

Read Next:

Photo Courtesy: jamesonwu1972 on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.