Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

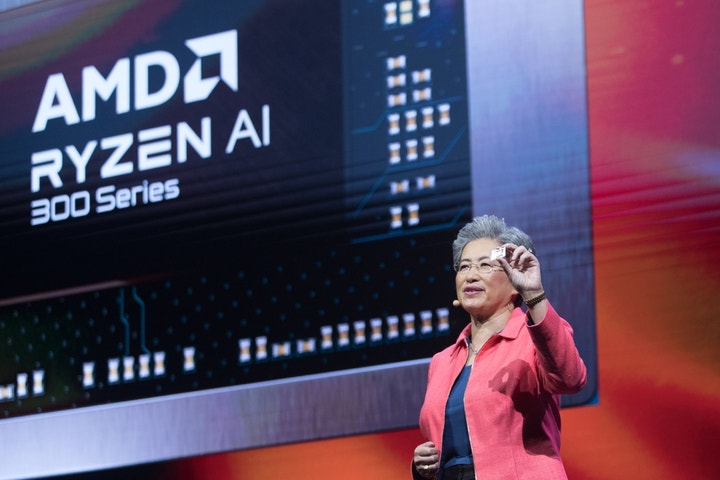

Advanced Micro Devices (NASDAQ:AMD) operates as a semiconductor company worldwide.

It is set to report its Q1 2025 earnings on May 6. Wall Street analysts expect the company to post EPS of $0.93, up from $0.62 in the prior-year period. According to Benzinga Pro, quarterly revenue is expected to reach $7.10 billion, up from $5.47 billion a year earlier.

Don’t Miss:

The company’s stock traded at approximately $2.31 per share 10 years ago. If you had invested $10,000, you could have bought roughly 4,329 shares. Currently, shares trade at $95.96, meaning your investment’s value could have grown to $415,411 from stock price appreciation.

That’s a total return of 4,054.11%, far outpacing the S&P 500’s return of 213.96% over the same period.

AMD has a consensus rating of “Buy” and a price target of $146.26 based on the ratings of 31 analysts. The price target implies more than 52% potential upside from the current stock price.

Trending: Donald Trump Just Announced a $500 Billion AI Infrastructure Deal — Here’s How You Can Invest in the Entertainment Market’s Next Big Disruptor for Just $998

On Feb. 4, the company announced its Q4 2024 earnings, posting revenues of $7.66 billion, beating analyst estimates of $7.53 billion, as reported by Benzinga. The chipmaker reported adjusted EPS of $1.09, above the consensus estimate of $1.08.

On April 16, AMD announced it had completed an initial review of new U.S. export controls on certain semiconductor products to China, including Hong Kong and Macau, and D:5 countries, which include nations under U.S. arms embargoes such as Russia, Iran, Iraq, North Korea, and others. The controls affect its MI308 products. AMD plans to apply for licenses but cannot guarantee approval. It expects up to $800 million in inventory, purchase commitments, and related reserves may be impacted.

Check out this article by Benzinga for 21 analysts’ insights on Advanced Micro Devices.

Given the historical stock price appreciation and expected upside potential, growth-focused investors may find AMD stock attractive.