We came across a bullish thesis on PriceSmart, Inc. (PSMT) on Substack by Charly AI. In this article, we will summarize the bulls’ thesis on PSMT. PriceSmart, Inc. (PSMT)’s share was trading at $101.71 as of April 24th. PSMT’s trailing P/E was 21.69 according to Yahoo Finance.

A convenience store full of customers shopping for groceries and other items.

PriceSmart (PSMT) presents a compelling investment opportunity grounded in consistent growth, prudent financial management, and strategic regional expansion. The company reported a solid 5.6% year-over-year revenue increase and an 11.4% jump in net income last quarter, showcasing its operational resilience. Expansion into Costa Rica and upcoming openings in Guatemala underscore PSMT’s focus on scaling in Central America, a region experiencing rising consumer demand. Despite a marginal dip in gross margins (down to 15.6%), the company remains on solid financial footing, with $145.5 million in cash exceeding its $107.1 million debt, giving it flexibility to weather macroeconomic headwinds such as tariffs or currency fluctuations.

Valuation-wise, PSMT trades at a P/E ratio of 19.99, below industry averages, suggesting it is undervalued relative to its growth profile. This discount becomes more attractive considering the company’s improved tax efficiency (effective tax rate down to 27.2% from 30.5%) and forward-looking initiatives. Investments in digital capabilities and enhanced membership offerings, such as the Platinum Membership program, aim to boost customer retention and recurring revenue. Although capital expenditures are elevated, they reflect long-term investments in infrastructure and club development, supporting future revenue acceleration.

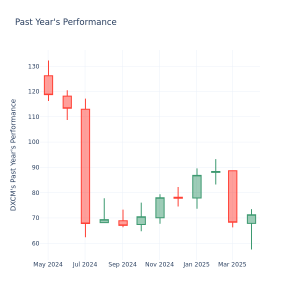

Technical indicators reinforce the bullish case, with a positive MACD and the stock trading above key moving averages, signaling upward momentum. While technology spending and geopolitical risks remain factors to monitor, they are mitigated by the company’s robust balance sheet and thoughtful capital allocation. Altogether, PSMT offers investors an attractive mix of earnings growth, strong financials, and regional tailwinds, all while trading at a valuation that leaves room for multiple expansion. For those seeking exposure to a disciplined, steadily growing international retailer with long-term potential, PSMT is a BUY.

PriceSmart, Inc. (PSMT) is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 22 hedge fund portfolios held PSMT at the end of the fourth quarter which was 20 in the previous quarter. While we acknowledge the risk and potential of PSMT as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than PSMT but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.