The Nasdaq entered bear market territory on Monday in a sign that the downturn may still be far from over. It may be an unnerving time to invest in stocks, but history suggests that buying when there’s fear in the market could indeed be a great long-term decision for investors. When valuations are low, that can set up investors for fantastic returns in the years ahead, especially since the market has always recovered.

Below, I’m going to look at how much you could make from investing $100 each month into the Nasdaq’s top stocks, and doing so over the long haul — a period of 25-plus years. Could it be enough to one day make you a millionaire?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Picking which stocks to buy on the Nasdaq can be challenging, as some investments will inevitably possesses much more risk and uncertainty than others. But one way you can simplify your strategy is by having a position in many stocks, rather than just one or two. And a great way to do that is to invest in an exchange-traded fund (ETF).

The Invesco QQQ Trust (NASDAQ: QQQ) is an ETF that tracks the Nasdaq 100 index, which includes the top 100 nonfinancial stocks on the Nasdaq. It’ll give you exposure to the most valuable companies on the exchange, so you won’t have to worry about small, high-risk growth stocks. The index features established names and well-known companies, including Microsoft and Nvidia, among other top growth stocks.

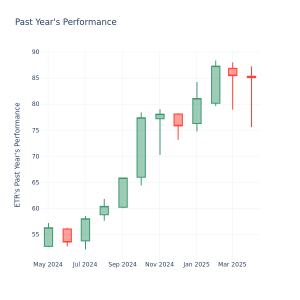

While the ETF is struggling this year, over the past decade it has soundly outperformed the market.

If you invest the same amount into this ETF each month, regardless of what’s going on in the market, that can be a good way to average into your position over time. You don’t need to try to time exactly when to buy stocks. And the simpler your investing strategy is, the easier it can be to sustain over the long haul.

The table below looks at how much your portfolio could be worth after 25-plus years of investing $100 each month into an ETF such as the Invesco QQQ Trust, and assuming it averages an annual growth rate between 9% and 11%. Historically, the S&P 500 has averaged a return of 10% per year. But with a focus on growth stocks and the Nasdaq being in a bear market, you may potentially do a bit better than that if you start investing today.