Colgate-Palmolive Co CL posted better-than-expected first-quarter FY25 earnings on Friday.

The company’s first-quarter FY25 sales declined 3% year over year to $4.91 billion, beating the analyst consensus estimate of $4.86 billion. Non-GAAP EPS of $0.91 beat the consensus estimate of $0.86.

“As we look ahead, uncertainty and volatility in global markets, including the impact of tariffs, remain challenging. We are confident in our strategy and will continue to execute with focus and agility to mitigate these factors and achieve our revised 2025 financial targets,” said Chairman, President, and CEO Noel Wallace.

For FY25, Colgate said it expects net sales to be up in the low single digits, including a negative impact from foreign exchange in the low single digits. The company anticipates organic sales growth to be 2% to 4%.

Colgate shares fell 3% to trade at $91.08 on Monday.

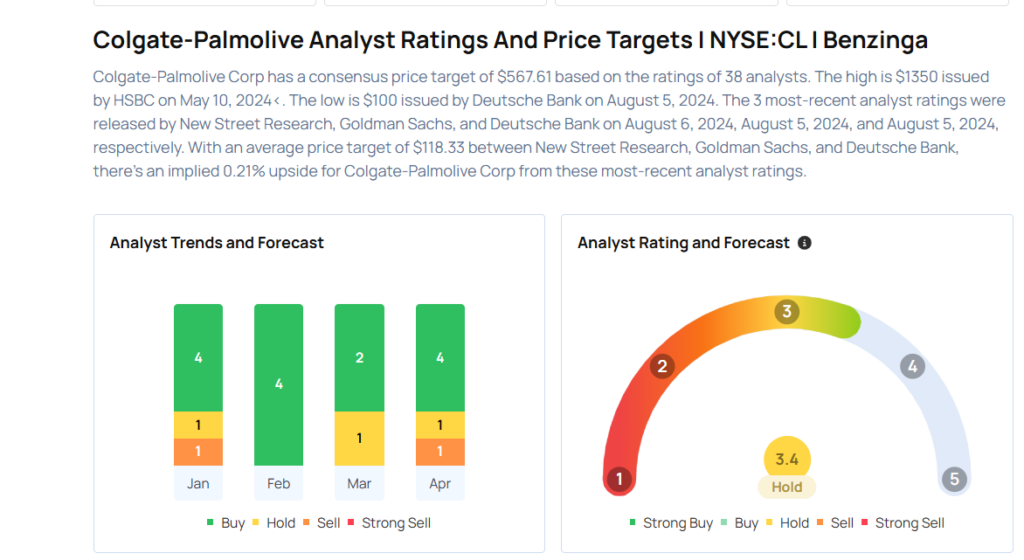

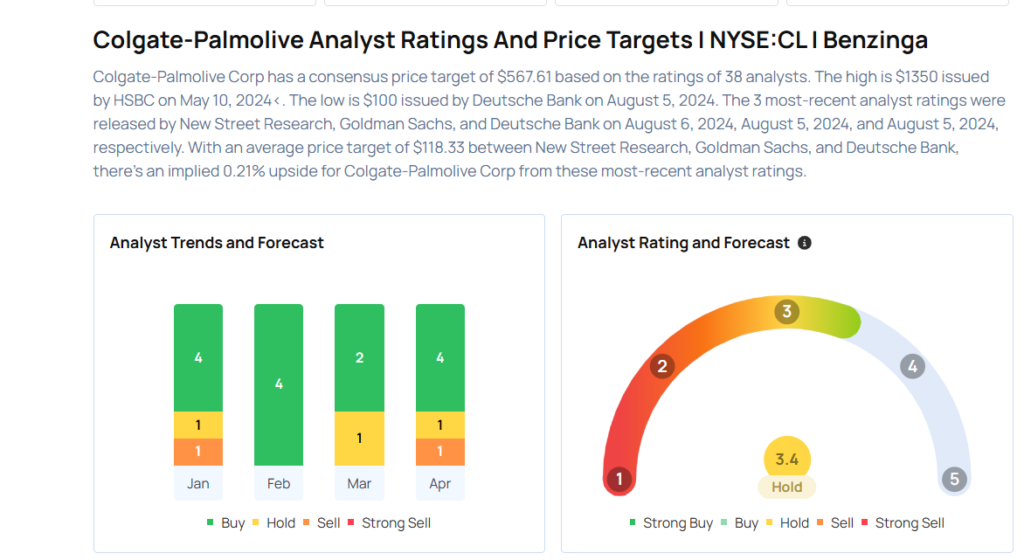

These analysts made changes to their price targets on Colgate following earnings announcement.

- JP Morgan analyst Andrea Teixeira maintained Colgate-Palmolive with an Overweight rating and raised the price target from $95 to $103.

- Citigroup analyst Filippo Falorni maintained Colgate-Palmolive with a Buy and raised the price target from $103 to $108.

Considering buying CL stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.