Kadant KAI will release its quarterly earnings report on Tuesday, 2025-04-29. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Kadant to report an earnings per share (EPS) of $1.97.

The market awaits Kadant’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

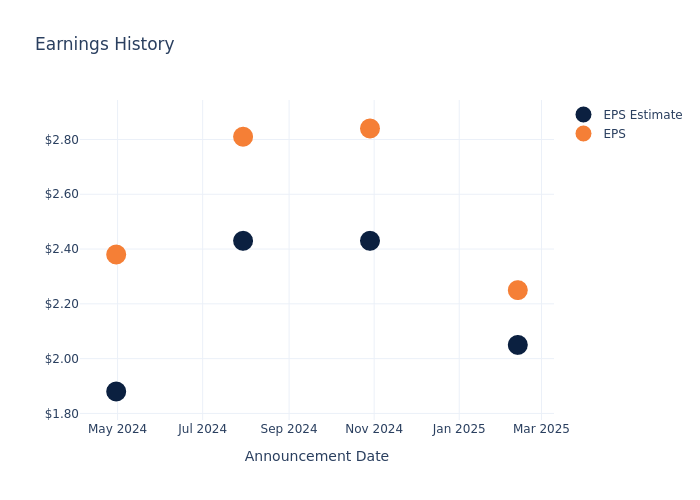

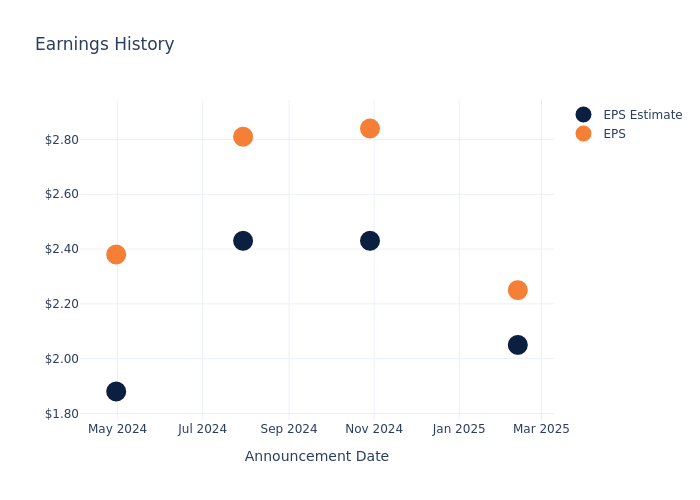

Performance in Previous Earnings

The company’s EPS beat by $0.20 in the last quarter, leading to a 0.74% drop in the share price on the following day.

Here’s a look at Kadant’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.05 | 2.43 | 2.43 | 1.88 |

| EPS Actual | 2.25 | 2.84 | 2.81 | 2.38 |

| Price Change % | -1.0% | 5.0% | -1.0% | -4.0% |

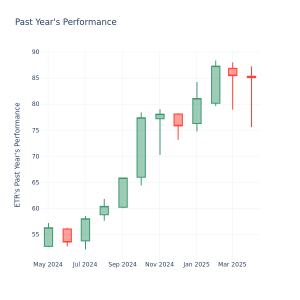

Tracking Kadant’s Stock Performance

Shares of Kadant were trading at $311.14 as of April 25. Over the last 52-week period, shares are up 13.15%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Kadant

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Kadant.

Analysts have given Kadant a total of 3 ratings, with the consensus rating being Outperform. The average one-year price target is $410.0, indicating a potential 31.77% upside.

Comparing Ratings with Peers

The below comparison of the analyst ratings and average 1-year price targets of ESCO Technologies, Mueller Water Products and Enpro, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for ESCO Technologies, with an average 1-year price target of $182.5, suggesting a potential 41.34% downside.

- Analysts currently favor an Neutral trajectory for Mueller Water Products, with an average 1-year price target of $29.0, suggesting a potential 90.68% downside.

- Analysts currently favor an Outperform trajectory for Enpro, with an average 1-year price target of $190.0, suggesting a potential 38.93% downside.

Snapshot: Peer Analysis

The peer analysis summary presents essential metrics for ESCO Technologies, Mueller Water Products and Enpro, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Kadant | Outperform | 8.11% | $111.86M | 2.83% |

| ESCO Technologies | Buy | 13.15% | $98.38M | 1.90% |

| Mueller Water Products | Neutral | 18.68% | $103M | 4.29% |

| Enpro | Outperform | 3.73% | $109.30M | 0.96% |

Key Takeaway:

Kadant ranks highest in Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Unveiling the Story Behind Kadant

Kadant Inc. supplies process and engineering equipment for papermaking, recycling, lumber manufacturing, and related industries. The company’s three reportable segments are the Flow Control segment which consists of the fluid-handling and doctoring, cleaning, & filtration product lines; the Industrial Processing segment which consists of the wood processing and stock-preparation product lines; and Material handling systems, which provides conveyor-belt equipment for industries such as mining, food processing, and packaging. The company has a geographic presence in the U.S., China, Asia, Germany, Canada, and Others.

Key Indicators: Kadant’s Financial Health

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Kadant’s remarkable performance in 3 months is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 8.11%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Kadant’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 9.31% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Kadant’s ROE excels beyond industry benchmarks, reaching 2.83%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Kadant’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 1.65% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Kadant’s debt-to-equity ratio is below the industry average. With a ratio of 0.34, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Kadant visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.