Union Pacific Corporation UNP reported worse-than-expected first-quarter 2025 results on Thursday.

Union Pacific reported operating revenue of $6.027 billion, flat year-over-year, missing the consensus of $6.08 billion. Freight revenue was $5.691 billion, with Bulk up 1 % year over year, Industrial down 1%, and Premium up 5%. Revenue carloads were up 7%.

Earnings per share were $2.70 compared to $2.69 a year ago, below the consensus of $2.75.

“The team delivered a solid start to the year as we worked closely with our customers to meet their needs in an uncertain environment. Looking to the rest of 2025, we will continue to execute our strategy that emphasizes safety, service, and operational excellence. Building on a strong foundation with our record First Quarter operating performance, we are positioned to deliver,” commented Jim Vena, Union Pacific’s Chief Executive Officer.

Union Pacific shares fell 1.4% to trade at $212.39 on Friday.

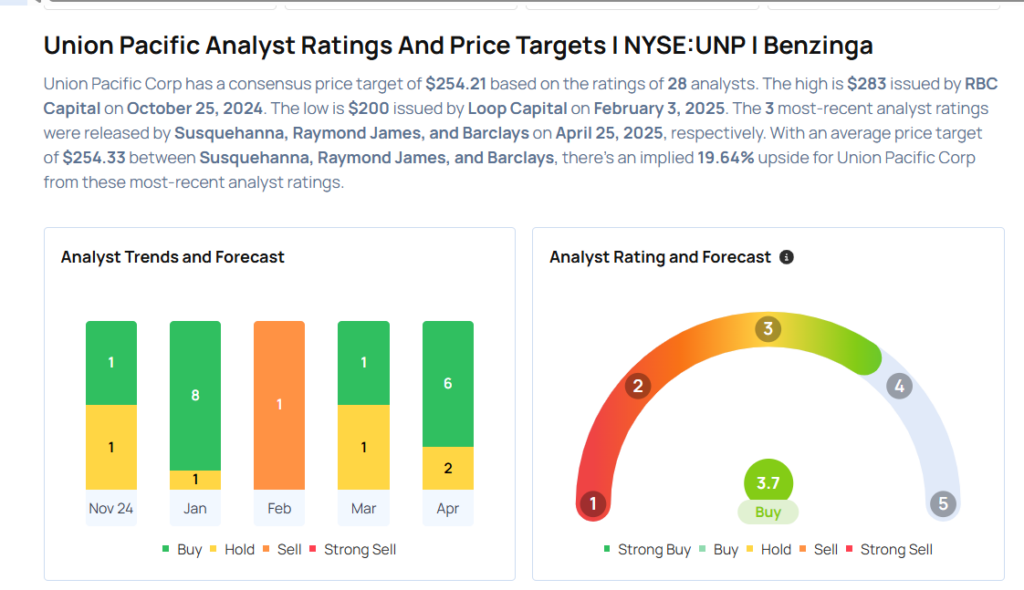

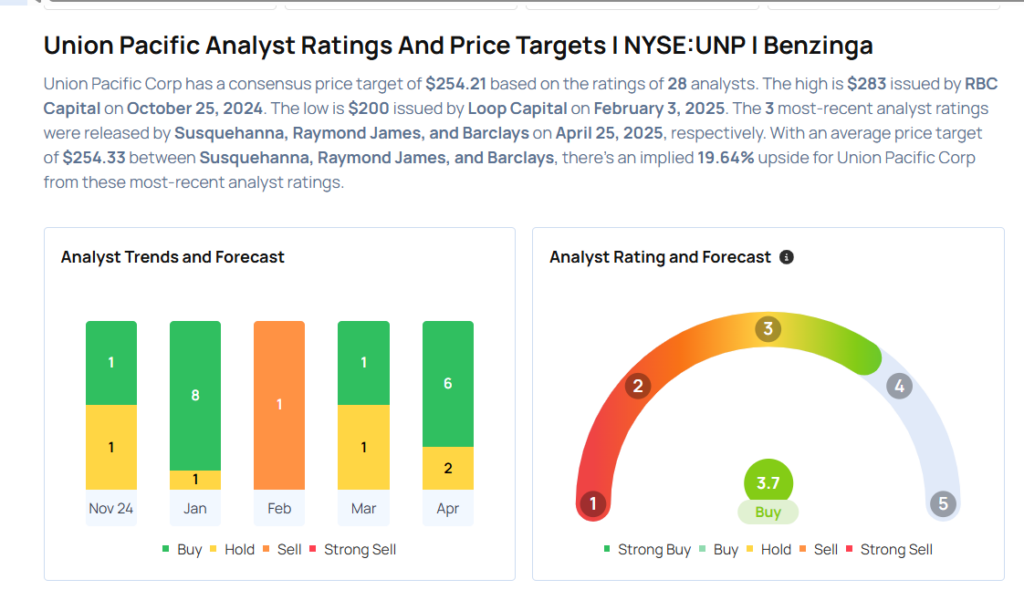

These analysts made changes to their price targets on Union Pacific following earnings announcement.

- Barclays analyst Brandon Oglenski maintained Union Pacific with an Overweight rating and lowered the price target from $285 to $260.

- Raymond James analyst Patrick Tyler Brown maintained the stock with a Strong Buy and cut the price target from $260 to $258.

- Susquehanna analyst Bascome Majors maintained Union Pacific with a Neutral rating and lowered the price target from $255 to $245.

Considering buying UNP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.