West Texas Intermediate (WTI) crude oil has been struggling lately, breaking below critical support levels, and experts are taking notice.

According to Adam Turnquist, chief technical strategist for LPL Financial, “Oil has struggled recently as tariff-related demand concerns weigh on risk appetite.”

The U.S. government’s recent 10% tariff on oil imports, combined with China’s retaliatory 125% tariff on U.S. goods (including oil), has spooked markets, fueling fears of reduced global oil demand.

The impact of the tariff tensions is evident in the International Energy Agency’s (IEA) decision to cut its 2025 demand growth forecast by 300,000 barrels per day to just 730,000.

Turnquist noted, “The White House’s recent tariff of 10% on oil imports … and China’s retaliatory tariffs on U.S. goods … have stoked fears of reduced global economic growth and oil demand.”

With the global outlook dimming, oil prices have taken a sharp downturn.

Read Also: ConocoPhillips Vs. Occidental: Both Ride The Oil Wave, Only One Is Shaping The Tide

The supply side isn’t providing much relief either. After months of delays, OPEC+ announced an unexpected supply increase of 411,000 barrels per day starting in May.

This is partly to punish members like Kazakhstan for not adhering to output restrictions. OPEC+ may even hike supply again at its next meeting on May 5, which could further pressurize the market.

From a technical standpoint, WTI has plummeted to multi-year lows, breaking key support near $64. Turnquist describes the pattern as a “bearish flag,” indicating heightened risk for further downside. If oil closes below $60, he warns, it could signal a drop toward $55-$56 as the next level of support.

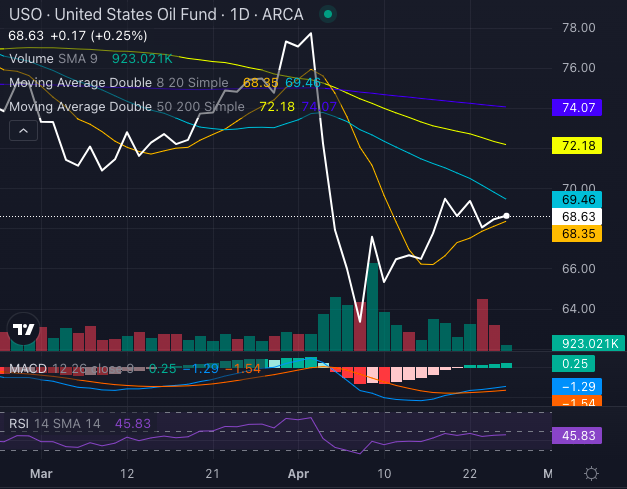

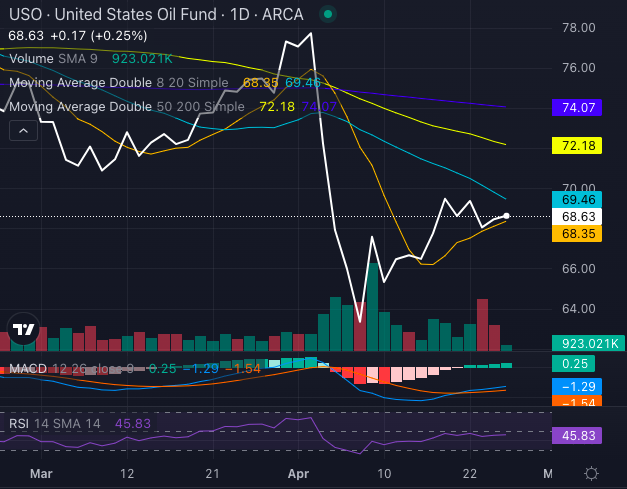

The United States Oil Fund LP USO, a popular proxy for oil, has mirrored this decline. The ETF is currently down 11.30% year-to-date and 8.79% over the past month.

Chart created using Benzinga Pro

With the stock price of USO sitting below its key moving averages and a bearish MACD (moving average convergence/divergence) indicator reading of a negative 1.29, the outlook for the ETF remains grim.

A continued bearish trend in oil could signal more trouble for USO in the near future.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.