As Intel Corporation INTC works to reclaim its position in the semiconductor race, its new CEO is urging patience from investors.

What Happened: On Thursday, during Intel’s first-quarter financial earnings call, CEO Lip-Bu Tan was asked how long Intel’s transformation might take.

In response, Tan admitted that “Clearly, there are no quick fixes,” but underscored that the company is working on both short- and long-term plans to improve its competitive standing, especially in AI, GPUs, and edge computing.

“We are working through the roadmap with weekly update with the team,” Tan said. “We may embrace some of the disruptive technology that is out there and partner with them to bring products to market faster.”

Despite not offering a specific timeline for the company’s recovery, Tan encouraged stakeholders to remain optimistic. “Stay tuned,” he said, adding that all these plans are a work in progress.

Why It’s Important: Intel stock has dropped 63.74% in the past five years, significantly underperforming than peers like Nvidia Corporation NVDA and Advanced Micro Devices AMD, both of which have capitalized on the AI boom and rising demand for advanced chips.

Last week, Reuters reported that Tan will now directly oversee the company’s data center, AI, and personal computer chip divisions, citing an internal memo.

“It’s clear to me that organizational complexity and bureaucratic processes have been slowly suffocating the culture of innovation we need to win,” he reportedly said in the memo, adding, “It takes too long to make decisions. New ideas are not given room or resources to incubate. And unnecessary silos lead to inefficient execution.”

Intel posted first-quarter revenue of $12.67 billion, topping analyst expectations of $12.3 billion. Adjusted earnings came in at 13 cents per share, well above projections of just 1 cent.

Looking ahead, the company expects second-quarter revenue between $11.2 billion and $12.4 billion, falling short of the $12.84 billion analysts had forecast. Intel also projected an adjusted loss of 32 cents per share for the second quarter, steeper than the expected 16-cent loss.

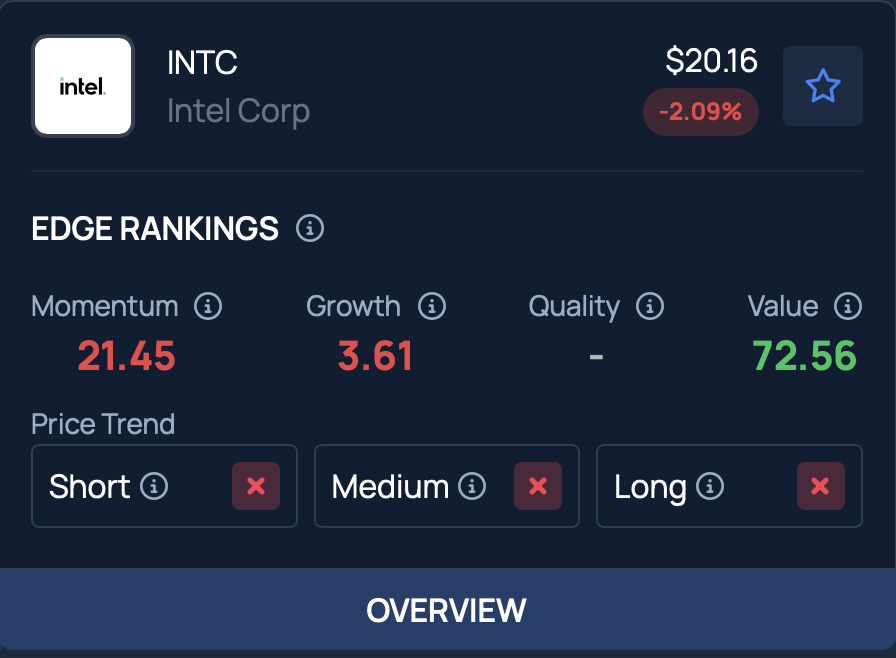

Price Action: Intel shares rose 4.37% on Thursday, closing at $21.49, but slipped 5.12% in after-hours trading to $20.39. So far this year, the stock is up 6.28%, according to Benzinga Pro.

The company currently holds a growth score of 3.61% in Benzinga Edge’s Stock Rankings. Click here to see how it compares with other top semiconductor stocks like Nvidia and AMD.

Read Next:

Photo Courtesy: Ascannio On Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.