As of April 23, 2025, two stocks in the consumer discretionary sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

ThredUp Inc TDUP

- ThredUp will release its financial results for the first quarter on Monday, May 5, after the close of the U.S. markets. The company’s stock jumped around 37% over the past month and has a 52-week high of $3.89.

- RSI Value: 83.2

- TDUP Price Action: Shares of ThredUp gained 15.3% to close at $3.85 on Tuesday.

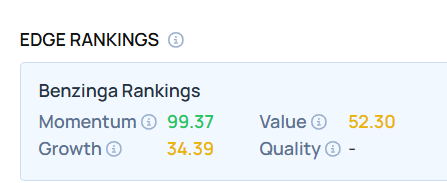

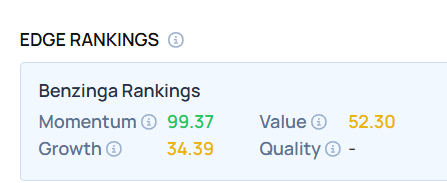

- Edge Stock Ratings: 99.37 Momentum score with Value at 52.30.

Ammo Inc POWW

- On April 18, AMMO completed the sale of ammunition manufacturing assets to Olin Winchester. “This transaction marks a defining moment in AMMO’s evolution,” said Christos Tsentas, Chair of the Board’s M&A Committee. “After a thorough strategic review and collaboration with our financial and legal advisors, we are confident this sale will unlock significant value and enable AMMO to accelerate growth as a pure-play e-commerce platform.” The company’s stock gained around 35% over the past five days and has a 52-week high of $2.86.

- RSI Value: 81.4

- POWW Price Action: Shares of Ammo rose 15.4% to close at $1.80 on Tuesday.

Don’t miss out on the full BZ Edge Rankings—compare all the key stocks now.

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.