Texas Instruments Inc TXN reported first-quarter financial results after the market close on Wednesday. Here’s a look at the key metrics from the quarter.

- Q1 Revenue: $4.07 billion, versus estimates of $3.91 billion

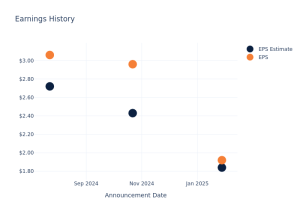

- Q1 EPS: $1.28, versus estimates of $1.07

Total revenue climbed 11% year-over-year and 2% sequentially as all markets saw a quarter-over-quarter increase with the exception of personal electronics, which the company attributed to seasonality.

Texas Instruments reported $6.2 billion in cash flow from operations over the trailing 12 months, and $1.7 billion of free cash flow over the same period.

“History says it is important to have capacity and inventory in times like these, and we are well positioned,” the company said on a conference call with investors.

“In addition, geopolitically dependable capacity will matter more, and it is increasingly critical and valuable to our customers. We have flexibility and are prepared to navigate the evolving supply chain dynamics.”

Related Link: IBM Shares Slide Despite Better-Than-Expected Q1: Details

Outlook: Texas Instruments sees second-quarter revenue of $4.17 billion to $4.53 billion versus estimates of $4.13 billion. The company expects second-quarter earnings to be between $1.21 and $1.47 per share versus estimates of $1.23 per share.

Texas Instruments noted on the conference call that it doesn’t expect any near-term impacts related to macroeconomic uncertainty. But, the company will take a cautious approach as there are “many things still changing.” Texas Instruments said it’s working with customers to understand and support their needs and is prepared for a “range of scenarios” in the second half of the year, heading into 2026.

TXN Price Action: Texas Instruments shares were up after-hours 5.15% at $159.99 at the time of publication on Wednesday, per Benzinga Pro.

Photo: michelmond/Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.