Nokia NOK is set to give its latest quarterly earnings report on Thursday, 2025-04-24. Here’s what investors need to know before the announcement.

Analysts estimate that Nokia will report an earnings per share (EPS) of $0.05.

Anticipation surrounds Nokia’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

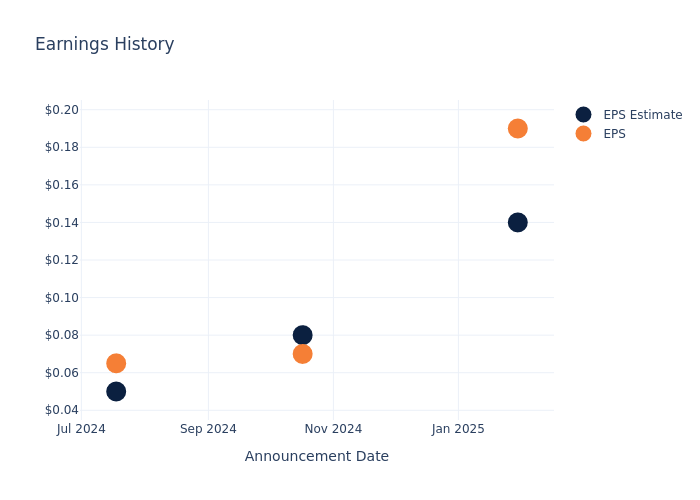

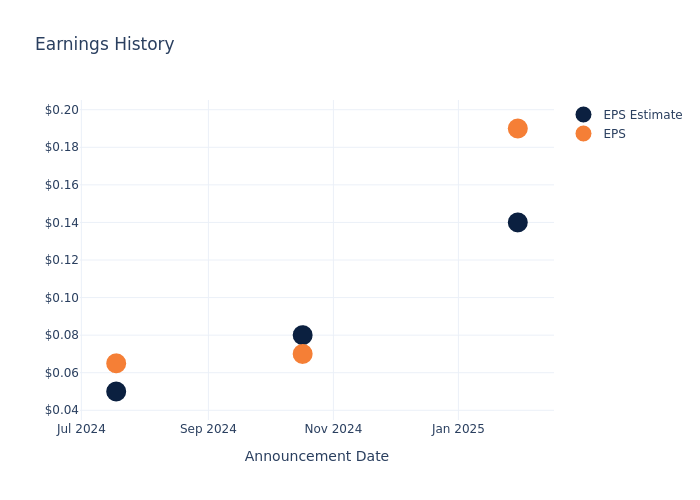

Earnings History Snapshot

During the last quarter, the company reported an EPS beat by $0.05, leading to a 2.13% drop in the share price on the subsequent day.

Here’s a look at Nokia’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.14 | 0.08 | 0.050 | 0.06 |

| EPS Actual | 0.19 | 0.07 | 0.065 | 0.10 |

| Price Change % | -2.0% | 9.0% | 1.0% | 1.0% |

Nokia Share Price Analysis

Shares of Nokia were trading at $5.28 as of April 22. Over the last 52-week period, shares are up 45.74%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Nokia

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Nokia.

The consensus rating for Nokia is Outperform, based on 1 analyst ratings. With an average one-year price target of $6.3, there’s a potential 19.32% upside.

Comparing Ratings with Competitors

In this analysis, we delve into the analyst ratings and average 1-year price targets of F5, Juniper Networks and Ciena, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for F5, with an average 1-year price target of $295.1, suggesting a potential 5489.02% upside.

- Analysts currently favor an Neutral trajectory for Juniper Networks, with an average 1-year price target of $39.5, suggesting a potential 648.11% upside.

- Analysts currently favor an Neutral trajectory for Ciena, with an average 1-year price target of $80.55, suggesting a potential 1425.57% upside.

Summary of Peers Analysis

In the peer analysis summary, key metrics for F5, Juniper Networks and Ciena are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ubiquiti | Buy | 29.02% | $247.23M | 57.17% |

| F5 | Neutral | 10.67% | $625.98M | 5.23% |

| Juniper Networks | Neutral | 2.88% | $838.70M | 3.44% |

| Ciena | Neutral | 3.33% | $471.82M | 1.59% |

Key Takeaway:

Nokia ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, Nokia is at the top compared to its peers.

About Nokia

Nokia provides telecom equipment and services that are used to build wireless and fixed-line networks. It operates in four segments. The mobile networks segment, which sells equipment and services to telecom carriers to power public wireless networks, is the largest. Network infrastructure focuses on fixed networks, including infrastructure, solutions, and components for IP networks, optical networks, and submarine networks. Cloud and network services is a nascent segment catering to enterprises, offering as-a-service platforms. Nokia also has a sizable research division and patent business, where it licenses technology used by handset providers, consumer electronics firms, and other firms making electronic and Internet of Things products.

Nokia: A Financial Overview

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Over the 3 months period, Nokia showcased positive performance, achieving a revenue growth rate of 10.49% as of 31 December, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 13.47%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Nokia’s ROE excels beyond industry benchmarks, reaching 3.9%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Nokia’s ROA stands out, surpassing industry averages. With an impressive ROA of 2.06%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.23, Nokia adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Nokia visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.