Ameriprise Finl AMP is gearing up to announce its quarterly earnings on Thursday, 2025-04-24. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Ameriprise Finl will report an earnings per share (EPS) of $9.12.

The market awaits Ameriprise Finl’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

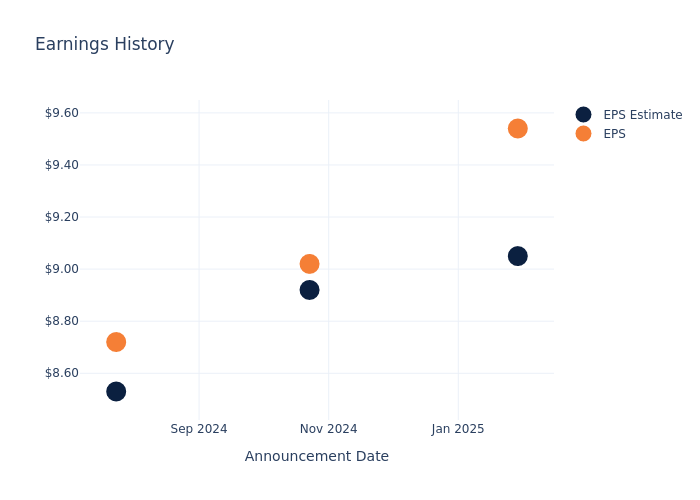

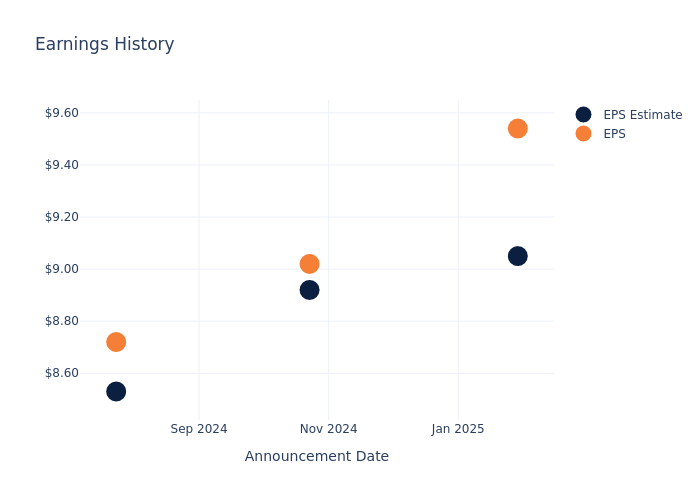

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.49, leading to a 4.75% drop in the share price the following trading session.

Here’s a look at Ameriprise Finl’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 9.05 | 8.92 | 8.53 | 8.20 |

| EPS Actual | 9.54 | 9.02 | 8.72 | 8.39 |

| Price Change % | -5.0% | -3.0% | 4.0% | -3.0% |

Ameriprise Finl Share Price Analysis

Shares of Ameriprise Finl were trading at $467.65 as of April 22. Over the last 52-week period, shares are up 16.89%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Ameriprise Finl

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ameriprise Finl.

A total of 6 analyst ratings have been received for Ameriprise Finl, with the consensus rating being Neutral. The average one-year price target stands at $554.0, suggesting a potential 18.46% upside.

Comparing Ratings with Peers

The analysis below examines the analyst ratings and average 1-year price targets of T. Rowe Price Group, Brookfield and Blue Owl Capital, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for T. Rowe Price Group, with an average 1-year price target of $96.14, suggesting a potential 79.44% downside.

- Analysts currently favor an Outperform trajectory for Brookfield, with an average 1-year price target of $70.83, suggesting a potential 84.85% downside.

- Analysts currently favor an Outperform trajectory for Blue Owl Capital, with an average 1-year price target of $25.6, suggesting a potential 94.53% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for T. Rowe Price Group, Brookfield and Blue Owl Capital, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ares Management | Outperform | 19.45% | $795.93M | -2.05% |

| T. Rowe Price Group | Neutral | 11.11% | $947.60M | 4.16% |

| Brookfield | Outperform | -20.77% | $5.03B | 0.93% |

| Blue Owl Capital | Outperform | 27.80% | $336.88M | 1.00% |

Key Takeaway:

Ameriprise Finl ranks highest in revenue growth among its peers. It ranks lowest in gross profit and return on equity.

Unveiling the Story Behind Ameriprise Finl

Ameriprise Financial is a major player in the US market for asset and wealth management, with around $1.5 trillion in total assets under management and administration at the end of 2024. With about 10,500 advisors, Ameriprise has one of the largest branded advisor networks in the industry. About 80% of the company’s revenue comes from its asset and wealth management segments. Ameriprise has reduced its exposure to insurance with the sale of its auto and home insurance business in 2019 and discontinuing the sale of proprietary fixed annuities in 2020.

Breaking Down Ameriprise Finl’s Financial Performance

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Ameriprise Finl displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 12.75%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: Ameriprise Finl’s net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 23.79%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ameriprise Finl’s ROE excels beyond industry benchmarks, reaching 19.57%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Ameriprise Finl’s ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.58%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Ameriprise Finl’s debt-to-equity ratio is below the industry average. With a ratio of 1.05, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Ameriprise Finl visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.