Editor’s Note: This article has been corrected to reflect the accurate date of Boeing’s earnings report.

The Boeing Company BA will release earnings results for the first quarter, before the opening bell on Wednesday, April 23.

Analysts expect the Arlington, Virginia-based company to report a quarterly loss at $1.30 per share, versus a year-ago loss of $1.13 per share in the year-ago period. Boeing projects to report quarterly revenue at $19.79 billion, compared to $16.57 billion a year earlier, according to data from Benzinga Pro.

Boeing recently finalized an agreement to sell parts of its Digital Aviation Solutions division to Thoma Bravo for $10.55 billion in cash.

Boeing shares rose 2% to close at $162.52 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

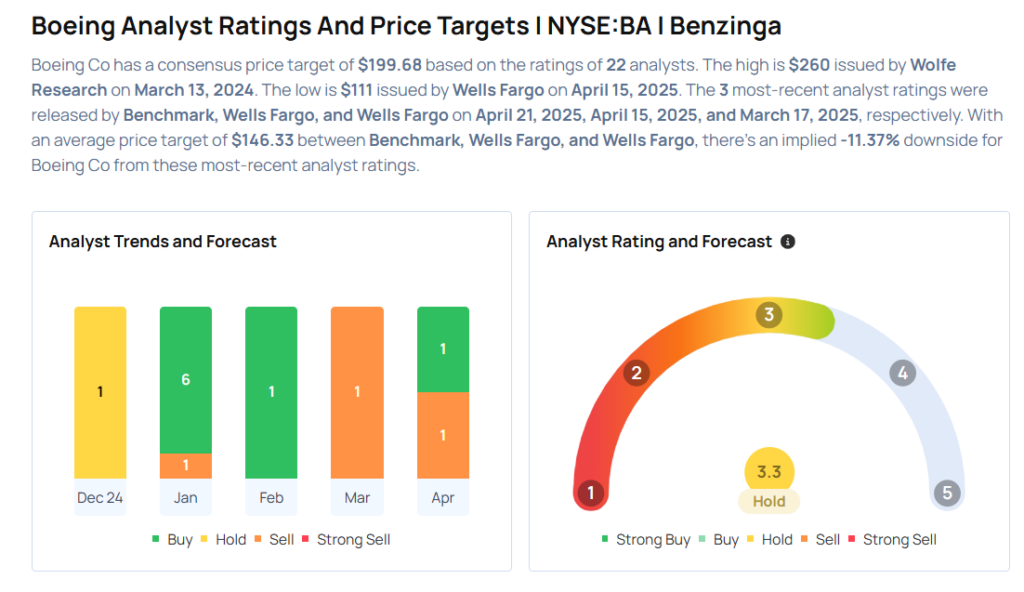

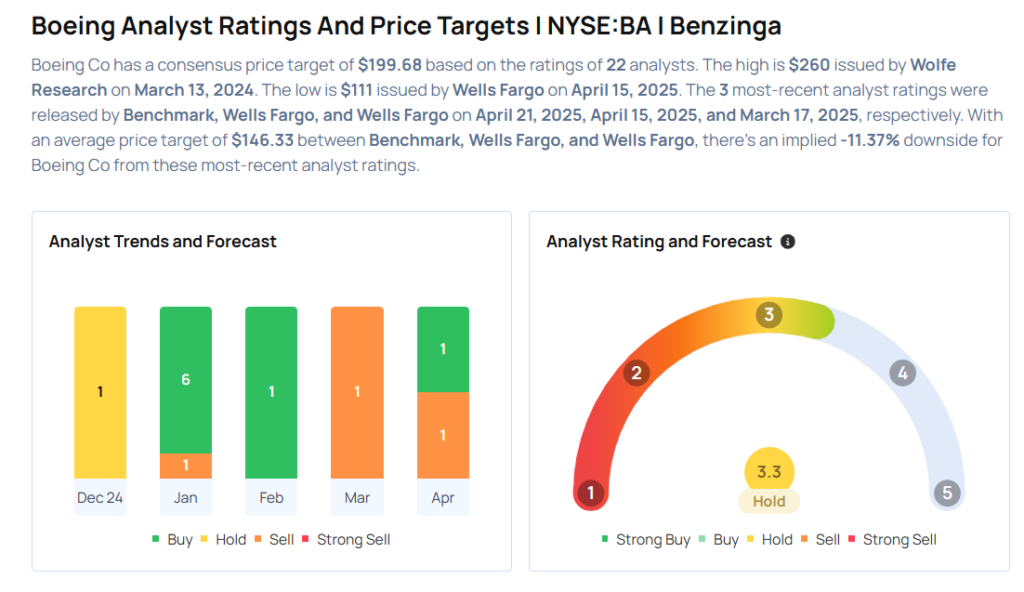

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Benchmark analyst Josh Sullivan maintained a Buy rating and cut the price target from $250 to $215 on April 21, 2025. This analyst has an accuracy rate of 83%.

- Wells Fargo analyst Matthew Akers maintained an Underweight rating and slashed the price target from $113 to $111 on April 15, 2025. This analyst has an accuracy rate of 72%.

- Citigroup analyst Jason Gursky maintained a Buy rating and raised the price target from $207 to $210 on Feb. 10, 2025. This analyst has an accuracy rate of 76%.

- JP Morgan analyst Seth Seifman maintained an Overweight rating and boosted the price target from $190 to $200 on Jan. 29, 2025. This analyst has an accuracy rate of 80%.

- RBC Capital analyst Ken Herbert maintained an Outperform rating with a price target of $200 on Jan. 29, 2025. This analyst has an accuracy rate of 67%.

Considering buying BA stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.