MSCI Inc (NYSE: MSCI) reported fiscal 2025 first-quarter results Tuesday. The quarterly revenue grew by 9.7% year-on-year to $745.8 million, topping the analyst consensus estimate of $744.2 million.

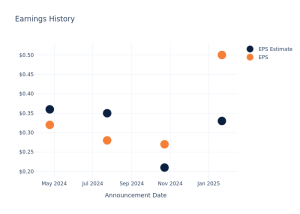

The adjusted EPS of $4.00 beat the analyst consensus estimate of $3.91.

The total run rate on March 31, 2025, rose 9.3% Y/Y to $2.98 billion.

Also Read: BofA Sees Mostly Inline Q1 For Industrials, Highlights 3M, JCI, GE Vernova As Top Picks

The organic recurring subscription run rate growth was 8.2%. The retention rate was 95.3% compared to 92.8% last year.

The investment research firm’s index operating revenues rose 12.8% Y/Y to $421.7 million, aided by higher recurring subscription revenues and asset-based fees.

Analytics operating revenues increased 5.0% Y/Y to $172.2 million, driven by higher recurring subscription revenues from equity and multi-asset class analytics products.

Sustainability and climate operating revenues (previously known as ESG and climate operating revenues) grew 8.6% Y/Y to $84.6 million, driven by solid growth in ratings and climate products.

All Other – private assets operating revenues improved by 4.7% Y/Y to $67.3 million.

Margin: The operating margin improved from 49.9% to 50.6%. The adjusted EBITDA margin improved from 56.4% to 57.1%.

MSCI generated $268.9 million in free cash flow and held $360.7 million in cash and equivalents as of March 31, 2025.

Chair and CEO Henry A. Fernandez expects deep client relationships, differentiated capabilities, and a resilient business model to weather periods of global turmoil, which are also when its clients rely on it the most.

FY25 Outlook: MSCI reiterated operating expenses of $1.405 billion– $1.445 billion, capex of $115–$125 million, and free cash flow of $1.40 billion–$1.46 billion.

Price Action: MSCI stock is down 1% at $527.71 at last check Tuesday.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.