We recently published a list of the 11 Cheap NASDAQ Stocks to Buy According to Hedge Funds. In this article, we are going to take a look at where United Airlines Holdings, Inc. (NASDAQ:UAL) stands against other cheap NASDAQ stocks.

On April 10, Dan Ives, Head of Global Tech Research at Wedbush Securities, appeared on an interview at CNBC and expressed that the tech sector could be heading into a period of major volatility. Dan Ives addressed the current landscape for technology companies and pointed out that while a temporary pause in tariffs has provided some structure, the sector remains uncertain in general. He noted that even with this framework, large tech purchases are still being downsized or paused, which contributes to ongoing volatility, especially as companies approach earnings season. Many tech firms are either withholding guidance or providing only general outlooks. Ives described the situation as a storm whose full damage is only beginning to be assessed, with the industry still only a quarter of the way through the fallout. He explained the sharp pullback in major tech stocks by likening it to emerging from a storm and confronting the resulting damage.

Ives highlighted that the uncertainty in tech has been amplified by the escalating tariffs on China, which are now as high as 125%, and are a major concern for a lot of companies, as China remains central to the global tech supply chain. Ives also pointed out that the recent tariffs on China have forced companies to reconsider the costs and logistics of importing critical components. For example, a $100,000 part might now cost double due to tariffs, causing companies to halt or delay large investments. This has resulted in a notable pause in tech spending, which he expects to continue at least through the current quarter. He cautioned that the June quarter is likely to be very weak. He maintained that, despite the challenges, he has not downgraded tech stocks, drawing on lessons from the pandemic playbook, where periods of uncertainty eventually led to clear winners and losers. Ives also addressed concerns that tech companies, by pulling back on spending, might risk drawing negative attention from the administration, especially given recent meetings between tech CEOs and the president. He reiterated that China is the epicenter of the current turmoil and that big tech is caught in the middle of a high-stakes situation, with companies still trying to navigate the evolving landscape.

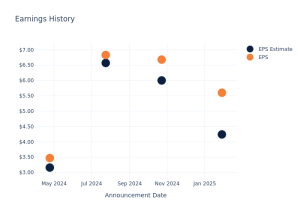

Ives predicted that Street estimates are likely to see earnings cuts of about 10% across internet and big tech companies, which reflects the broader pullback in spending and ongoing volatility.