Westinghouse Air Brake WAB is set to give its latest quarterly earnings report on Wednesday, 2025-04-23. Here’s what investors need to know before the announcement.

Analysts estimate that Westinghouse Air Brake will report an earnings per share (EPS) of $2.03.

The announcement from Westinghouse Air Brake is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

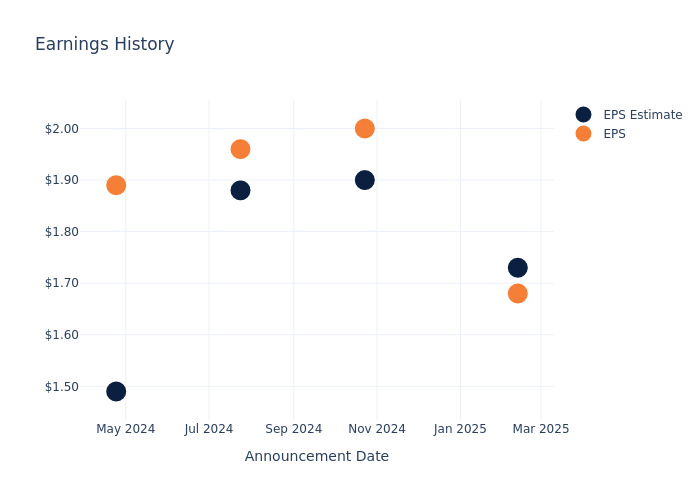

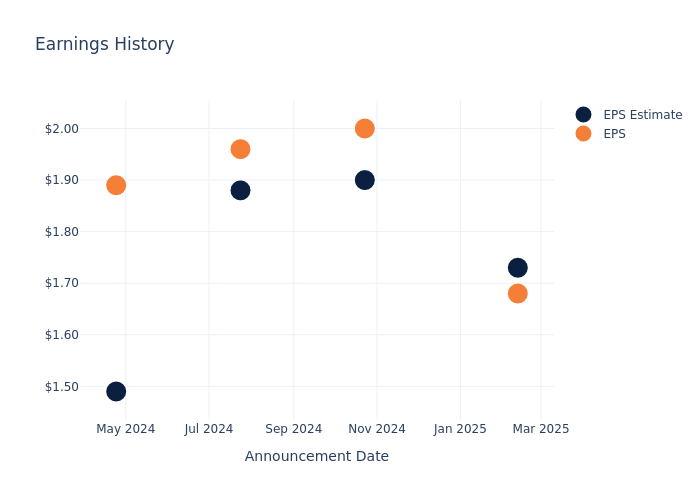

Earnings History Snapshot

The company’s EPS missed by $0.05 in the last quarter, leading to a 3.81% increase in the share price on the following day.

Here’s a look at Westinghouse Air Brake’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.73 | 1.9 | 1.88 | 1.49 |

| EPS Actual | 1.68 | 2 | 1.96 | 1.89 |

| Price Change % | 4.0% | 1.0% | 1.0% | -0.0% |

Performance of Westinghouse Air Brake Shares

Shares of Westinghouse Air Brake were trading at $167.06 as of April 21. Over the last 52-week period, shares are up 4.5%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Westinghouse Air Brake

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Westinghouse Air Brake.

The consensus rating for Westinghouse Air Brake is Neutral, based on 2 analyst ratings. With an average one-year price target of $197.5, there’s a potential 18.22% upside.

Peer Ratings Comparison

In this analysis, we delve into the analyst ratings and average 1-year price targets of Cummins, PACCAR and Allison Transmission, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Cummins, with an average 1-year price target of $352.92, suggesting a potential 111.25% upside.

- Analysts currently favor an Neutral trajectory for PACCAR, with an average 1-year price target of $108.8, suggesting a potential 34.87% downside.

- Analysts currently favor an Neutral trajectory for Allison Transmission, with an average 1-year price target of $103.75, suggesting a potential 37.9% downside.

Insights: Peer Analysis

The peer analysis summary presents essential metrics for Cummins, PACCAR and Allison Transmission, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Westinghouse Air Brake | Neutral | 2.26% | $797M | 2.08% |

| Cummins | Neutral | -1.12% | $2.03B | 4.06% |

| PACCAR | Neutral | -12.88% | $1.47B | 4.82% |

| Allison Transmission | Neutral | 2.71% | $373M | 10.70% |

Key Takeaway:

Westinghouse Air Brake ranks in the middle among its peers for Consensus. It is at the bottom for Revenue Growth and Gross Profit, but at the top for Return on Equity.

About Westinghouse Air Brake

Westinghouse Air Brake Technologies Corp provides value-added, technology-based products and services for the freight rail and passenger transit industries and the mining, marine, and industrial markets. It provides its products and services through two main business segments: Freight and Transit. The company generates maximum revenue from the Freight segment, which manufactures new and modernized locomotives, provides aftermarket parts and services to existing locomotives, provides components to new and existing freight cars; builds new commuter locomotives; supplies rail control and infrastructure products, including electronics, positive train control equipment, signal design, and engineering services. Geographically, it generates a majority of its revenue from the United States.

Financial Insights: Westinghouse Air Brake

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Positive Revenue Trend: Examining Westinghouse Air Brake’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 2.26% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Westinghouse Air Brake’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 8.21% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Westinghouse Air Brake’s ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.08%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Westinghouse Air Brake’s ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.14%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Westinghouse Air Brake’s debt-to-equity ratio is below the industry average at 0.39, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Westinghouse Air Brake visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.