Range Resources RRC is set to give its latest quarterly earnings report on Tuesday, 2025-04-22. Here’s what investors need to know before the announcement.

Analysts estimate that Range Resources will report an earnings per share (EPS) of $0.89.

Anticipation surrounds Range Resources’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

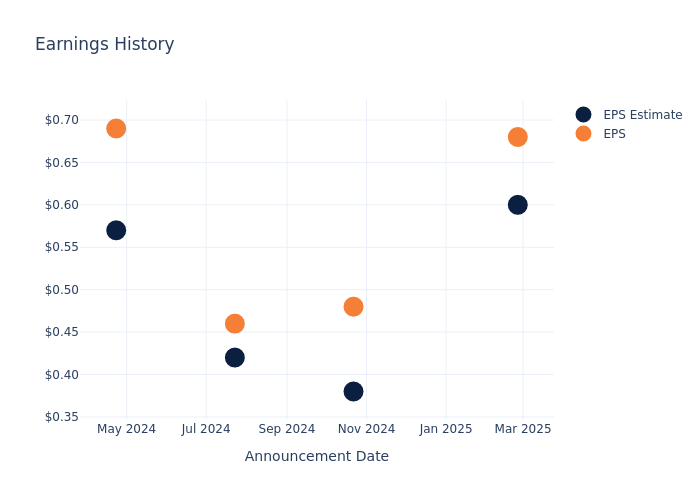

Performance in Previous Earnings

The company’s EPS beat by $0.08 in the last quarter, leading to a 2.8% increase in the share price on the following day.

Here’s a look at Range Resources’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.60 | 0.38 | 0.42 | 0.57 |

| EPS Actual | 0.68 | 0.48 | 0.46 | 0.69 |

| Price Change % | 3.0% | 4.0% | -4.0% | 3.0% |

Tracking Range Resources’s Stock Performance

Shares of Range Resources were trading at $34.18 as of April 18. Over the last 52-week period, shares are down 9.49%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Observations about Range Resources

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Range Resources.

Range Resources has received a total of 15 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $41.27, the consensus suggests a potential 20.74% upside.

Peer Ratings Comparison

In this analysis, we delve into the analyst ratings and average 1-year price targets of Permian Resources, Ovintiv and APA, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Permian Resources, with an average 1-year price target of $18.5, suggesting a potential 45.87% downside.

- Analysts currently favor an Outperform trajectory for Ovintiv, with an average 1-year price target of $51.5, suggesting a potential 50.67% upside.

- Analysts currently favor an Neutral trajectory for APA, with an average 1-year price target of $25.55, suggesting a potential 25.25% downside.

Peer Analysis Summary

In the peer analysis summary, key metrics for Permian Resources, Ovintiv and APA are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Range Resources | Neutral | 4.50% | $207.72M | 2.42% |

| Permian Resources | Outperform | 15.44% | $575.46M | 2.45% |

| Ovintiv | Outperform | -30.89% | $1.19B | -0.57% |

| APA | Neutral | 25.15% | $1.10B | 6.81% |

Key Takeaway:

Range Resources is positioned in the middle among its peers for revenue growth, with a growth rate of 4.50%. It ranks at the bottom for gross profit at $207.72M. In terms of return on equity, Range Resources is also at the bottom with a rate of 2.42%.

Discovering Range Resources: A Closer Look

Fort Worth-based Range Resources is an independent exploration and production company with that focuses entirely on its operations in the Marcellus Shale in Pennsylvania. At year-end 2024, Range Resources’ proven reserves totaled 18.1 trillion cubic feet equivalent, with net production of 2.18 billion cubic feet equivalent per day. Natural gas accounted for 68% of production.

Range Resources: Delving into Financials

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Positive Revenue Trend: Examining Range Resources’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.5% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Range Resources’s net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 14.16%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Range Resources’s ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.42%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 1.29%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Range Resources’s debt-to-equity ratio is below the industry average at 0.46, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Range Resources visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.