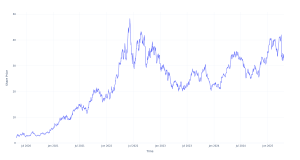

Gold surged to fresh all-time highs on Monday, with bullion jumping 2.5% to $3,410 per ounce by 11:20 a.m. ET, as mounting distrust in U.S. financial assets and inflation fears drive a flight to safety unlike anything seen since the global debt crises of the early 2010s.

Since early March, gold prices — tracked by the SPDR Gold Trust GLD — have climbed an astonishing 19.4%, putting the metal on track for its strongest two-month rally since August 2011.

A perfect storm of macro instability, political friction and investor skepticism about the dollar and U.S. Treasuries is fueling the run.

The root of gold’s dramatic resurgence lies in a potent mix of fundamental, structural and behavioral drivers.

The U.S. dollar and long-duration Treasuries — once go-to safe havens — have come under pressure in recent weeks amid President Donald Trump‘s tariff offensive and his escalating feud with Fed Chair Jerome Powell, raising fears over political interference and eroding confidence in U.S. institutions.

In this climate, gold’s reputation as a neutral, time-tested store of value is attracting capital seeking stability.

As a result, traditional hedges have faltered. But gold, immune to sovereign missteps and backed by centuries of store-of-value status, has emerged as a refuge for capital looking for shelter from rising macro uncertainty.

Read also: Are Investors Selling US Treasuries As Trump Attacks Powell? Here’s What Latest ETF Flows Tell You

Investor appetite for gold is clearly visible in the massive inflows into gold-backed exchange-traded funds (ETFs) since mid-January, when Trump made his official return to the White House:

| ETF Name | Inflows (Mid-January to Mid-April) |

|---|---|

| SPDR Gold Trust GLD | $8.35 billion |

| iShares Gold Trust IAU | $3.5 billion |

| SPDR Gold MiniShares Trust GLDM | $2.46 billion |

| ProShares Ultra Gold UGL | $117 million |

| Goldman Sachs Physical Gold ETF AAAU | $304.9 million |

These blockbuster flows signal broad-based institutional and retail demand. According to Goldman Sachs analyst Lina Thomas, the rally is not being fueled by short-term speculators.

“Data suggests the move has occurred without a substantial return of speculative flows,” Thomas said.

“With estimated COMEX speculative positioning still moderate, we view the rally as structurally supported and less exposed to sharp near-term liquidation risk. Thus, we see current levels as a tactically attractive entry point… and believe this reinforces upside risk to our $3,700/toz year-end forecast.”

Ed Yardeni, president of Yardeni Research, said the current momentum validates his call from over a year ago.

“We’ve been bullish on gold since it broke out above $2,000 per ounce at the end of February 2024. Our $4,000 target by the end of this year looks increasingly realistic. If that happens, then $5,000 would be our target for the end of 2026.”

“This situation may come as a crisis for many assets, but for gold, it’s a perfect outcome. Inflation fears remain high as the U.S. stock market loses trillions of dollars, and investors are leaning toward physical gold in search of security rather than risky assets like stocks and Bitcoin BTC/USD,” said Rick Kanda, managing director at The Gold Bullion Company, in an email.

The rally is also lifting gold miners, many of which had lagged physical bullion for much of 2024. Now, they’re catching up. “Gold has surged to new all-time highs above $3,000/ounce, driven by renewed flows into gold-backed ETFs and continued strong demand from global central banks,” VanEck said Monday.

“At the same time, gold miners are beginning to regain leverage to gold prices, emerging as some of the best-performing stocks so far this year.”

The VanEck Gold Miners ETF GDX is up nearly 52% year-to-date, eyeing the strongest annual gain since the fund’s inception in 2007.

In response to the metal’s powerful rally, Bank of America on Monday raised price targets across its North American gold and silver coverage.

The move comes just ahead of first-quarter earnings season in the precious metals sector, which begins April 23 with Newmont Corp. NEM and continues with Agnico Eagle Mines Ltd. AEM on April 24.

Here are the new price targets for key names:

| Company | New Target | Previous Target |

|---|---|---|

| Agnico Eagle Mines | $159 | $142 |

| Barrick Gold Corp. GOLD | $23 | $19.50 |

| Kinross Gold Corp. KGC | $17.50 | $15 |

| Newmont Corp. | $70 | $60 |

| B2Gold Corp. BTG | $3.10 | $2.75 |

| Centerra Gold CGAU | $6.50 | $5.50 |

| Eldorado Gold Corp. EGO | $19.50 | $17.25 |

| IAMGOLD Corp. IAG | $9.25 | $7.75 |

| SSR Mining Inc. SSRM | $9.75 | $8.50 |

| Alamos Gold Inc. AGI | $35 | $30.50 |

| New Gold Inc. NGD | $4.55 | $4.10 |

| Pan American Silver Corp. PAAS | $32 | $27 |

| Franco-Nevada Corp. FNV | $195 | $165 |

| Royal Gold Inc. RGLD | $183 | $164 |

| Triple Flag Precious Metals TFPM | $27 | $24 |

| Wheaton Precious Metals WPM | $100 | $86 |

Read Now:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.