Calix Inc CALX shares are trading higher in Monday’s after-hours session after the company reported strong first-quarter financial results and increased its stock repurchase authorization by $100 million.

What Happened: After market close on Monday, cloud and managed services company Calix announced that its board increased its buyback authorization by an additional $100 million, bringing the total repurchase authorization up to $162.9 million.

The company noted that it repurchased 1.2 million shares in the first quarter and ended the period with $282 million in cash and investments.

Shares jumped about 13% on the announcement. The company also reported financial results for the first quarter in a subsequent press release.

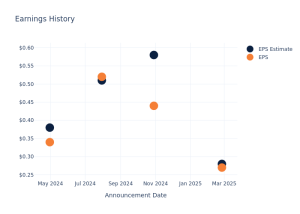

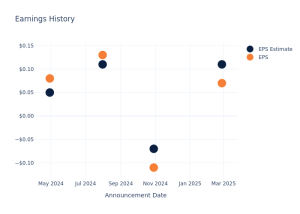

Calix reported first-quarter revenue of $220.24 million, beating analyst estimates of $206.98 million. The company reported first-quarter adjusted earnings of 19 cents per share, beating estimates of 13 cents per share, according to Benzinga Pro.

“Our focus on operational excellence drove our eighth consecutive quarter of double-digit free cash flow and our 19th consecutive quarter of positive free cash flow, which continued to strengthen our already strong balance sheet,” the company said in a letter to shareholders.

Calix guided for second-quarter revenue of $221 million to $227 million versus estimates of $210.53 million. The company said it expects second-quarter adjusted earnings of 18 cents to 24 cents per share versus estimates of 15 cents per share.

“With strong demand for our appliances, platform, cloud and managed services, we are confident in our sequential growth, and we are excited by the multi-year outlook for our business. We remain focused on growing our footprint by adding to our BXP customer base and expanding the reach of our platform, cloud and managed services across their subscribers,” the company said.

CALX Price Action: Calix shares were up 14.14% at $37.95 after-hours at the time of publication Monday, according to Benzinga Pro.

Read Next:

Photo: Tada Images/Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.