Genuine Parts GPC will release its quarterly earnings report on Tuesday, 2025-04-22. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Genuine Parts to report an earnings per share (EPS) of $2.04.

Anticipation surrounds Genuine Parts’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.06, leading to a 0.35% increase in the share price on the subsequent day.

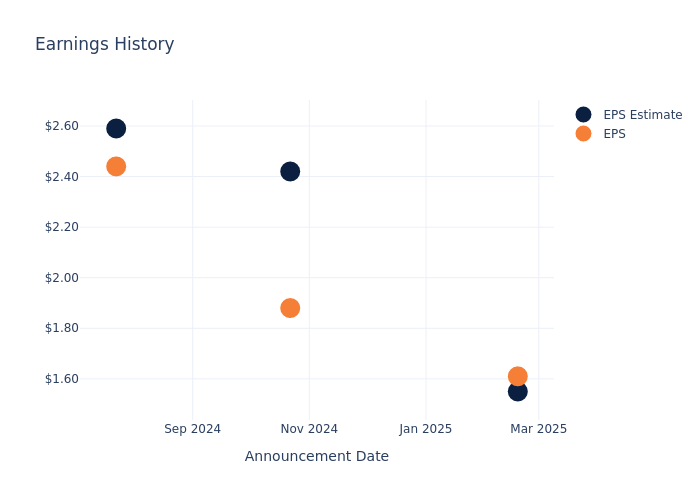

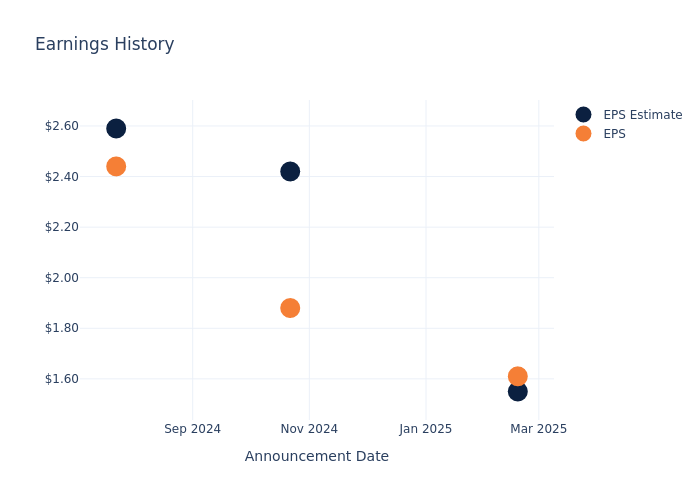

Here’s a look at Genuine Parts’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.55 | 2.42 | 2.59 | 2.16 |

| EPS Actual | 1.61 | 1.88 | 2.44 | 2.22 |

| Price Change % | 0.0% | 3.0% | -1.0% | 1.0% |

Market Performance of Genuine Parts’s Stock

Shares of Genuine Parts were trading at $114.1 as of April 18. Over the last 52-week period, shares are down 30.82%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analysts’ Perspectives on Genuine Parts

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Genuine Parts.

Analysts have provided Genuine Parts with 5 ratings, resulting in a consensus rating of Neutral. The average one-year price target stands at $127.0, suggesting a potential 11.31% upside.

Peer Ratings Overview

In this comparison, we explore the analyst ratings and average 1-year price targets of Pool, LKQ and A-Mark Precious Metals, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Pool, with an average 1-year price target of $339.67, suggesting a potential 197.7% upside.

- Analysts currently favor an Outperform trajectory for LKQ, with an average 1-year price target of $56.17, suggesting a potential 50.77% downside.

- Analysts currently favor an Buy trajectory for A-Mark Precious Metals, with an average 1-year price target of $35.33, suggesting a potential 69.04% downside.

Key Findings: Peer Analysis Summary

Within the peer analysis summary, vital metrics for Pool, LKQ and A-Mark Precious Metals are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Genuine Parts | Neutral | 3.30% | $2.07B | 2.95% |

| Pool | Neutral | -1.55% | $290.24M | 2.74% |

| LKQ | Outperform | -4.11% | $1.32B | 2.55% |

| A-Mark Precious Metals | Buy | 31.92% | $44.77M | 1.07% |

Key Takeaway:

Genuine Parts ranks in the middle for revenue growth among its peers. It has the highest gross profit compared to others. The company’s return on equity is also in the middle range.

Get to Know Genuine Parts Better

Genuine Parts sells aftermarket automotive parts (about 60% of sales) and industrial products (40% of sales) in the United States and internationally. The automotive segment primarily acts as a distributor to its network of 9,800 global retail locations of which about two thirds are independently owned and operated. We estimate Genuine serves around 6,000 retail locations in the US operating under the Napa Auto Parts brand, with about 80% of end market sales derived from professional customers. Its industrial segment, primarily operating under the Motion banner in the United States, serves as a leading distributor of bearings, power transmission, and other industrial products to more than 200,000 maintenance, repair, and original equipment manufacturer customers.

Genuine Parts: Financial Performance Dissected

Market Capitalization Analysis: Above industry benchmarks, the company’s market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Genuine Parts displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 3.3%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Genuine Parts’s net margin excels beyond industry benchmarks, reaching 2.31%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Genuine Parts’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 2.95% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Genuine Parts’s ROA excels beyond industry benchmarks, reaching 0.67%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.32, caution is advised due to increased financial risk.

To track all earnings releases for Genuine Parts visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.