GE Aero GE is gearing up to announce its quarterly earnings on Tuesday, 2025-04-22. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that GE Aero will report an earnings per share (EPS) of $1.24.

Anticipation surrounds GE Aero’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

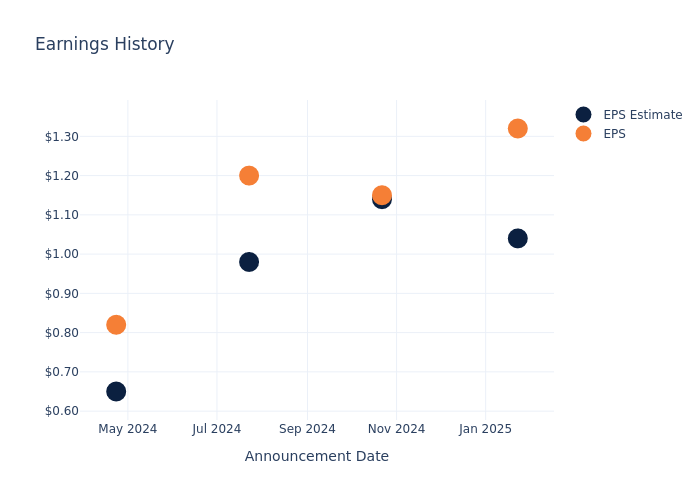

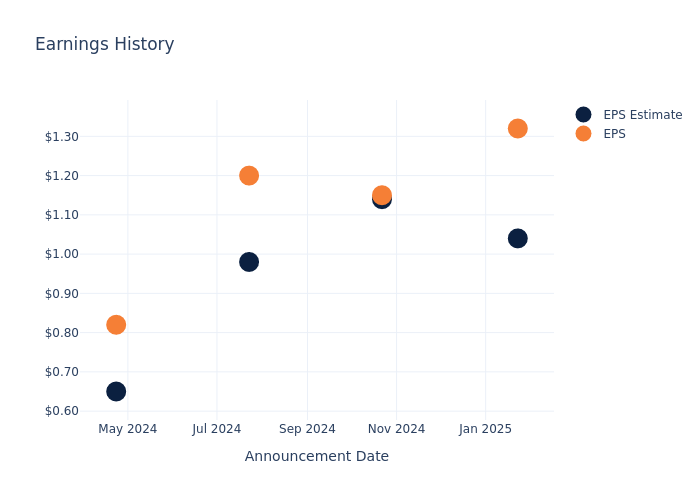

Performance in Previous Earnings

The company’s EPS beat by $0.28 in the last quarter, leading to a 2.02% drop in the share price on the following day.

Here’s a look at GE Aero’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.04 | 1.14 | 0.98 | 0.65 |

| EPS Actual | 1.32 | 1.15 | 1.20 | 0.82 |

| Price Change % | -2.0% | 3.0% | -6.0% | -2.0% |

Stock Performance

Shares of GE Aero were trading at $181.79 as of April 18. Over the last 52-week period, shares are up 9.83%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analysts’ Take on GE Aero

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on GE Aero.

The consensus rating for GE Aero is Outperform, based on 10 analyst ratings. With an average one-year price target of $221.7, there’s a potential 21.95% upside.

Peer Ratings Comparison

The analysis below examines the analyst ratings and average 1-year price targets of RTX, Lockheed Martin and Northrop Grumman, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for RTX, with an average 1-year price target of $147.92, suggesting a potential 18.63% downside.

- Analysts currently favor an Neutral trajectory for Lockheed Martin, with an average 1-year price target of $508.83, suggesting a potential 179.9% upside.

- Analysts currently favor an Outperform trajectory for Northrop Grumman, with an average 1-year price target of $572.3, suggesting a potential 214.81% upside.

Peers Comparative Analysis Summary

Within the peer analysis summary, vital metrics for RTX, Lockheed Martin and Northrop Grumman are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| GE Aerospace | Outperform | 14.33% | $4.05B | 9.94% |

| RTX | Outperform | 8.51% | $4.24B | 2.44% |

| Lockheed Martin | Neutral | -1.34% | $690M | 7.79% |

| Northrop Grumman | Outperform | 0.45% | $1.93B | 8.42% |

Key Takeaway:

GE Aerospace outperforms its peers in revenue growth and gross profit, ranking at the top. It also has the highest return on equity among the group.

Discovering GE Aero: A Closer Look

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000 until GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

GE Aero’s Financial Performance

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: GE Aero’s revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 14.33%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: GE Aero’s net margin excels beyond industry benchmarks, reaching 17.57%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): GE Aero’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 9.94% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): GE Aero’s ROA stands out, surpassing industry averages. With an impressive ROA of 1.52%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: GE Aero’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.0. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for GE Aero visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.