Editor’s Note: This article has been updated to clarify that the Bitcoin ETF positions disclosed in Bank of America’s 13F filings represent client holdings, not investments made by the firm itself. Bank of America has no direct exposure to Bitcoin ETFs.

Warren Buffett’s anti-Bitcoin BTC/USD rhetoric has long been discussed in market circles, with many trying to comprehend why one of the world’s most valuable assets failed to impress the “Oracle of Omaha.”

That being said, his firm, Berkshire Hathaway Inc. BRK BRK, has indirect exposure to the price moves of the apex cryptocurrency through a company that bets on spot Bitcoin exchange-traded funds.

What happened: According to the latest 13F filing, Berkshire Hathaway held 680.23 million shares of banking giant Bank of America Corp. BAC, translating to a stake worth nearly $29.89 billion, at the end of 2024.

Notably, BAC was Berkshire Hathaway’s third-largest holding, cornering about 11.88% of its investment portfolio.

However, unlike its investor, client accounts at the financial behemoth have exposure to Bitcoin ETFs, according to 13F filings.

BAC’s 13F filings show client-held positions in each of the six top ETFs tracking Bitcoin’s spot price, with the largest valued at $21.78 million in the iShares Bitcoin Trust ETF (IBIT). The 13F filing indicated that clients held the shares since Q1 2024, with an increase of 249,292 shares reported in Q4.

See Also: Solana Breaks Free From Bitcoin, Ethereum Lag After Cathie Wood’s Ark Invest Accumulates New SOL Staking ETF

Why It Matters: The investment sharply contrasted with Buffett’s disdain toward Bitcoin and cryptocurrencies. The seasoned stock picker has called Bitcoin “probably rat poison squared” and a “delusion” in the past, questioning its intrinsic value.

Interestingly, like BAC, some other Berkshire Hathaway holdings are tied to cryptocurrencies.

Financial services company Jefferies Financial Group Inc. JEF also held over $85 million worth of IBIT shares and deemed Bitcoin a “critical hedge” against fiat debasement and inflation.

Additionally, Berkshire has a stake in Nu Holdings Ltd. NU, a Brazil-based cryptocurrency-friendly bank.

Price Action: At the time of writing, Bitcoin traded at $84,624.93, up 0.03% in the last 24 hours, according to data from Benzinga Pro.

Shares of Berkshire Hathaway rose 0.13% in after-hours trading after closing 0.34% higher at $518.21 during Thursday’s regular session. BAC stock closed 0.21% higher at $37.41.

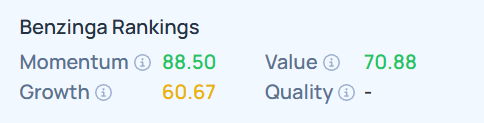

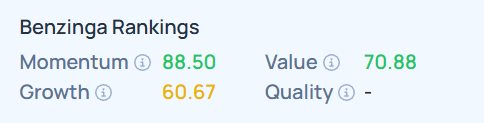

As of this writing, Berkshire Hathaway’s stock was experiencing strong momentum. Go to Benzinga Edge Stock Rankings to see how BAC and its other top holdings perform on this metric.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.