CSX Corp. CSX posted weaker-than-expected first-quarter results after Wednesday’s closing bell.

CSX reported quarterly GAAP earnings of 34 cents per share, which missed the analyst consensus estimate of 37 cents. Quarterly revenue came in at $3.42 billion, missing the $3.46 billion consensus estimate, as declines in coal revenue, fuel surcharge and merchandise volume were only partially offset by the effects of higher merchandise pricing and growth in intermodal volume.

“CSX faced operational challenges to start the year, which contributed to first quarter results that did not meet our expectations,” said Joe Hinrichs, president and CEO of CSX. “In response, our talented and dedicated team of railroaders are working together to lift our performance and drive success through an uncertain market outlook. We are taking targeted actions to address the network constraints posed by two major ongoing infrastructure projects, and we remain committed to safely and reliably serving our customers.”

CSX shares gained 1.6% to trade at $27.79 on Thursday.

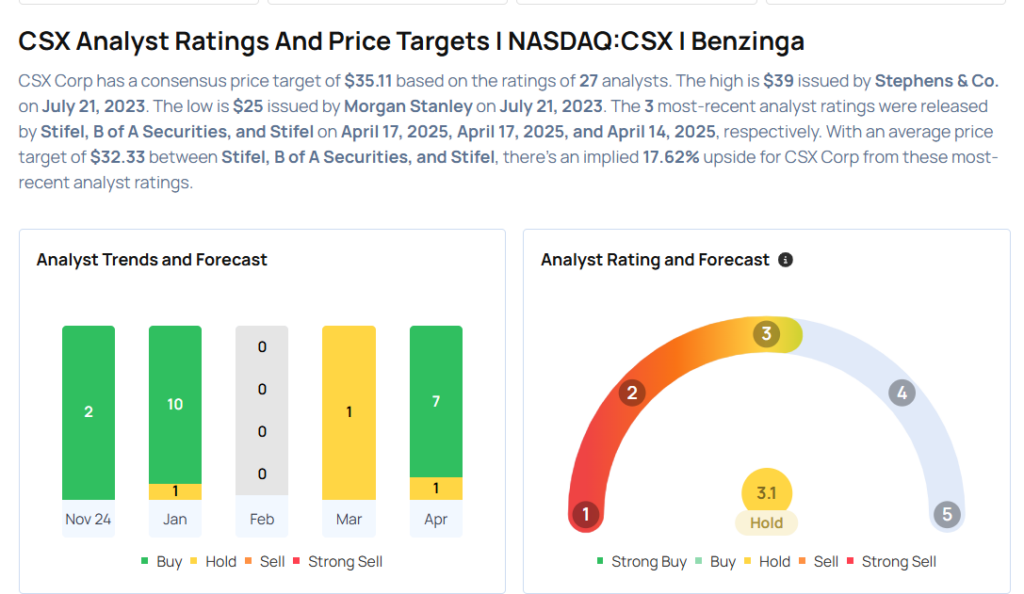

These analysts made changes to their price targets on CSX following earnings announcement.

- B of A Securities analyst Ken Hoexter maintained CSX with a Neutral and lowered the price target from $33 to $30.

- Stifel analyst Benjamin Nolan maintained CSX with a Buy and lowered the price target from $34 to $33.

Considering buying CSX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.