U.S. Bancorp USB will release earnings results for the first quarter, before the opening bell on Wednesday, April 16.

Analysts expect the Minneapolis, Minnesota-based company to report quarterly earnings at 98 cents per share, up from 78 cents per share in the year-ago period. U.S. Bancorp projects to report quarterly revenue at $6.91 billion, compared to $6.68 billion a year earlier, according to data from Benzinga Pro.

On Monday, U.S. Bank announced a new Spend Management platform to help businesses monitor, track, and control their card-based spending.

U.S. Bancorp shares gained 1.1% to close at $38.63 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

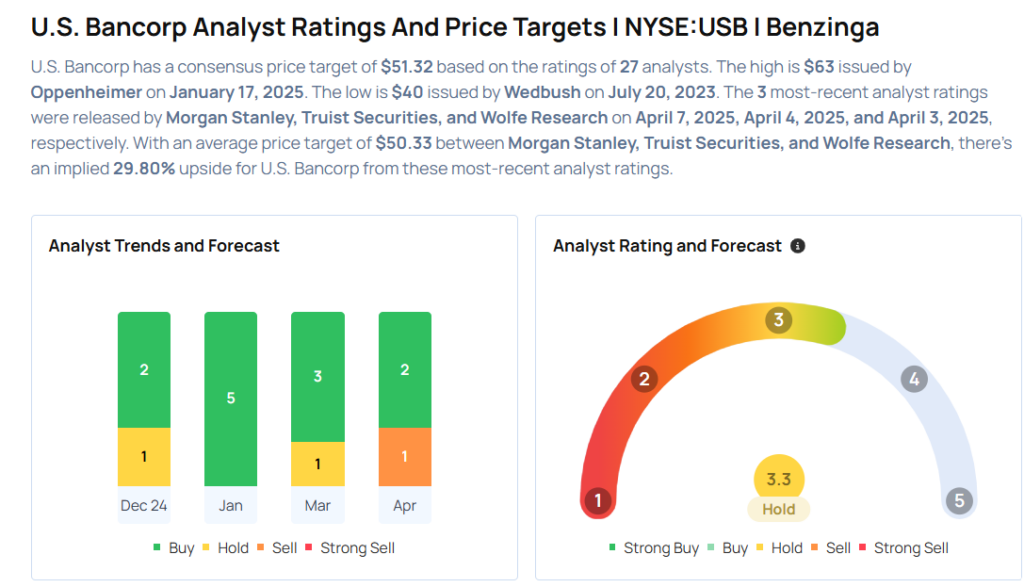

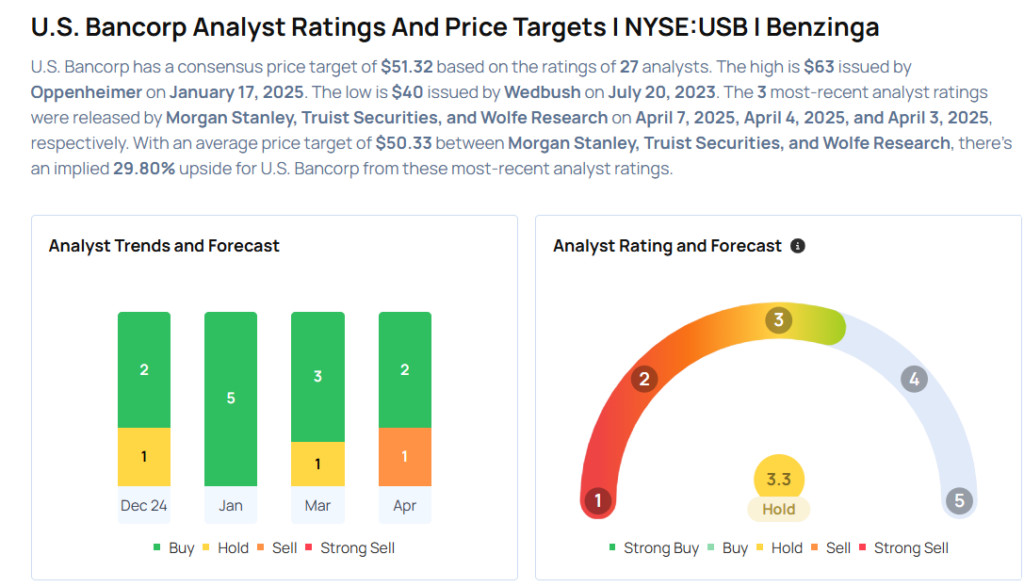

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Betsy Graseck maintained an Overweight rating and cut the price target from $55 to $51 on April 7, 2025. This analyst has an accuracy rate of 61%.

- Wolfe Research analyst Bill Carcache upgraded the stock from Peer Perform to Outperform with a price target of $49 on April 3, 2025. This analyst has an accuracy rate of 80%.

- Wells Fargo analyst Mike Mayo maintained an Overweight rating and slashed the price target from $62 to $56 on March 28, 2025. This analyst has an accuracy rate of 65%.

- Citigroup analyst Keith Horowitz maintained a Buy rating and cut the price target from $65 to $55 on March 24, 2025. This analyst has an accuracy rate of 74%.

- Goldman Sachs analyst Richard Ramsden maintained a Neutral rating and slashed the price target from $51 to $45 on March 19, 2025. This analyst has an accuracy rate of 70%.

Considering buying USB stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.