Financial giants have made a conspicuous bullish move on Robinhood Markets. Our analysis of options history for Robinhood Markets HOOD revealed 29 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $752,293, and 19 were calls, valued at $2,392,628.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $35.0 to $100.0 for Robinhood Markets over the recent three months.

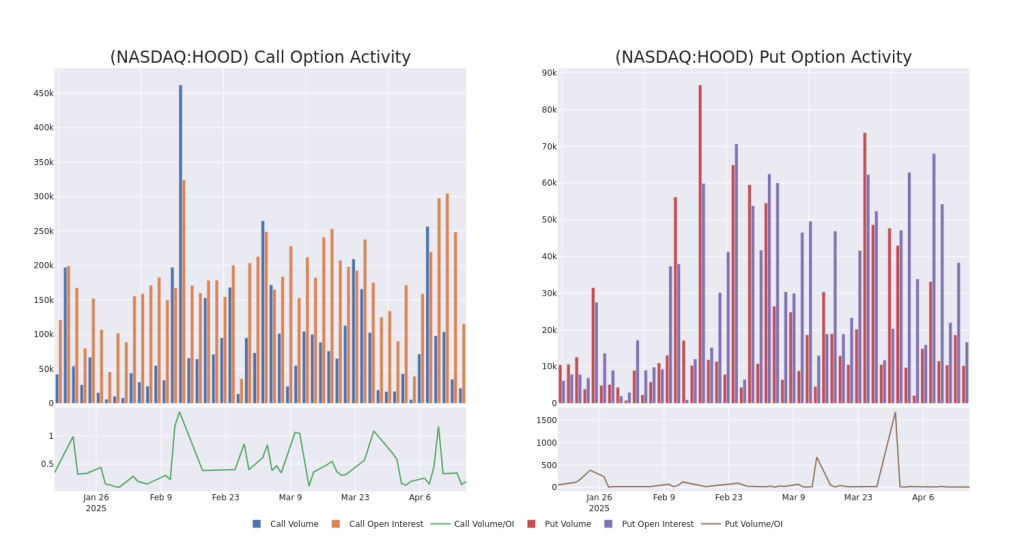

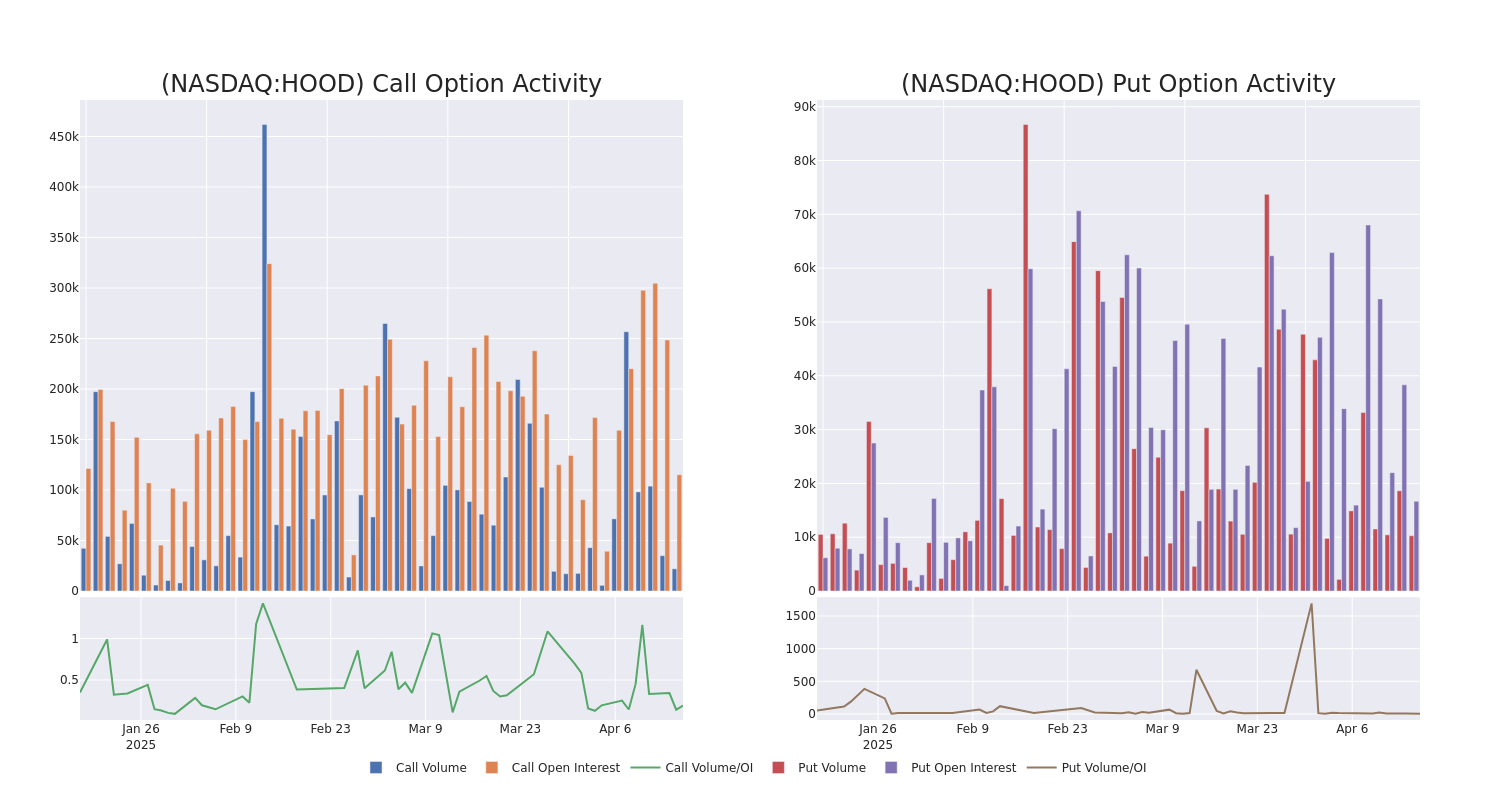

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Robinhood Markets options trades today is 6590.95 with a total volume of 32,278.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Robinhood Markets’s big money trades within a strike price range of $35.0 to $100.0 over the last 30 days.

Robinhood Markets Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | TRADE | NEUTRAL | 05/16/25 | $2.96 | $2.75 | $2.85 | $45.00 | $504.4K | 21.0K | 5.4K |

| HOOD | CALL | TRADE | BULLISH | 04/25/25 | $8.0 | $7.75 | $8.0 | $35.00 | $480.0K | 1.5K | 600 |

| HOOD | CALL | TRADE | BULLISH | 05/16/25 | $1.8 | $1.7 | $1.78 | $50.00 | $259.8K | 20.1K | 1.7K |

| HOOD | CALL | TRADE | BULLISH | 06/20/25 | $2.05 | $1.81 | $2.0 | $55.00 | $200.0K | 13.9K | 1.0K |

| HOOD | CALL | TRADE | BEARISH | 05/16/25 | $3.4 | $3.3 | $3.33 | $45.00 | $199.8K | 21.0K | 740 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fraud detection, derivatives, fractional shares, recurring investments, and others.

Following our analysis of the options activities associated with Robinhood Markets, we pivot to a closer look at the company’s own performance.

Current Position of Robinhood Markets

- With a volume of 7,928,097, the price of HOOD is down -2.88% at $42.81.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 14 days.

Expert Opinions on Robinhood Markets

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $57.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Robinhood Markets with a target price of $50.

* An analyst from JMP Securities has decided to maintain their Market Outperform rating on Robinhood Markets, which currently sits at a price target of $70.

* Reflecting concerns, an analyst from Keefe, Bruyette & Woods lowers its rating to Market Perform with a new price target of $60.

* An analyst from Needham persists with their Buy rating on Robinhood Markets, maintaining a target price of $62.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Robinhood Markets, targeting a price of $45.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Robinhood Markets, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.