Whales with a lot of money to spend have taken a noticeably bullish stance on Booking Holdings.

Looking at options history for Booking Holdings BKNG we detected 49 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 20% with bearish.

From the overall spotted trades, 25 are puts, for a total amount of $1,147,811 and 24, calls, for a total amount of $9,912,768.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3620.0 to $5400.0 for Booking Holdings over the last 3 months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Booking Holdings options trades today is 27.14 with a total volume of 425.00.

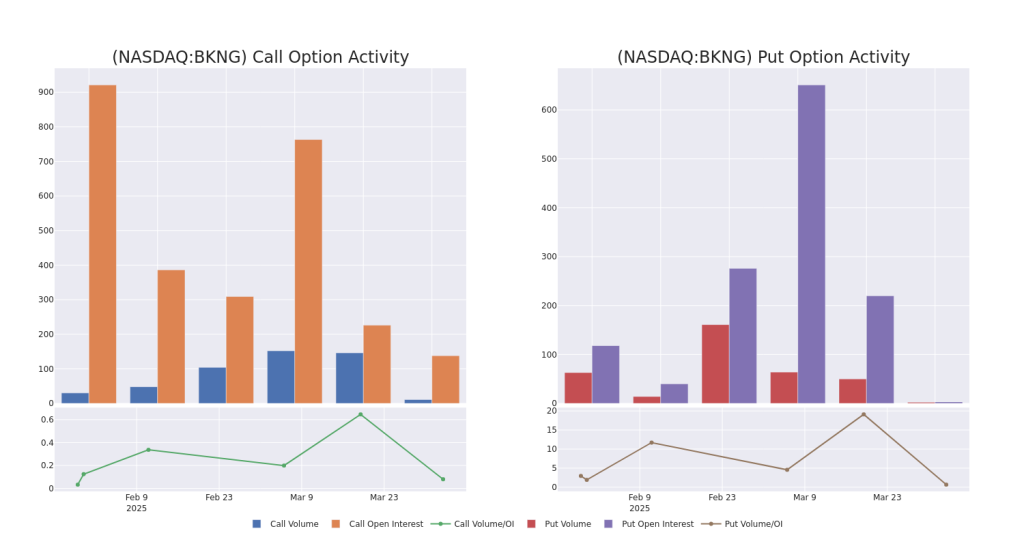

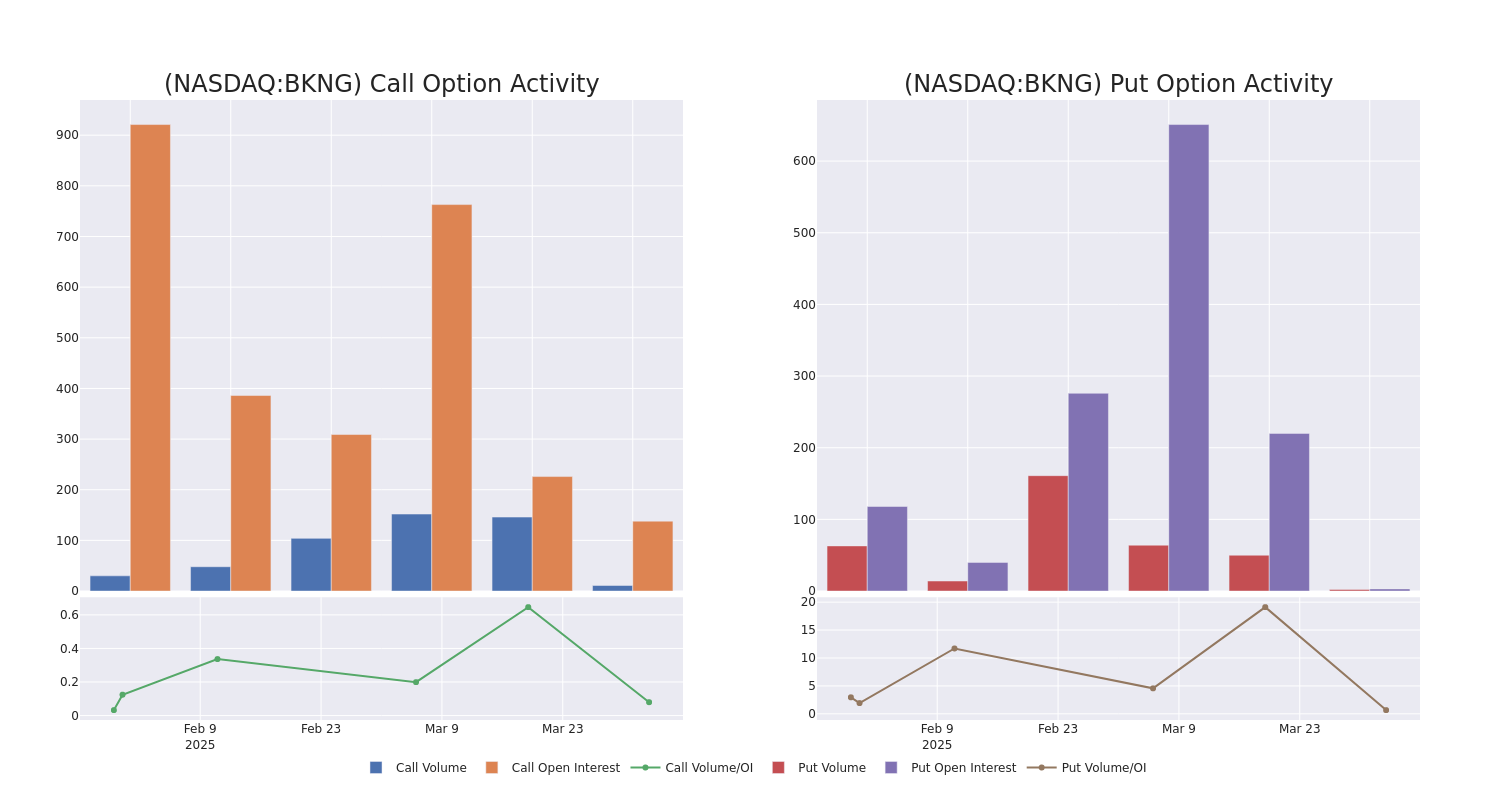

In the following chart, we are able to follow the development of volume and open interest of call and put options for Booking Holdings’s big money trades within a strike price range of $3620.0 to $5400.0 over the last 30 days.

Booking Holdings Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | CALL | SWEEP | BEARISH | 01/16/26 | $1174.8 | $1144.0 | $1144.0 | $3750.00 | $8.9M | 91 | 78 |

| BKNG | PUT | TRADE | BULLISH | 09/19/25 | $192.0 | $175.0 | $175.0 | $3900.00 | $175.0K | 47 | 0 |

| BKNG | CALL | TRADE | BULLISH | 07/18/25 | $235.6 | $223.3 | $235.6 | $4830.00 | $117.8K | 18 | 5 |

| BKNG | PUT | SWEEP | NEUTRAL | 05/09/25 | $294.1 | $272.7 | $283.0 | $4730.00 | $84.9K | 0 | 0 |

| BKNG | PUT | TRADE | BULLISH | 06/20/25 | $288.8 | $265.3 | $273.6 | $4600.00 | $82.0K | 107 | 3 |

About Booking Holdings

Booking is the world’s largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, Rentalcars.com, Kayak, and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

Booking Holdings’s Current Market Status

- With a trading volume of 76,526, the price of BKNG is down by -0.32%, reaching $4597.66.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 13 days from now.

Professional Analyst Ratings for Booking Holdings

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $4969.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from BTIG upgraded its action to Buy with a price target of $5500.

* Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for Booking Holdings, targeting a price of $5600.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Booking Holdings, targeting a price of $4567.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Booking Holdings with a target price of $4850.

* Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Neutral rating on Booking Holdings with a target price of $4330.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Booking Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.