President Donald Trump credited his tariff policies for driving Nvidia Corp.’s NVDA massive $500 billion commitment to build artificial intelligence infrastructure in the United States during a White House press conference on Monday.

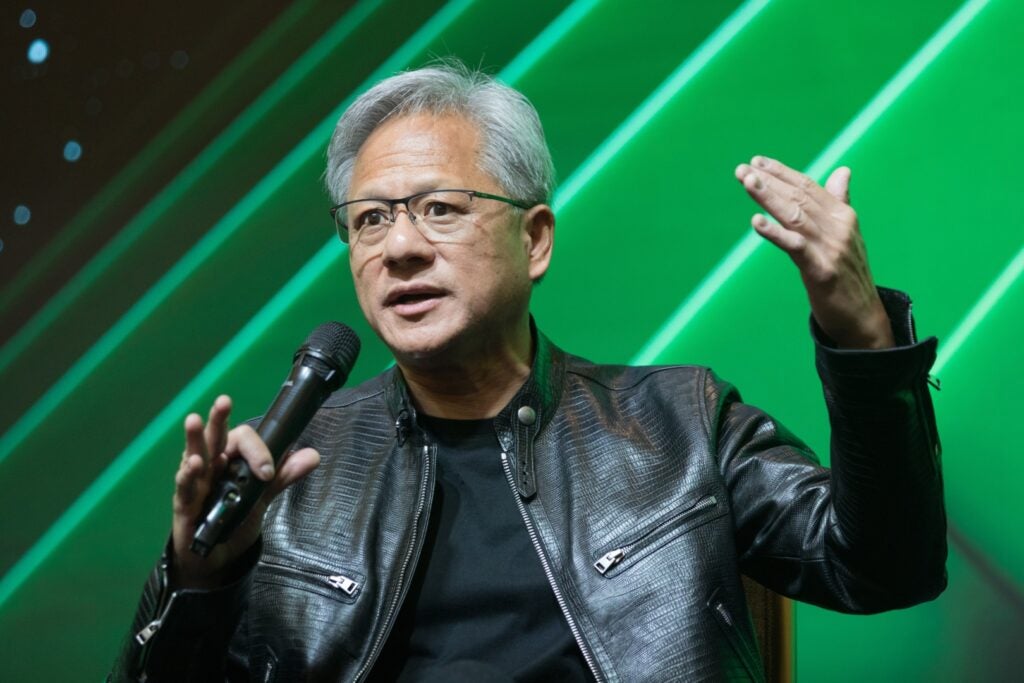

What Happened: “The reason they did it is because of the election on Nov. 5 and because of a thing called tariffs,” Trump said while hosting El Salvador President Nayib Bukele. “I want to thank Jensen and all of the people that we deal with. They’re great people, they’re brilliant people, and without tariffs, they wouldn’t be doing it.”

The chipmaker announced plans to partner with manufacturing giants, including Foxconn, Wistron, TSMC, Amkor, and SPIL to develop AI-related infrastructure across the United States over the next four years. Production of Nvidia’s Blackwell chips is already underway at TSMC’s Phoenix facility, with assembly operations planned for Texas.

“The engines of the world’s AI infrastructure are being built in the United States for the first time,” Nvidia CEO Jensen Huang said in the announcement. “Adding American manufacturing helps us better meet the incredible and growing demand for AI chips and supercomputers.”

See Also: 5 Small Businesses Hit Trump With Lawsuit Over Tariffs: Trade Deficits ‘Are Not An Emergency’

Why It Matters: The move comes as U.S. chip companies received temporary relief last week when Trump paused tariffs for 90 days on nations that haven’t imposed retaliatory trade penalties. However, Trump indicated on Sunday that he would announce new semiconductor import tariff rates this week, though with “flexibility with some companies.”

Nvidia’s initiative coincides with similar moves by competitors. Advanced Micro Devices Inc. AMD CEO Lisa Su confirmed Tuesday that AMD will manufacture more AI servers in the United States and begin chip production at Taiwan Semiconductor Manufacturing Co.’s TSM Arizona facility.

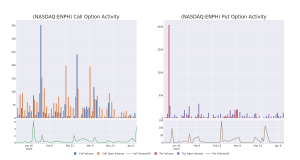

Price Action: Nvidia stock closed at $110.71 on Monday, down by 0.20%. In after-hours trading, the stock dipped to $109.37, a decrease of 1.21%. Year-to-date, the stock has fallen 19.96%, according to data from Benzinga Pro.

Nvidia beats rivals AMD and Intel in momentum but lacks a positive valuation, according to Benzinga Edge Stock Rankings. Sign up for more insights.

Read Next:

Photo Courtesy: jamesonwu1972 On Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.