Financial giants have made a conspicuous bullish move on Brinker International. Our analysis of options history for Brinker International EAT revealed 25 unusual trades.

Delving into the details, we found 72% of traders were bullish, while 20% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $140,629, and 23 were calls, valued at $2,108,182.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $150.0 for Brinker International over the recent three months.

Analyzing Volume & Open Interest

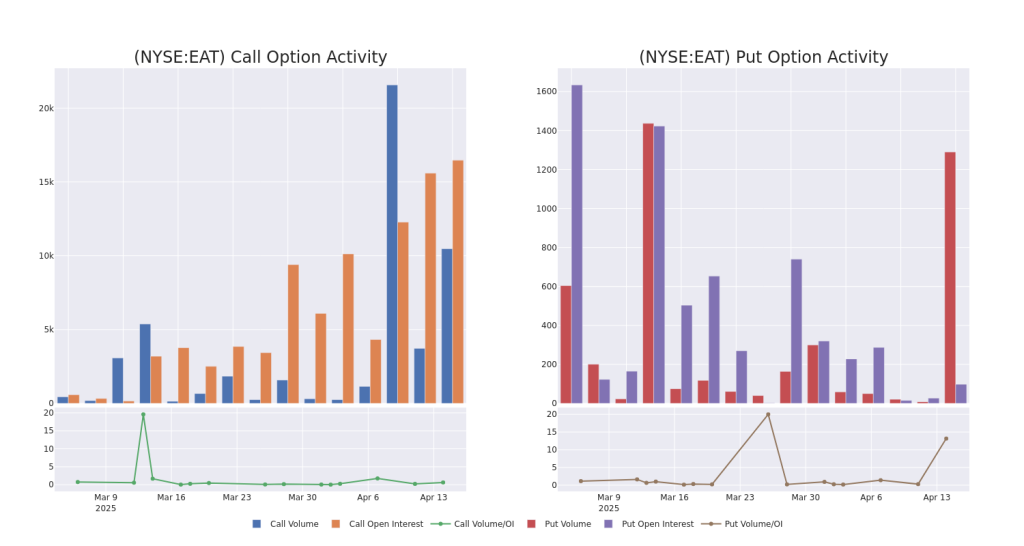

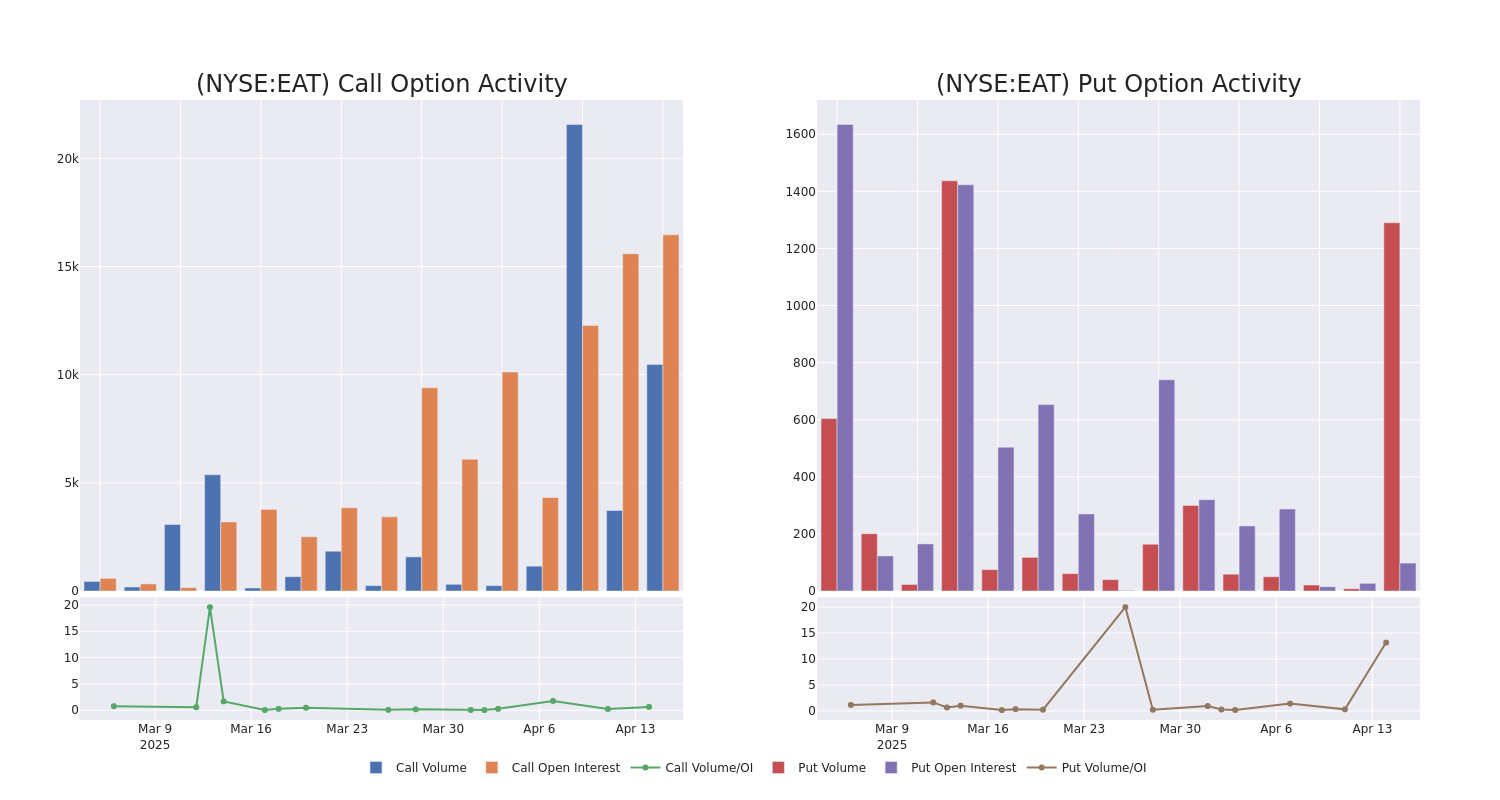

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Brinker International’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Brinker International’s substantial trades, within a strike price spectrum from $130.0 to $150.0 over the preceding 30 days.

Brinker International Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EAT | CALL | SWEEP | BEARISH | 05/16/25 | $17.7 | $15.2 | $15.2 | $145.00 | $241.6K | 600 | 463 |

| EAT | CALL | SWEEP | BULLISH | 05/16/25 | $15.5 | $13.9 | $15.5 | $145.00 | $206.1K | 600 | 1.1K |

| EAT | CALL | SWEEP | BULLISH | 05/16/25 | $15.3 | $13.9 | $15.3 | $145.00 | $203.5K | 600 | 1.0K |

| EAT | CALL | SWEEP | BULLISH | 05/16/25 | $15.3 | $15.2 | $15.2 | $145.00 | $199.1K | 600 | 453 |

| EAT | CALL | SWEEP | BULLISH | 05/16/25 | $15.8 | $15.2 | $15.8 | $145.00 | $115.3K | 600 | 1.3K |

About Brinker International

Brinker International Inc operates casual dining restaurants under the brand’s Chili Grill and Bar (Chili’s) and Maggiano’s Little Italy (Maggiano’s). Chili’s falls in the Bar and Grill category of casual dining. Its menu features Fresh Mex and Fresh Tex favorites including signature items such as slow-smoked baby back ribs, craft burgers, fajitas, and bottomless chips and salsa paired with tableside guacamole. Maggiano’s is an Italian restaurant brand with a full lunch and dinner menu offering chef-prepared, such as appetizers, chicken, seafood, veal and prime steaks, and desserts. The company generates maximum revenue from Chili’s segment.

After a thorough review of the options trading surrounding Brinker International, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Brinker International Standing Right Now?

- With a volume of 543,026, the price of EAT is up 2.08% at $146.75.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 15 days.

Professional Analyst Ratings for Brinker International

In the last month, 1 experts released ratings on this stock with an average target price of $170.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Brinker International, targeting a price of $170.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Brinker International options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.