Beer giant Constellation Brands (STZ) is taking multiple hits from the Trump administration.

“Well, the consumer is concerned about a number of things … The pricing and costs of things, inflation. They’re concerned about immigration, particularly consumers that have had friends or family who have been involved with issues around immigration. How that’s translating is that people are spending less. They’re out less in restaurants. They’re spending less on consumer goods and consumables,” Constellation Brands CEO Bill Newlands said on Yahoo Finance’s Catalysts.

Newlands added, “Fortunately, beer is pretty far down the list, but there’s an overall concern in that [Hispanic] community. Less social gatherings … Those are beer moments. So for us, that creates a bit of a challenge.”

Constellation Brands is the maker of popular beers Corona and Modelo. The company’s earnings this week shed light on its challenges.

The company guided to fiscal year earnings of $12.60 to $12.90 a share, well below analyst estimates of $13.97 a share. The weak guidance reflects the impact of tariffs and sluggish consumer spending.

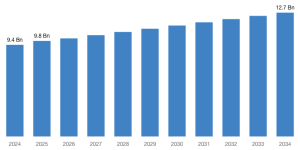

The company sees mid-single-digit to low-double-digit EPS growth in FY27. In FY28, it anticipates low-single-digit to mid-single-digit EPS growth. Previously, the company modeled for low-double-digit EPS growth for both fiscal years.

While Trump has put a 90-day pause on reciprocal tariffs, the abatement doesn’t apply to sector-specific duties. The 25% tariff on imported canned beer and empty aluminum cans that went into effect on April 4 remains in place.

Constellation imports all of its beer from Mexico. Its beer portfolio, which also includes Pacifico, accounted for 78% of the company’s net sales during the quarter.

“To be fair, 4Q25 results were mixed (beer top-line/depletions missing, but with robust margin delivery), and FY26 guidance was well-below our estimates across beer and wine and spirits as the current macro landscape exacerbates an already soft demand environment. However, FY26 beer growth expectations appear prudent (+0-3% on the top line),” said Deutsche Bank analyst Steve Powers in a research note this week.

“Moreover, with respect to tariffs, the company’s outlook for its Mexican import beer portfolio and wine & spirits (the latter of which has sizeable exposure to Canada, Australia, and New Zealand) embeds expected cost headwinds from announced tariffs by the US from last week (which have seemingly been deferred at least in part until July as of today).”