Bitcoin evangelist Michael Saylor has a biblical take on the latest return figures of his business intelligence firm, Strategy (Nasdaq: MSTR), formerly MicroStrategy.

On Apr. 11, Saylor wrote on X (formerly Twitter), “In the beginning was the Bitcoin. Then came the @Strategy.”

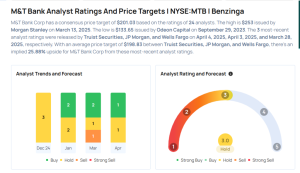

Saylor posted an image along with comparing the 1-year return offered by the Strategy stock to that offered by other giants such as Tesla (Nasdaq: TSLA), SPDR Gold Shares (NYSEArca: GLD), Nvidia (Nasdaq: NVDA), and even Bitcoin — the king coin — itself.

While MSTR offered a 1-year return of 92% as of Apr. 11, Elon Musk’s Tesla stood far behind with a 44% annual return.

SPDR Gold Shares, one of the largest gold holders in the world, offered a 1-year return of 36%. Note that gold hit its record high of $3,237 an ounce on Apr. 11.

Nvidia, the leading chip manufacturer, generated a 1-year return of 36%.

Bitcoin, the world’s largest corporate holder of which is Strategy, itself could only offer a 1-year return of 20%.

Except for Tesla, Nvidia, and Apple, other Magnificent Seven stocks performed rather poorly in terms of annual returns.

While Meta with 4% annual return lied in the green zone, Alphabet, Amazon, and Microsoft lied in the red zone as they offered negative annual returns.

The stock market is still reeling under the drastic impact of President Donald Trump’s tariff war.

Related: Trump Tariff Live Updates: Trump open to make a trade deal with Xi Jinping

The resilience of Strategy amid such trying times had the Strategy founder founding the Genesis myth for the Bitcoin community.

Strategy holds more than 500,000 Bitcoin worth $44 billion as of now.

As far as Bitcoin is concerned, it was trading at $83,871.28 at press time as per Kraken’s price feed.