Producer input prices fell far more than expected in March, aligning with a broader slowdown in consumer inflation seen the previous day, as the early effects of tariffs fail to materialize at the wholesale level.

The Producer Price Index (PPI) increased by 2.7% year-over-year last month, well below the previous 3.2%, according to data released Friday by the Bureau of Labor Statistics. The figure was sharply below economists’ forecast of 3.3%.

On a monthly basis, wholesale prices fell by 0.4% in March, following an upwardly revised 0.1% increase in February and missing expectations for a 0.2% gain. The decline was driven largely by goods prices, which accounted for over 70% of the drop in the index for final demand.

Prices for final demand goods slipped 0.9%—the steepest monthly decline since October 2023, when they fell 1.4%. More than three-quarters of March’s pullback in goods prices was due to a 4.0% drop in the index for final demand energy. Notably, gasoline prices plunged 11.1%, contributing to two-thirds of the overall decline in goods.

Other categories that saw price drops included chicken eggs, beef and veal, fresh and dry vegetables, diesel fuel, and jet fuel.

Core producer prices—excluding food and energy—rose 3.3% year-over-year, down from an upwardly revised 3.5% in February and below expectations of a rise to 3.6%.

On a monthly basis, core inflation declined by 0.1%, reversing the 0.1% increase seen in February and falling short of the 0.3% gain economists had forecast.

Market Reactions

Futures on major U.S. indexes advanced by 8:37 a.m. ET, with S&P 500 contracts up 0.6%, despite China raising U.S. tariffs to 125% overnight.

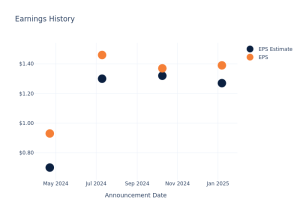

Dow Jones futures led the gains, up 0.8%, lifted by stronger-than-expected earnings from major banks, including JPMorgan Chase & Co. JPM, Morgan Stanley MS, and Wells Fargo & Co. WFC.

Meanwhile, the U.S. dollar index pared earlier losses slightly, while Treasury yields climbed, with the 10-year yield rising 7 basis points to 4.43%.

Gold futures were 1.5% higher to $3,225 per ounce.

Premarket moves in major U.S. ETFs:

- SPDR S&P 500 ETF Trust SPY up 0.8%.

- SPDR Dow Jones Industrial Average DIA up 0.9%.

- Invesco QQQ Trust Series QQQ up 0.9%.

- iShares Russell 2000 ETF IWM up 0.7%.

Read now:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.