By Nupur Anand and Suzanne McGee

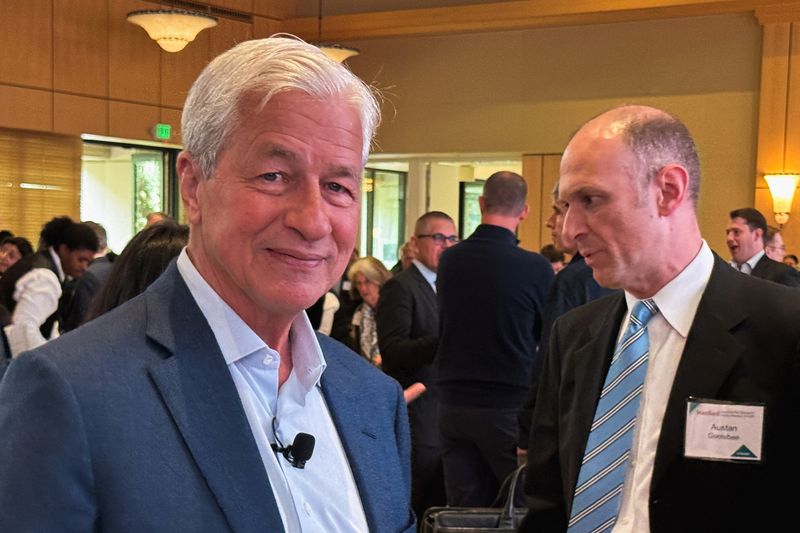

NEW YORK (Reuters) -JPMorgan Chase CEO Jamie Dimon said on Wednesday that sweeping tariffs imposed by U.S. President Donald Trump will probably lead to a recession and defaults by borrowers, he told Fox Business’ “Mornings with Maria” program.

“So long as you have rates going up … inflation is sticky and credit spreads are gapping out, which they’re going to, I think you’ll see more credit problems,” Dimon said.

Dimon urged fast progress on trade negotiations with U.S. trading partners in order to calm markets, which have been roiled by tariff announcements.

“I hope what they really do is … get those things done quickly,” he said, referring to trade negotiations between U.S. Treasury Secretary Scott Bessent and other nations. “If they want to calm down markets, show progress on those things.”

Dimon, 69, is one of the most prominent voices in corporate America and has regularly been consulted by administrations during times of crisis. His name was floated for senior economic roles in government during the 2024 presidential campaign, including Treasury secretary, but he stayed put at the bank.

“I’m taking a calm view, but I think it could get worse if we don’t make some progress here,” Dimon said.

JPMorgan’s economists raised the risk of a U.S. and global recession this year to 60% from 40% after Trump unveiled the trade barriers.

The longest running CEO of a large bank also said that IPOs were being canceled amid market volatility.

“The bad part of these volatile markets is… what it does to the capital markets and the ability of companies to raise money. So IPOs are being canceled, a couple of hung deals out there in the high-yield land, bridge loans, and that just slows everything down,” he said.

Even before Trump’s latest tariff announcement, new U.S. tariffs and worries about trade contributed to a 13% decline in U.S. mergers and acquisitions in the first quarter, Dealogic data compiled for Reuters showed.

“Volatile markets generally are good for our capital markets business, but they’re generally not good for equity issuance,” Dimon added.

In some cases, clients overseas have shunned the U.S. lender in favor of banks closer to home.

“We’ve lost a couple of bond deals already,” Dimon said. “They simply say that, you know, we’d rather just do this with a local bank than with a U.S. bank.”

U.S. stock indexes opened mostly lower on Wednesday, then rebounded, after China announced more levies on U.S. goods, retaliating to President Donald Trump’s reciprocal tariffs that took effect earlier in the day.