Benzinga’s options scanner has just identified more than 8 option transactions on Progressive PGR, with a cumulative value of $214,254. Concurrently, our algorithms picked up 2 puts, worth a total of 80,190.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $260.0 to $290.0 for Progressive over the last 3 months.

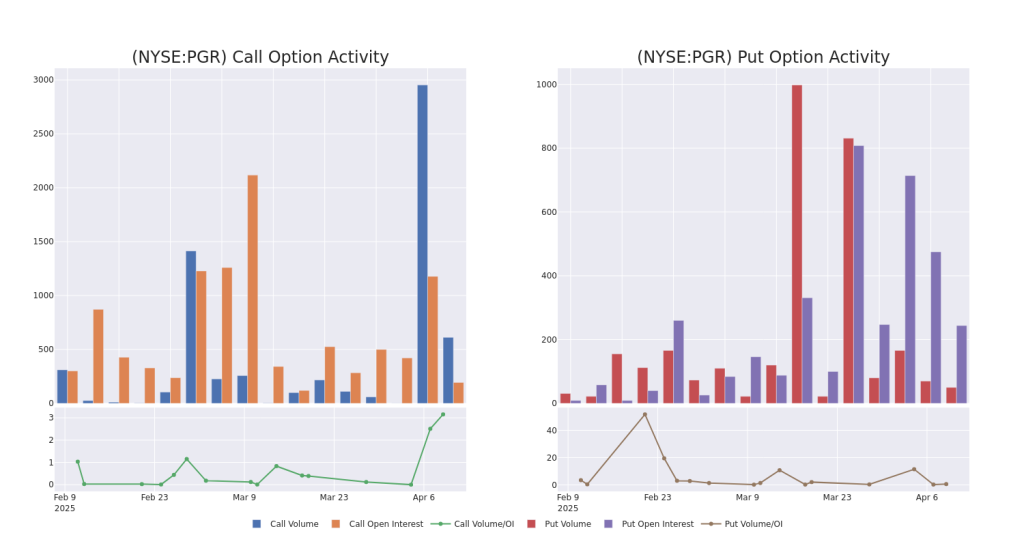

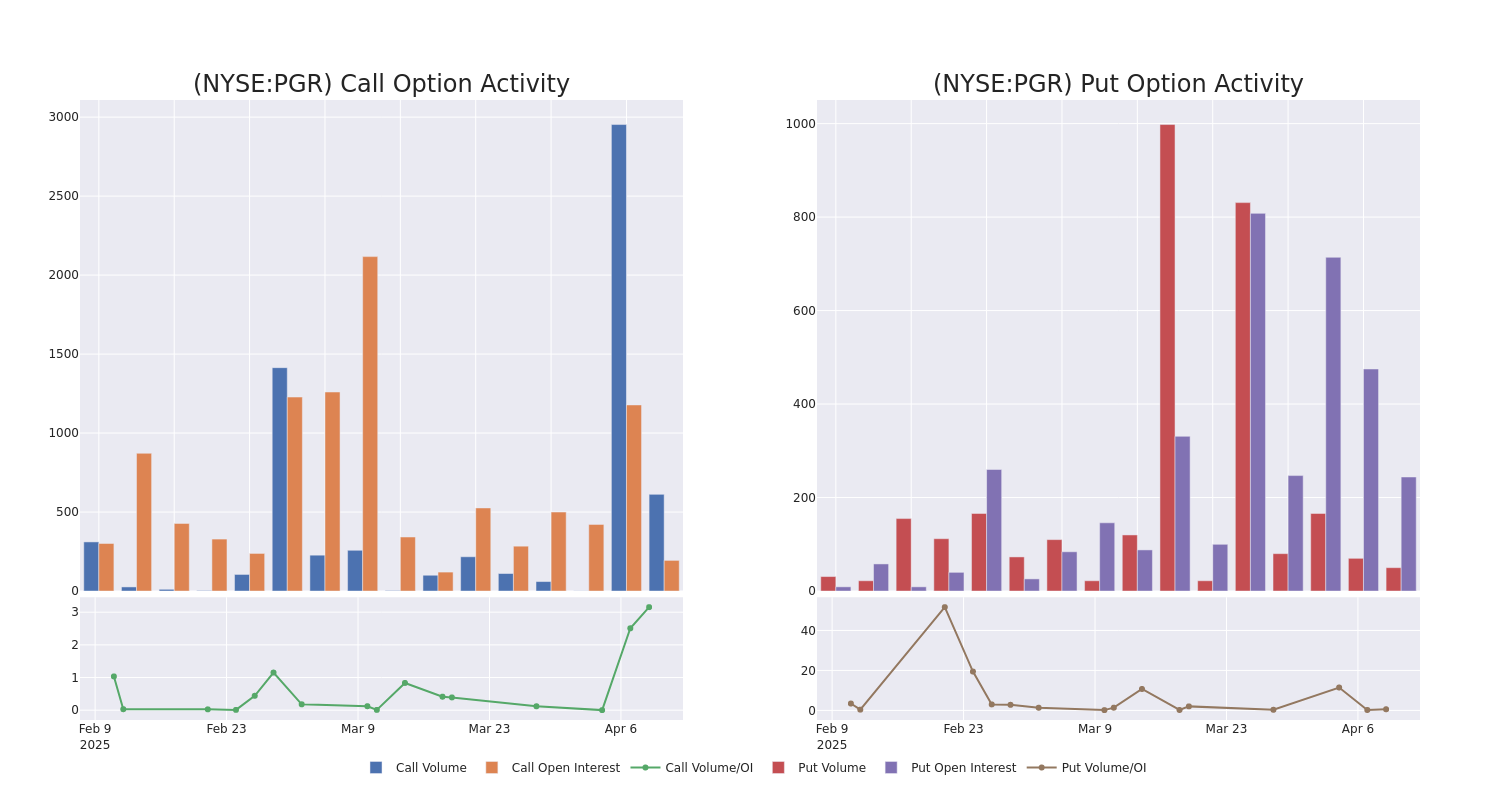

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Progressive’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Progressive’s whale trades within a strike price range from $260.0 to $290.0 in the last 30 days.

Progressive Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PGR | PUT | TRADE | NEUTRAL | 09/19/25 | $23.7 | $21.4 | $22.5 | $260.00 | $42.7K | 45 | 19 |

| PGR | PUT | TRADE | BULLISH | 01/16/26 | $33.6 | $29.8 | $31.2 | $280.00 | $37.4K | 199 | 31 |

| PGR | CALL | SWEEP | BULLISH | 06/20/25 | $8.9 | $8.5 | $8.5 | $285.00 | $31.4K | 104 | 111 |

| PGR | CALL | SWEEP | BULLISH | 06/20/25 | $8.8 | $8.4 | $8.4 | $285.00 | $31.0K | 104 | 111 |

| PGR | CALL | SWEEP | BULLISH | 06/20/25 | $9.4 | $8.7 | $9.4 | $285.00 | $31.0K | 104 | 0 |

About Progressive

Progressive underwrites private and commercial auto insurance and specialty lines; it has almost 24 million personal auto policies in force and is one of the largest auto insurers in the United States. Progressive markets its policies through independent insurance agencies in the US and Canada and directly via the internet and telephone. Its premiums are split roughly equally between the agent and the direct channel. The company also offers commercial auto policies and entered homeowners insurance through an acquisition in 2015.

In light of the recent options history for Progressive, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Progressive

- Trading volume stands at 4,282,651, with PGR’s price up by 3.53%, positioned at $269.56.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 12 days.

What Analysts Are Saying About Progressive

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $289.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Keefe, Bruyette & Woods persists with their Outperform rating on Progressive, maintaining a target price of $288.

* Reflecting concerns, an analyst from B of A Securities lowers its rating to Neutral with a new price target of $287.

* An analyst from B of A Securities persists with their Buy rating on Progressive, maintaining a target price of $300.

* An analyst from UBS has decided to maintain their Neutral rating on Progressive, which currently sits at a price target of $285.

* An analyst from JP Morgan persists with their Overweight rating on Progressive, maintaining a target price of $287.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Progressive with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.