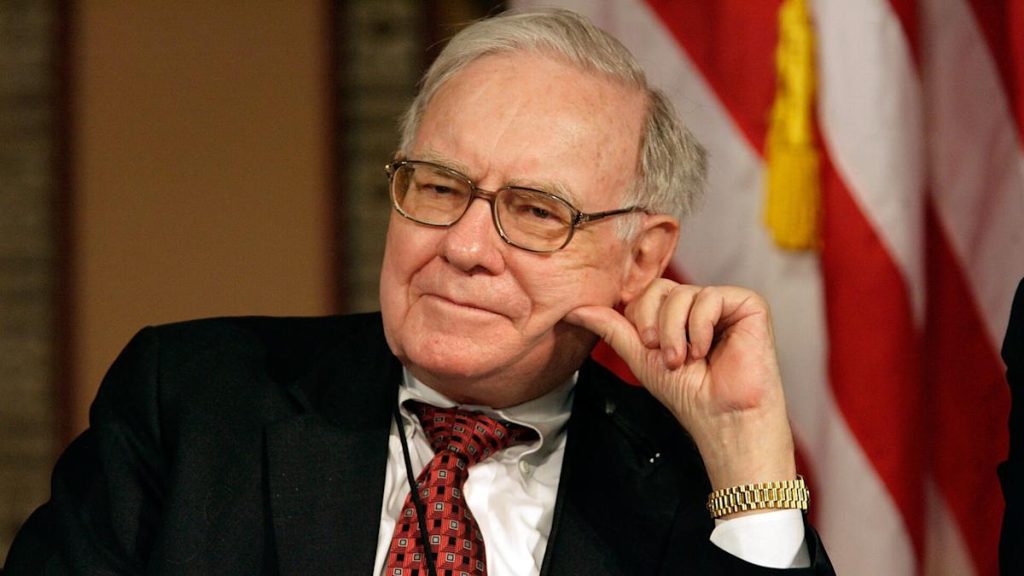

The stock market had already endured steep losses before President Donald Trump’s tariff announcements accelerated the selloff. With many pundits and analysts now predicting a full-on crash, jittery shareholders are wondering how they should prepare — and the world’s most famous value investor might have some answers.

Explore Next: Warren Buffett: 10 Things Poor People Waste Money On

See Next: 4 Affordable Car Brands You Won’t Regret Buying in 2025

Warren Buffett’s knack for weathering market downturns is the stuff of legend. Here’s how you can follow his lead and shore up your defenses if an already bad stock market situation gets even worse.

For Buffett, the best preparation is to adopt an opportunistic mindset by accepting historical evidence that crashes are both inevitable and transient.

On Oct. 16, 2008 — at the peak of the Great Recession — Buffett wrote an op-ed in the New York Times stating, “The market hit bottom in April 1942, well before Allied fortunes turned. Again, in the early 1980s, the time to buy stocks was when inflation raged and the economy was in the tank.”

Investors who understand that crashes are certain to come but also sure to pass can view them as opportunities to increase their long-term holdings at a deep discount.

“In short, bad news is an investor’s best friend. It lets you buy a slice of America’s future at a marked-down price,” Buffett said.

When investors start to see crashes as once-in-a-generation opportunities, they should build cash reserves so they can stock up on discounted shares when a downturn strikes.

In November 2024, when the market was roaring, the AP reported that Buffett was going against the grain and selling vast portions of his portfolio to build a massive $325 billion cash reserve. Investor sentiment was sky-high as stocks continued to break new records, but Buffett just saw an ocean of overpriced stocks that wouldn’t stay that way for long.

He has a long history of stockpiling cash when the market is up so he has money to spend when prices drop.

Fortune reports that instead of bandwagon buying inflated tech stocks during the dot-com bubble’s peak, Buffett instead “built a massive cash pile” just before the crash in the early 2000s.

Buffett’s central investing thesis is to buy and hold shares of high-quality companies with strong financials and unique competitive advantages that can sustain them through rough patches over the long term.