Deep-pocketed investors have adopted a bullish approach towards CrowdStrike Holdings CRWD, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CRWD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 126 extraordinary options activities for CrowdStrike Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 45% leaning bullish and 38% bearish. Among these notable options, 70 are puts, totaling $12,676,261, and 56 are calls, amounting to $3,816,499.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $165.0 and $500.0 for CrowdStrike Holdings, spanning the last three months.

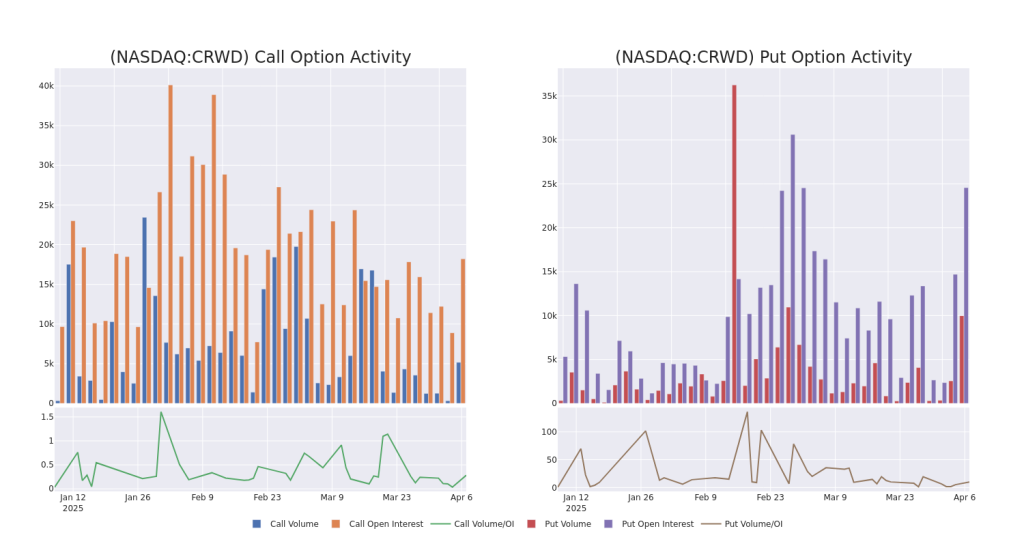

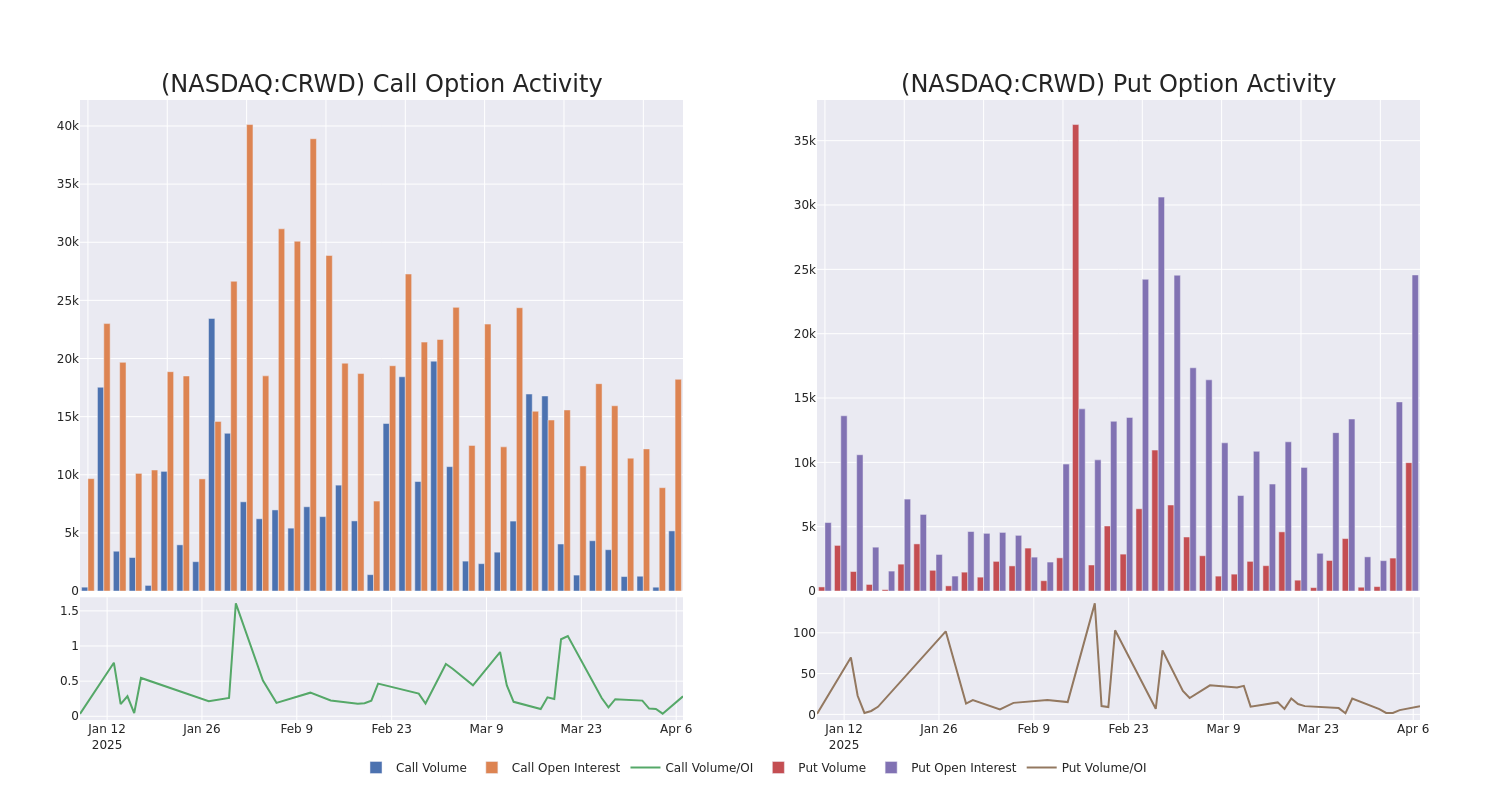

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in CrowdStrike Holdings’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to CrowdStrike Holdings’s substantial trades, within a strike price spectrum from $165.0 to $500.0 over the preceding 30 days.

CrowdStrike Holdings Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | PUT | SWEEP | BEARISH | 06/20/25 | $29.6 | $25.3 | $29.02 | $300.00 | $1.1M | 1.7K | 431 |

| CRWD | PUT | SWEEP | BEARISH | 05/16/25 | $45.65 | $40.45 | $43.0 | $350.00 | $215.0K | 651 | 78 |

| CRWD | CALL | TRADE | BULLISH | 09/19/25 | $50.55 | $46.2 | $49.0 | $330.00 | $147.0K | 176 | 62 |

| CRWD | PUT | SWEEP | BEARISH | 04/17/25 | $35.0 | $31.05 | $35.0 | $350.00 | $140.0K | 1.1K | 105 |

| CRWD | PUT | TRADE | BEARISH | 06/20/25 | $52.05 | $48.0 | $50.45 | $350.00 | $126.1K | 3.6K | 453 |

About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike’s primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

Having examined the options trading patterns of CrowdStrike Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of CrowdStrike Holdings

- With a volume of 3,997,718, the price of CRWD is down -0.55% at $319.87.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 57 days.

What The Experts Say On CrowdStrike Holdings

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $435.25.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a positive move, an analyst from BTIG has upgraded their rating to Buy and adjusted the price target to $431.

* An analyst from Jefferies has decided to maintain their Buy rating on CrowdStrike Holdings, which currently sits at a price target of $410.

* Reflecting concerns, an analyst from Stephens & Co. lowers its rating to Overweight with a new price target of $450.

* Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on CrowdStrike Holdings with a target price of $450.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CrowdStrike Holdings options trades with real-time alerts from Benzinga Pro.

Momentum84.52

Growth79.78

Quality–

Value3.45

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.