Vltava Fund, an investment management company, recently released its first-quarter 2025 investor letter. A copy of the letter can be downloaded here. The letter contemplated whether the stock market is a casino. The author emphasized that the stock market is not a casino, and investors must not treat it as such to achieve better returns. The trend shows that a growing number of people have recently started to view stock market trading as gambling. However, the firm believes that stocks are the best long-term investment. In the first quarter, markets were both interesting and volatile due to several factors. The fund has been in existence for 21 years and has never engaged in stock trading solely due to political changes. The fund believes that it is vital to focus on selecting companies with long-term value growth and strong shareholder-focused management, when the political changes affect the economy and corporate profitability. In addition, please check the fund’s top five holdings to know its best picks in 2025.

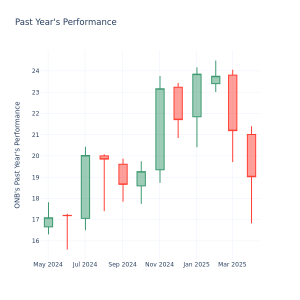

In its first quarter 2025 investor letter, Vltava Fund emphasized stocks such as Berkshire Hathaway Inc. (NYSE:BRK-B). Berkshire Hathaway Inc. (NYSE:BRK-B) engages in insurance, freight rail transportation, and utility businesses. The one-month return of Berkshire Hathaway Inc. (NYSE:BRK-B) was -0.72%, and its shares gained 18.65% of their value over the last 52 weeks. On April 4, 2025, Berkshire Hathaway Inc. (NYSE:BRK-B) stock closed at $493.54 per share with a market capitalization of $1.066 trillion.

Vltava Fund stated the following regarding Berkshire Hathaway Inc. (NYSE:BRK-B) in its Q1 2025 investor letter:

“Our oldest and longest-held position in our portfolio is Berkshire Hathaway Inc. (NYSE:BRK-B). When we included it into the portfolio more than 13 years ago, in January 2012, the stock was priced at $119,000. Book value per share at that time was approximately $100,000. By the end of 2024, the book value per share was approximately $446,000. The book value has therefore increased by almost 3.5 times in 13 years. How did this happen? Berkshire generates a profit every year through its businesses. The profit generated increases the company’s equity and the amount of capital available to it. The capital is reinvested again and again into the company’s businesses. As the amount of capital invested increases, the absolute amount of returns grows and the entire process accelerates as time goes on. At the same time, the amount of capital attributable to each Berkshire share that we own in the Vltava Fund also grows. The share price has gradually reflected this development, rising from an initial $119,000 to $680,000 by the end of 2024.