U.S. stock futures were swinging between gains and losses on Tuesday after a mixed session on Monday. Futures of major benchmark indices were mixed in premarket trading.

President Donald Trump‘s “Liberation Day”, the term he’s used for April 2nd, the day of incoming reciprocal tariffs, preceded a drop in stock prices.

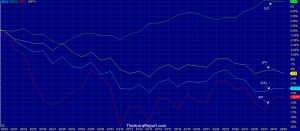

S&P 500 declined by 4.59% for the first quarter of 2025, whereas the Nasdaq 100 was down over 10%.

With the 10-year Treasury yield at 4.18% and the two-year at 3.87%, the CME Group’s FedWatch tool shows markets pricing in an 86.8% likelihood of the Federal Reserve maintaining current interest rates through its May meeting.

| Futures | Change (+/-) |

| Nasdaq 100 | 0.03% |

| S&P 500 | -0.11% |

| Dow Jones | -0.21% |

| Russell 2000 | -0.15% |

The SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust ETF QQQ, which track the S&P 500 index and Nasdaq 100 index, respectively, were mixed in premarket on Tuesday. The SPY was down 0.17% to $558.43, while the QQQ advanced 0.071% to $469.00, according to Benzinga Pro data.

Cues From Last Session:

Consumer staples, financials, and utilities led the S&P 500 gains on Monday, while consumer discretionary stocks declined.

Overall, U.S. stocks were mixed; the Dow rose over 400 points amidst Trump’s tariff concerns, but the Nasdaq fell due to drops in Nvidia Corp. NVDA and Tesla Inc. TSLA.

March saw significant declines for major indices, with the S&P 500 down 5.8%, the Nasdaq 8.2%, and the Dow 4.2%. Quarterly, the Nasdaq fell 10.4%, and the Dow lost 1.3%.

Economic data showed a rise in the Chicago PMI but a decline in the Dallas Fed’s manufacturing index.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.14% | 17,299.29 |

| S&P 500 | 0.55% | 5,611.85 |

| Dow Jones | 1.00% | 42,001.76 |

| Russell 2000 | -0.56% | 2,011.91 |

Insights From Analysts:

After the S&P 500 index declined 4.59% in the first quarter, marking its largest quarterly underperformance against global markets in 37 years, Ryan Detrick, the chief market strategist at Carson Research, cited historical data in his latest X post and stated that “April does better after a weak Q1.”

The average return in April stood at 3.1% after a poor first quarter, however, the average return for the full year after a bad first quarter stood at just 6.6%.

On the other hand, Stephanie Link, the chief investment strategist and head of investment solutions at Hightower Advisors, said, “I’m buying.”

According to her U.S. was not in a recession, the consumer sentiment was in a better shape, and the jobs, wages, and savings were higher.

“Not all is perfect, but corporate EPS will be better than the long-term average of 5%,” she said, making a case to buy more. Her top picks were Meta Platforms Inc. META, NextEra Energy Inc. NEE, Target Corp. TGT, and Greystone Housing Impact Investors LP GHI.

Despite investor fears surrounding potential tariffs from Trump’s upcoming announcement, Fundstrat’s Tom Lee predicts a market rebound, arguing that markets are oversold and pricing in only worst-case scenarios. He believes the high anxiety among fund managers is excessive and that post-announcement, increased market visibility will alleviate selling pressure, with Bitcoin BTC/USD potentially leading the recovery.

See Also: How to Trade Futures

Upcoming Economic Data

Here’s what investors will keep an eye on Tuesday:

- Richmond Federal Reserve President Thomas Barkin will speak at 9:00 a.m. ET.

- March’s S&P final U.S. manufacturing PMI will be out by 9:45 a.m. ET.

- February’s construction spending, job openings, and March’s ISM manufacturing data will be released by 10:00 a.m. ET and the time for auto sales data is yet to be determined.

Stocks In Focus:

- Ultralife Corp. ULBI jumped 3.72% in premarket on Tuesday ahead of its earnings after the closing bell. Analysts expect a quarterly earnings of $3.22 per share on revenue of $2.34 million.

- nCino Inc. NCNO was up 2.37% as Wall Street expects it to report a quarterly earnings of 19 cents per share on revenue of $140.84 million after the closing bell.

- Sportsman’s Warehouse Holdings Inc. SPWH was 2.61% higher ahead of its earnings after the closing bell. Analysts expect a quarterly earnings of 6 cents per share on revenue of $329.61 million.

- Allarity Therapeutics Inc. ALLR climbed 7.80% after reporting FY24 financial results and beating its earnings expectations.

- Xpeng Inc. ADR XPEV advanced 2.80% after achieving 33,205 Smart EV deliveries, representing a 268% surge year-over-year, and topping 30,000 units for the fifth month in a row. For the first quarter, the company delivered 94,008 Smart EVs, representing a 331% year-over-year surge.

- PVH Corp. PVH surged 15.87% after reporting quarterly earnings of $3.27 per share, which beat the analyst consensus estimate of $3.21. Quarterly revenue came in at $2.37 billion, which beat the analyst consensus estimate of $2.33 billion.

- bioAffinity Technologies Inc. BIAF skyrocketed 136.31% after its revenue soared 270% to $9.4 million in 2024, driven by a 1,400% increase in CyPath Lung orders due to wider physician adoption and Medicare coverage.

- Microvast Holdings Inc. MVST gained 29.91% after it hit a record $379.8 million in FY24 revenue, a 23.9% year-over-year increase, with fourth quarter revenue also reaching a record $113.4 million.

- Cloudastructure Inc. CSAI rose 36.26% after reporting strong financial results for 2024, with revenue surging 125% year-over-year to $1.4 million. The company achieved broad-based growth across all segments.

- Sonim Technologies Inc. SONM zoomed 17.29% as it saw fourth quarter revenue up 12% to $15 million, but FY24 revenue dropped 38% to $58.3 million due to a strategic shift. Key 2024 wins include new product launches and significant enterprise deals.

Commodities, Gold, And Global Equity Markets:

Crude oil futures were trading lower in the early New York session by 0.39% to hover around $71.20 per barrel.

Gold Spot US Dollar advanced 0.27% to hover around $3,132.53 per ounce. Its fresh record high stood at $3,149.03 per ounce. The U.S. Dollar Index spot was lower by 0.02% at the 104.188 level.

Asian markets closed on a higher note on Tuesday, except India’s BSE Sensex index. China’s CSI 300, Hong Kong’s Hang Seng, South Korea’s Kospi, Japan’s Nikkei 225, and Australia’s ASX 200 index advanced. European markets were mostly higher in early trade.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.