Cristina Arias / Cover / Getty Images

-

Johnson & Johnson shares fell Tuesday, after the company said a judge rejected its proposed “prepackaged bankruptcy plan” for a subsidiary to settle thousands of claims alleging its baby powder and other talc products cause ovarian cancer.

-

The company said that it will now go back to the tort system “to litigate and defeat” the claims.

-

Johnson & Johnson had tried twice before, in 2021 and 2023, to use the bankruptcy system to settle the claims.

Johnson & Johnson (JNJ) shares fell Tuesday after the company said a judge rejected its proposed “prepackaged bankruptcy plan” for a subsidiary, as part of its latest attempt to use a bankruptcy court to settle thousands of claims alleging its baby powder and other talc products cause ovarian cancer.

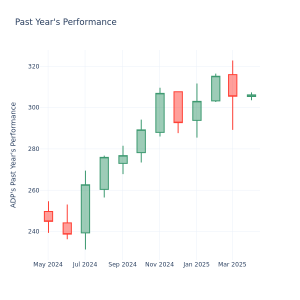

Shares of Johnson & Johnson were down around 5% in recent trading, among the stocks leading declines on the S&P 500.

The company, which has long held that the talc-related claims hold no merit, said Monday that it will now go back to the “tort system to litigate and defeat” the claims and would reverse around $7 billion it had set aside to resolve the bankruptcy.

“The Court has unfortunately allowed a couple of law firms with financially conflicted motives, who have conceded they have not recovered a dime for their clients in a decade of litigation, to defeat the overwhelming desire of claimants,” said Erik Haas, worldwide vice president of litigation at Johnson & Johnson.

“The decision to litigate every filed case is based on the simple fact that this is a fake claim created by greedy plaintiff lawyers looking for another deep pocket to sue and fueled by litigation-financed attorney advertising,” he added.

Johnson & Johnson has tried twice before, in 2021 and 2023, to use the bankruptcy system to settle the claims.

Read the original article on Investopedia