The cryptocurrency market shrank considerably last week due to an uncertain macroeconomic environment, although a few lesser-known coins netted significant returns.

What happened: CRO, the native token of cryptocurrency exchange Crypto.com, topped the gainers list with a 21.89% rally last week.

The upsurge was built on the exchange’s partnership with President Donald Trump-owned Trump Media and Technology Group to launch exchange-traded funds. Later that week, the firm declared the end of an SEC enforcement action, which boosted the token’s value further.

ZEC, a privacy-focused cryptocurrency, narrowly trailed CRO, as it too surged over 21% last week. Interestingly, the coin is built on Bitcoin’s BTC/USD codebase and also has a fixed supply of 21 million like the apex cryptocurrency.

FORM, the token of the newly-branded GameFi network Four, ranked third on the weekly gainers list. The coin hit an all-time high of $2.62 last week amid growing interest around its newest product, Four.meme, an ecosystem for meme coins.

| Cryptocurrency | Gains +/- | Price |

| Cronos CRO/USD | +21.89% | $0.1001 |

| Zcash ZEC/USD | +21.86% | $38.13 |

| Four FORM/USD | +21.15% | $2.38 |

See Also: Shiba Inu Attracts More Diamond Hands Than Bitcoin, Ethereum But Is High Whale Concentration Something To Lose Sleep Over?

Elsewhere, the sentiment was gloomy. Bitcoin lost over 5% of its value, and Ethereum ETH/USD reeled under double-digit losses.

Top altcoins such as XRP XRP/USD and Solana SOL/USD also had declines of 14.83% and 10.06%, respectively.

Comparatively, meme heavyweights Dogecoin DOGE/USD and Shiba Inu SHIB/USD were less damaged, falling 5.80% and 5.75%, respectively.

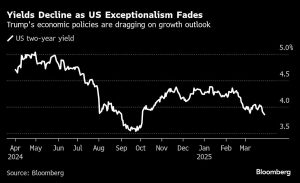

Risk appetite has shrunk ahead of President Donald Trump’s tariff “Liberation Day,” with cryptocurrencies following declines in equities.

The total cryptocurrency market capitalization contracted 6% over the week to $2.64 trillion.

Photo by CMP_NZ on Shutterstock

Read Next:

Momentum–

Growth–

Quality–

Value–

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.