Every market crash feels like a crisis, but what if it’s your greatest wealth-building opportunity? History has proven it repeatedly, yet fear keeps many investors from seizing the moment. The opportunity lies not in predicting crashes but in courageously navigating the storm.

Historical perspective: Resilience wins

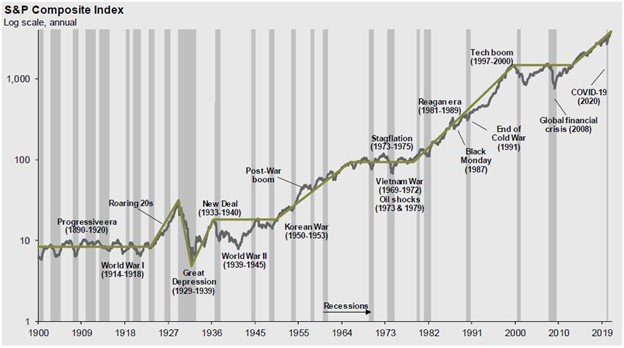

History makes one thing clear: you shouldn’t go rogue, but you should remain resilient. The following chart shows the market’s trajectory over the past 120 years.

The vertical gray lines represent recessionary periods, with the three most recent being the dot-com bust (2001), the financial crisis meltdown (2008), and the COVID-19 pandemic (2020).

Take note: through all the economic setbacks, wars, and dozens of recessions, the market’s trend line over the 120 years is upward. If you believe, as I do, that America’s economy and the global markets will continue upward over the long term, then in the short term, stay the course.

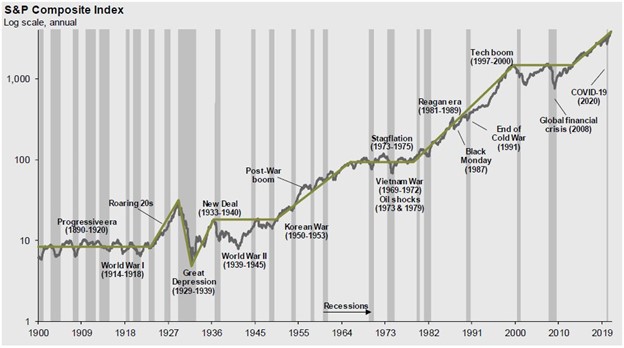

Imagine flipping a coin where three out of four times, you win. That’s how often the stock market has delivered positive annual returns over the past 45 years. During downturns, many ask, “Will the market recover? (Spoiler: It always has.) The better question to ask yourself is: “Will I still be in the game as the market rebounds?”

Market volatility reality check

But know this: it won’t be a smooth ride. Over those 45 years, the market had an intra-year average decline of 14.1%. This means that even in the 34 calendar years with positive returns, significant declines occurred at some point during the year.

Think back to 2020. As the COVID-19 pandemic triggered a shocking 34% market free-fall in just weeks, fear and uncertainty dominated investor sentiment. Yet those who remained disciplined and stayed invested not only weathered the storm but also enjoyed the subsequent surge, with the market closing up 16% for the year.

In stark contrast, those who panicked and sold near the bottom locked in their losses, missing one of the most remarkable market rebounds in modern history.

The odds are on your side for being invested over the long term with a healthy dose of stocks. Short-term volatility, however, makes timing the market a loser’s game. Stick to your long-term plan. Stay the course.

The Entrepreneur’s mindset: Opportunity in uncertainty

Market downturns don’t just create challenges, they forge legends. History proves that when the economy stumbles, innovation surges. Some of the world’s most successful companies weren’t just built during crises; they were born because of them.

While most people saw chaos, these visionaries saw opportunity. They understood that innovation doesn’t stop in downturns, it accelerates:

- 1893 – General Electric: While the Panic of 1893 crushed businesses nationwide, Thomas Edison’s relentless drive led to the formation of GE. More than a century later, his vision still powers the world.

- 1908 – General Motors: While the Panic of 1907 triggered a 50% stock market decline, William Durant saw an opening and created GM, redefining the automobile industry.

- 1929 – Walt Disney Productions: Just as the Great Depression began, two brothers introduced the world to Mickey Mouse. From hardship, an entertainment empire was born.

- 1971 – Federal Express: As a recession ended and businesses doubted the reliability of overnight delivery, Fred Smith pressed forward, launching FedEx and reshaping global logistics.

- 1975 – Microsoft: With the stock market still reeling from a bear market and an oil crisis, two young programmers bet on the future of personal computing. Today, the company is worth trillions.

- 2008 – The Great Recession’s Entrepreneurs: While Wall Street crumbled, the seeds of innovation were planted. Uber, Venmo, Square, and Instagram all emerged, transforming the way we live and transact.

- 2020 – A Pandemic and a Startup Boom: The fastest market decline in decades sent shockwaves through the world but entrepreneurs stepped forward, launching businesses at record levels. Some of today’s most promising companies were born or reinvented in the uncertainty of a global crisis. One standout is Wiz, a cybersecurity startup founded in 2020, which just made history by securing a remarkable $32 billion acquisition by Google.

From fear to fortune: A simple framework

Market downturns test your resolve, but a disciplined approach turns uncertainty into opportunity:

- Plan: Define your long-term strategy based on your goals, risk tolerance, and timeline.

- Course-Correct: Adjust as needed—not out of fear, but in response to life changes and financial milestones.

- Repeat: Keep investing, trust the process, and let compounding do its work in up and down markets.

Look fear in the face

Down markets don’t ask if you’re ready; they test your mettle. Those who stay invested aren’t just survivors; they’re the biggest winners. You just won’t recognize that fact until after the market rebounds.

Patience and discipline are key virtues when it comes to long-term investing. And like the entrepreneurs that came before us, you also must learn to look fear in the face and not flinch.

Every bear market plants the seeds of the next bull market. But only those who stay invested will reap the rewards.

Sideline spectator or wealth creator?

Market downturns don’t just destroy wealth, they create it. Long-term investors who maintain discipline during turbulent times consistently outperform those who panic and sell.

Compounding portfolio growth rewards patience. The market rewards courage, not capitulation.

As inevitable market downturns unfold, will fear keep you on the sidelines, or are you ready to seize the opportunity?

As always, invest often and wisely. Thank you for reading.

My book, Wealth Your Way is available on Amazon, and consider subscribing to my free newsletter.

The content is for informational purposes only. It is not intended to be, nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to financial freedom!

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.