We recently published a list of 10 Firms Mirror Wall Street Slump on Thursday. In this article, we are going to take a look at where AppLovin Corp. (NASDAQ:APP) stands against other firms that mirrored Wall Street slump on Thursday.

Wall Street’s shares traded lower anew on Thursday, as investor sentiment continued to be dampened by President Donald Trump’s fresh tariffs on US imports.

The tech-heavy Nasdaq fell the heaviest, down 0.53 percent, followed by the Dow Jones at 0.37 percent, and the S&P 500 at 0.33 percent.

The market decline was mainly weighed down by the performance of car manufacturers after Trump announced a 25-percent tariff on all vehicles imported beginning April 2.

Ten companies mirrored the broader market decline. In this article, we listed Thursday’s 10 worst performers and detailed the reasons behind their drop.

To come up with the list, we considered only the stocks with a $2-billion market capitalization and $5 million in trading volume.

A close-up of a mobile device, showing an advertiser reaching out to a consumer via a software-based platform.

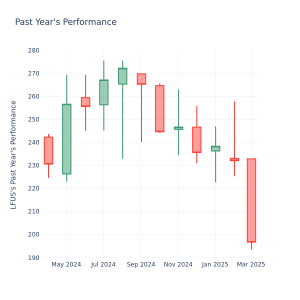

AppLovin dropped its share prices for a second day, tumbling 20.12 percent to end at $261.70 apiece after another short seller accused the company of engaging in practices that could lead to deplatforming.

According to Muddy Waters Research, a significant portion of APP’s e-commerce conversions might be retargeting rather than new sales, with an estimated incrementality of only 25 to 35 percent.

The report raised concerns about APP’s methods in identifying high-value users, suggesting that it might be extracting proprietary IDs from major platforms such as Facebook, Snap, TikTok, Reddit, and Google.

Muddy Waters said this could be a violation of its terms and service and could result in APP being deplatformed, similar to what happened with Cheetah Mobile.

APP is currently embroiled in a class action lawsuit over allegations of possible securities violations.

According to the lawsuit, APP provided investors with material information concerning its financial growth and stability.

APP has yet to issue any statement about the allegations.

Overall, APP ranks 2nd on our list of firms that mirrored Wall Street slump on Thursday. While we acknowledge the potential of APP as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is as promising as APP but trades at less than 5 times its earnings, check out our report about the cheapest AI stock.