Is the U.S. stock market’s oversold rally already failing? After the S&P 500 Index SPX tumbled 9% in less than a month, the U.S. stock market became oversold, spurring a rally back to the benchmark’s declining 20-day moving average (MA).

Oversold rallies typically die out after reaching the 20-day MA. SPX also faces resistance at 5,800. But there’s support at the recent lows, in the 5,500-5,540 area. Moreover, there should be support near 5,400, dating back to last September’s lows.

On a positive note, there has been a confirmed McMillan Volatility Band (MVB) buy signal, as of March 24. It is marked with a green “B” on the SPX chart above. These are intermediate-term signals. The target is for SPX to trade at the +4σ “modified Bollinger band,” which is currently at 6,040 and declining. The buy signal would be stopped out if SPX were to close below the -4σ band, which is currently at 5,400 and declining. This is the first confirmed signal from the MVB indicator since the buy signal last August.

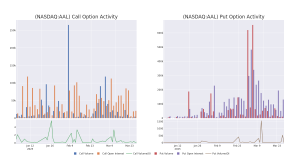

Equity-only put-call ratios have raced higher while the selling has occurred in SPX. A rising put-call ratio is bearish for stocks. From the charts below, you can see that both ratios appear to be peaking.

In fact, the weighted ratio has generated a buy signal, meaning that the computer programs we use to analyze these charts are “saying” the peak has been reached, and the ratio is declining now. So a green “B” has been placed on that chart. However, the standard ratio has not clearly peaked. In fact, the computer analysis is failing to call this a buy signal. So, while the height of the ratios on their charts indicates an oversold stock market, there won’t be a confirmed buy signal from the standard ratio until it, too, begins to trend downward.

Market breadth has been deteriorating, so the previous breadth-oscillator oversold buy signals are in jeopardy. So far, they have withstood the onslaught and remain bullish, but another day or two of negative breadth will reverse that.