Whales with a lot of money to spend have taken a noticeably bearish stance on Dell Technologies.

Looking at options history for Dell Technologies DELL we detected 74 trades.

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 32% with bearish.

From the overall spotted trades, 45 are puts, for a total amount of $5,563,904 and 29, calls, for a total amount of $2,587,275.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $60.0 and $145.0 for Dell Technologies, spanning the last three months.

Insights into Volume & Open Interest

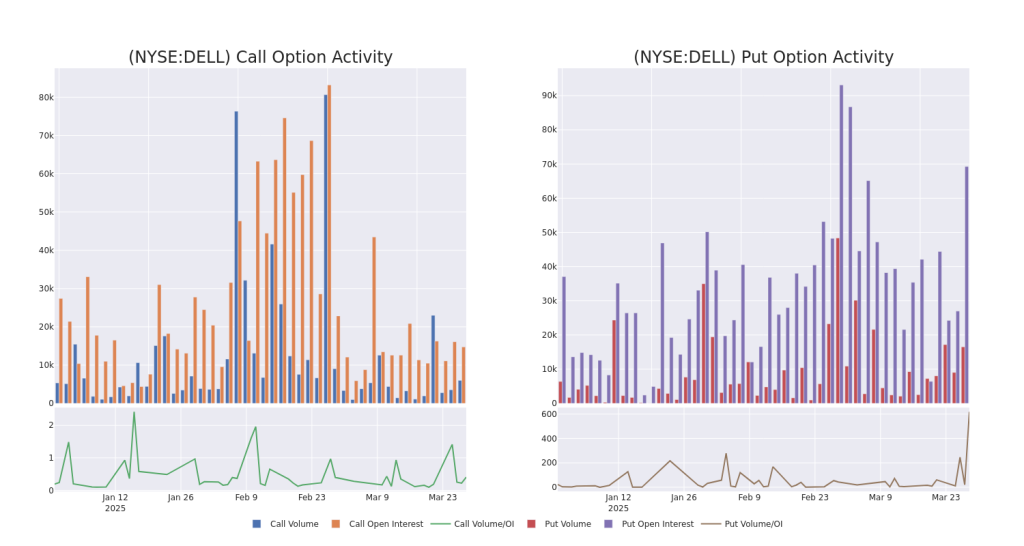

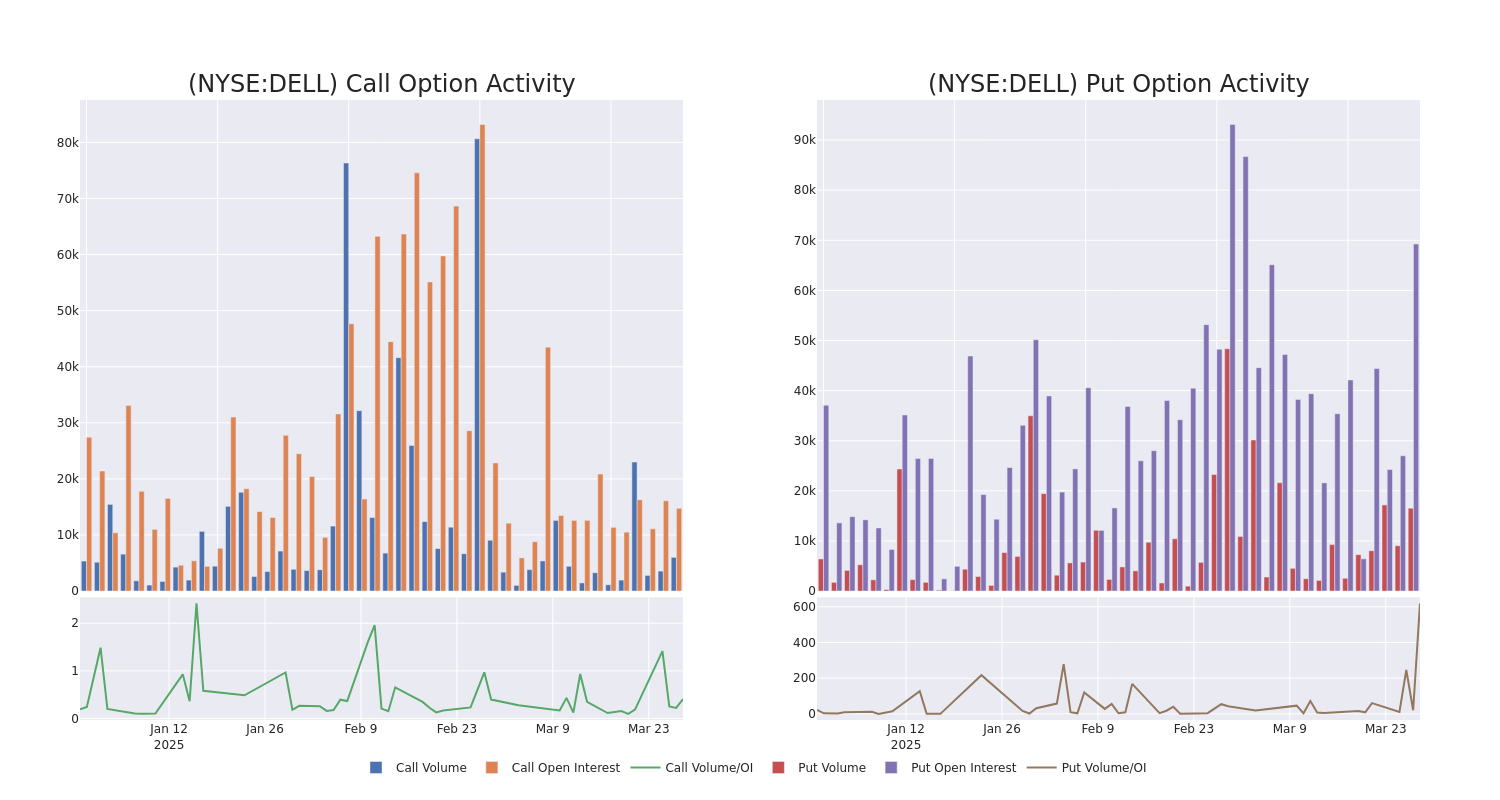

In terms of liquidity and interest, the mean open interest for Dell Technologies options trades today is 1866.47 with a total volume of 22,309.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dell Technologies’s big money trades within a strike price range of $60.0 to $145.0 over the last 30 days.

Dell Technologies Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | PUT | TRADE | NEUTRAL | 01/15/27 | $12.1 | $11.4 | $11.75 | $75.00 | $940.0K | 350 | 1.5K |

| DELL | PUT | TRADE | NEUTRAL | 12/17/27 | $14.95 | $10.5 | $12.4 | $70.00 | $719.2K | 1 | 580 |

| DELL | PUT | TRADE | BULLISH | 01/16/26 | $9.1 | $8.85 | $8.85 | $80.00 | $708.0K | 4.9K | 801 |

| DELL | PUT | SWEEP | BULLISH | 01/15/27 | $12.25 | $11.7 | $11.75 | $75.00 | $512.3K | 350 | 438 |

| DELL | CALL | TRADE | NEUTRAL | 12/18/26 | $8.95 | $8.6 | $8.8 | $145.00 | $484.0K | 39 | 551 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium and commercial personal computers and enterprise on-premises data center hardware. It holds top-three market shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

Having examined the options trading patterns of Dell Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Dell Technologies

- Currently trading with a volume of 5,463,788, the DELL’s price is down by -4.82%, now at $92.42.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 62 days.

Expert Opinions on Dell Technologies

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $138.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Dell Technologies with a target price of $150.

* An analyst from Wells Fargo persists with their Overweight rating on Dell Technologies, maintaining a target price of $150.

* Consistent in their evaluation, an analyst from Loop Capital keeps a Buy rating on Dell Technologies with a target price of $130.

* An analyst from Barclays persists with their Equal-Weight rating on Dell Technologies, maintaining a target price of $116.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Dell Technologies with a target price of $145.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dell Technologies with Benzinga Pro for real-time alerts.

Momentum25.30

Growth49.64

Quality–

Value40.04

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.