Investors with a lot of money to spend have taken a bearish stance on Verona Pharma VRNA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don’t know. But when something this big happens with VRNA, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 8 options trades for Verona Pharma.

This isn’t normal.

The overall sentiment of these big-money traders is split between 25% bullish and 75%, bearish.

Out of all of the options we uncovered, 7 are puts, for a total amount of $517,086, and there was 1 call, for a total amount of $25,000.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $60.0 and $65.0 for Verona Pharma, spanning the last three months.

Insights into Volume & Open Interest

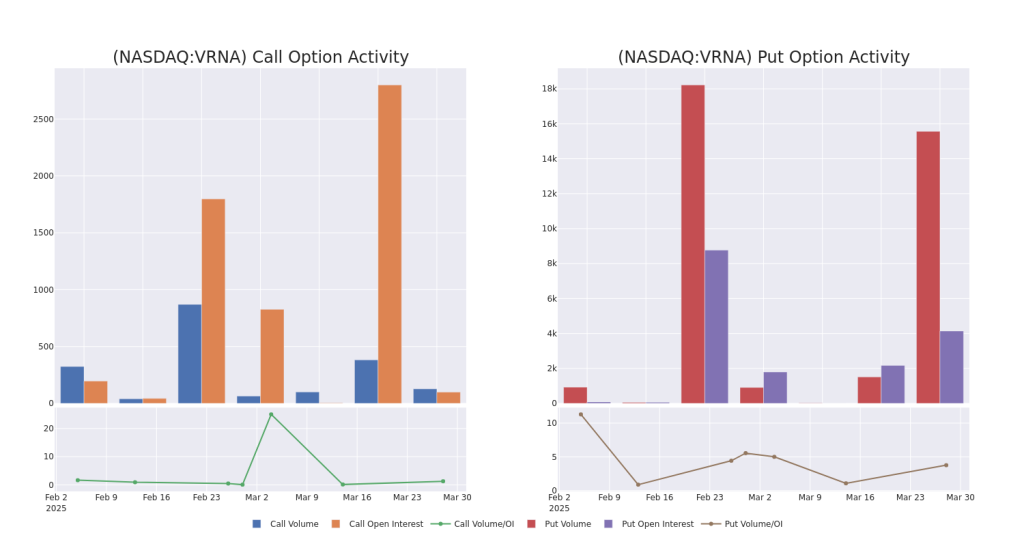

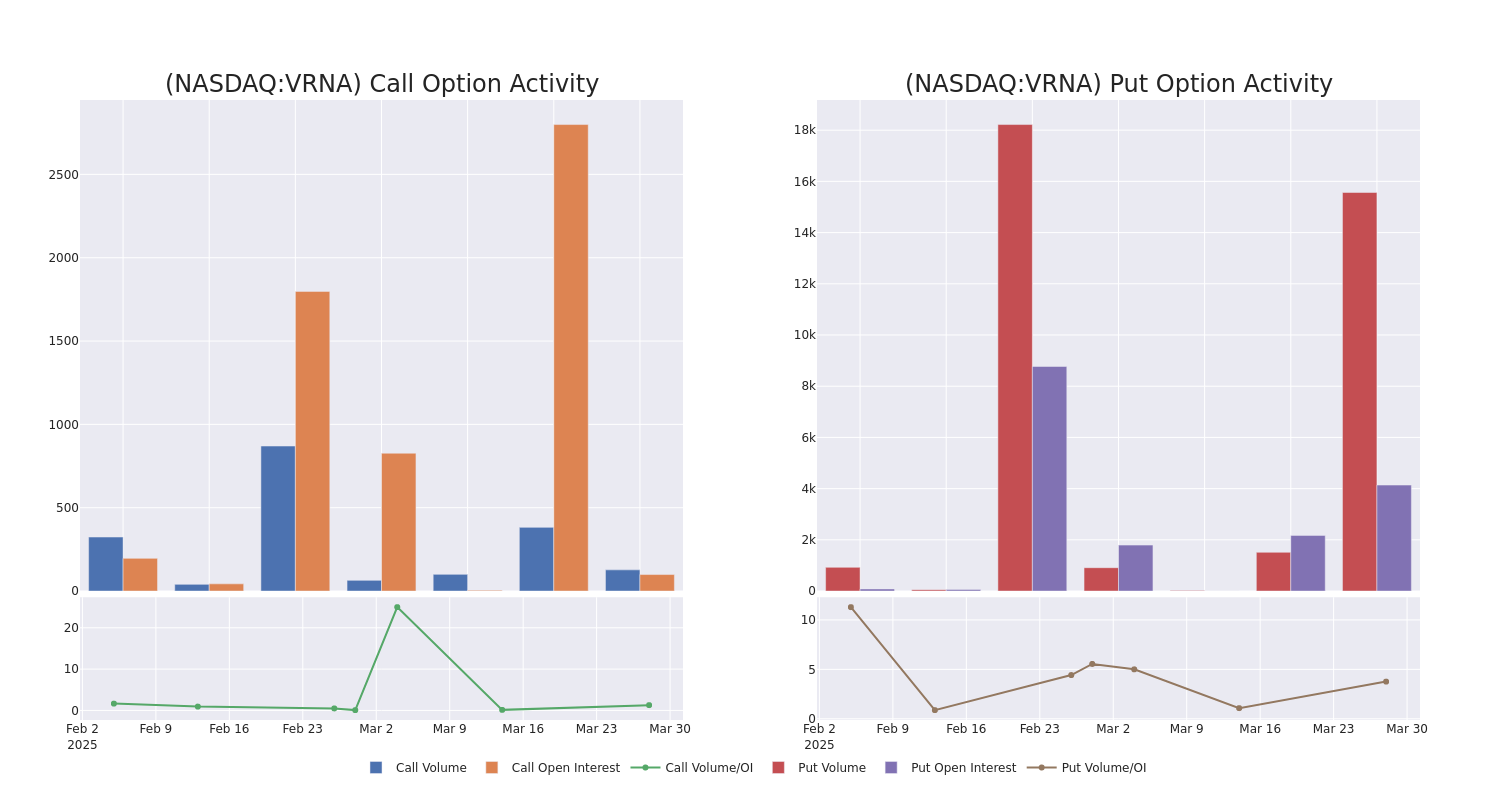

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Verona Pharma’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Verona Pharma’s significant trades, within a strike price range of $60.0 to $65.0, over the past month.

Verona Pharma Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRNA | PUT | SWEEP | BEARISH | 04/17/25 | $2.2 | $1.6 | $2.2 | $60.00 | $159.5K | 4.1K | 1.5K |

| VRNA | PUT | SWEEP | BEARISH | 04/17/25 | $3.6 | $3.0 | $3.0 | $60.00 | $118.7K | 4.1K | 3.6K |

| VRNA | PUT | TRADE | BEARISH | 04/17/25 | $2.55 | $1.6 | $2.4 | $60.00 | $66.0K | 4.1K | 2.4K |

| VRNA | PUT | SWEEP | BEARISH | 04/17/25 | $1.95 | $1.35 | $1.95 | $60.00 | $53.8K | 4.1K | 296 |

| VRNA | PUT | SWEEP | BEARISH | 04/17/25 | $2.8 | $2.7 | $2.7 | $60.00 | $49.1K | 4.1K | 3.0K |

About Verona Pharma

Verona Pharma PLC is a clinical-stage biopharmaceutical company focused on developing and commercializing therapeutics for the treatment of respiratory diseases with unmet medical needs. The company is currently focusing on developing its Ensifentrine product candidate, which will treat chronic obstructive pulmonary disease (COPD), cystic fibrosis (CF), and other respiratory diseases, including asthma.

In light of the recent options history for Verona Pharma, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Verona Pharma

- Currently trading with a volume of 598,786, the VRNA’s price is down by -2.73%, now at $62.75.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 41 days.

Expert Opinions on Verona Pharma

2 market experts have recently issued ratings for this stock, with a consensus target price of $84.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from HC Wainwright & Co. continues to hold a Buy rating for Verona Pharma, targeting a price of $75.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Verona Pharma, targeting a price of $93.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Verona Pharma options trades with real-time alerts from Benzinga Pro.

Momentum99.11

Growth–

Quality–

Value3.75

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.