Super Micro Computer (SMCI) may have cleared up its financial reporting issues, but SMCI stock remains under pressure from competitive and demand concerns in the AI data center market.

On Tuesday, Joe Tsai, the chairman of Chinese e-commerce giant Alibaba (BABA), suggested that the artificial intelligence data center market is in a bubble. He said companies were investing astounding amounts ahead of actual demand.

↑

X

Why Russia And China’s AI Partnership Is A Real Threat To U.S. Dominance

SMCI stock and other companies exposed to the AI megatrend fell following his comments.

On Monday, Goldman Sachs analyst Michael Ng downgraded SMCI stock to sell from neutral and cut his price target to 32 from 40.

On the stock market today, SMCI stock dropped 8.9% to close at 37.04.

In a client note, Ng said he views the risk/reward for the stock as unfavorable. The company, better known as Supermicro, faces intensifying competition in the market for AI servers, he said. Supermicro’s gross profit margins are likely to decline in the current environment, he said.

U.S. competitors in the data center market include Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE).

On Friday, JPMorgan analyst Samik Chatterjee upgraded SMCI stock to neutral from underweight, or sell. He also increased his price target to 45 from 35.

However, Chatterjee remains cautious on Supermicro because of concerns about “an increasingly competitive landscape driving aggressive pricing and gross margin pressures.”

On the plus side, he said Supermicro has cycled past the uncertainty related to its delinquent financial reports. Supermicro filed those late reports with the U.S. Securities and Exchange Commission on Feb. 25.

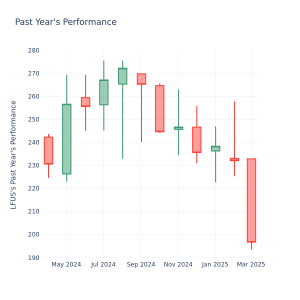

SMCI stock was a highflier until it was hit with accounting concerns in 2024. It reached its all-time high of 122.90 in March 2024.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Nvidia’s China Sales Face New Threat: Beijing’s Energy-Use Rules

U.S. Trade Restrictions Remain Big Overhang On AI Chip Stocks

How To Know It’s Time To Sell Your Favorite Stock