Investors with a lot of money to spend have taken a bearish stance on Snowflake SNOW.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SNOW, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Snowflake.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 55%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $139,035, and 6 are calls, for a total amount of $379,390.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $210.0 for Snowflake during the past quarter.

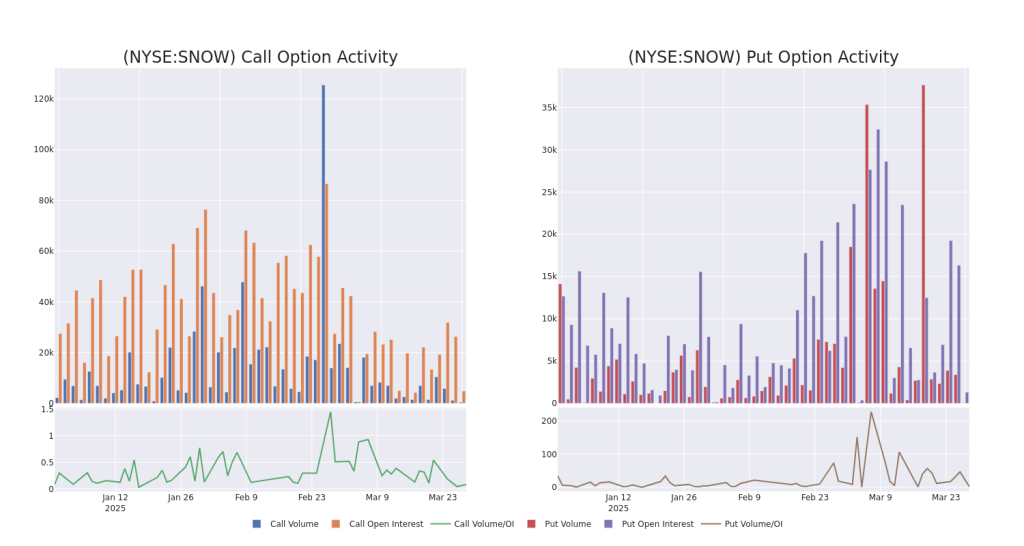

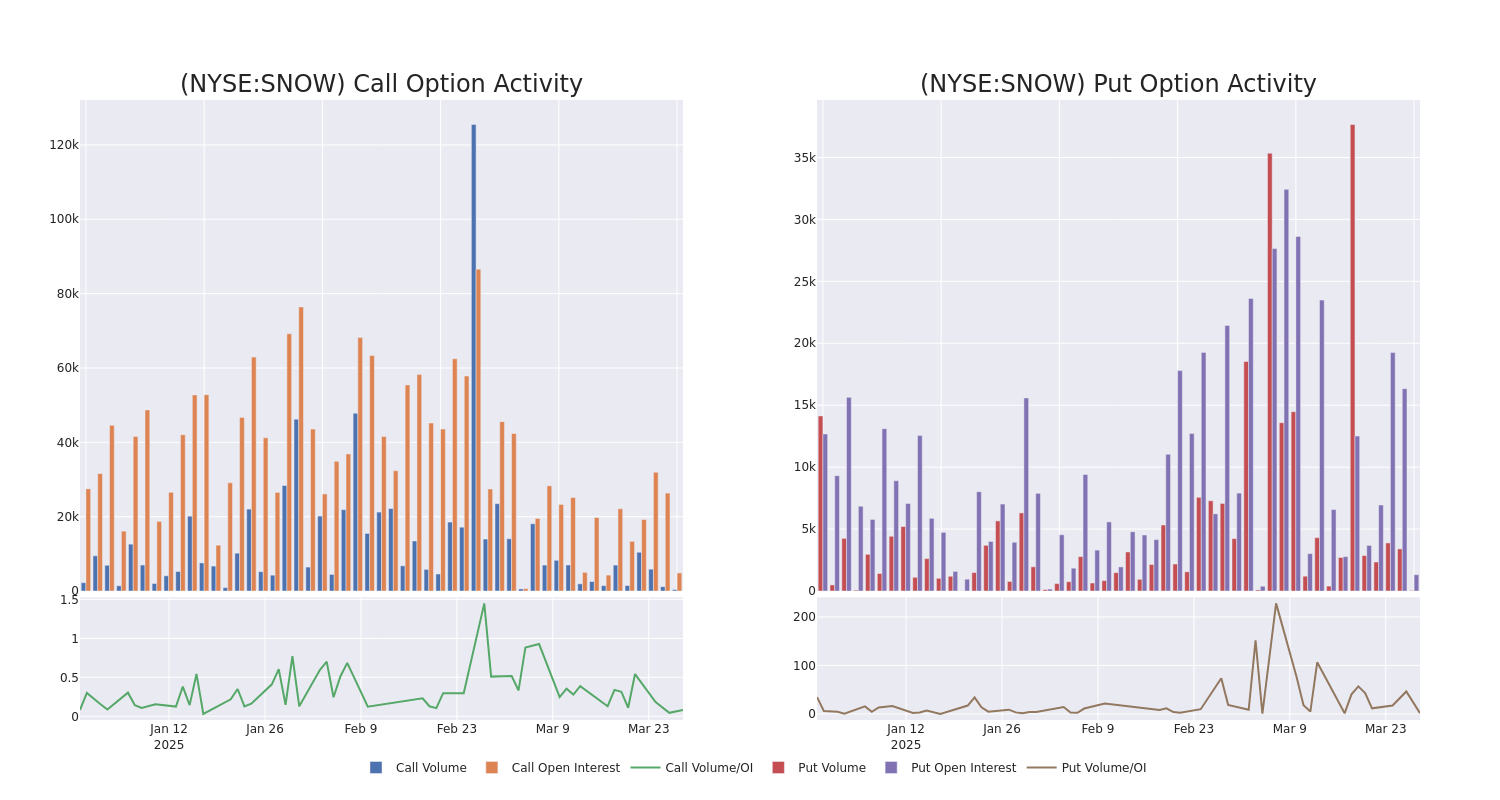

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Snowflake stands at 773.38, with a total volume reaching 412.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Snowflake, situated within the strike price corridor from $75.0 to $210.0, throughout the last 30 days.

Snowflake Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | CALL | SWEEP | BEARISH | 01/16/26 | $26.3 | $25.1 | $25.1 | $160.00 | $125.5K | 1.4K | 101 |

| SNOW | CALL | SWEEP | BEARISH | 01/16/26 | $26.2 | $25.1 | $25.1 | $160.00 | $125.5K | 1.4K | 51 |

| SNOW | PUT | SWEEP | BEARISH | 07/18/25 | $57.0 | $56.35 | $56.85 | $210.00 | $51.1K | 13 | 9 |

| SNOW | PUT | TRADE | NEUTRAL | 04/11/25 | $31.8 | $30.0 | $30.81 | $185.00 | $49.2K | 21 | 16 |

| SNOW | CALL | TRADE | BULLISH | 01/16/26 | $83.4 | $79.95 | $83.4 | $75.00 | $41.7K | 45 | 0 |

About Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that went public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500. Snowflake’s data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake’s data sharing capability allows enterprises to buy and ingest data, while its data solutions can be hosted on various public clouds.

After a thorough review of the options trading surrounding Snowflake, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Snowflake’s Current Market Status

- Currently trading with a volume of 1,155,039, the SNOW’s price is down by -1.74%, now at $154.25.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 54 days.

Professional Analyst Ratings for Snowflake

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $210.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Snowflake with a target price of $200.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Snowflake with a target price of $220.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Snowflake with a target price of $221.

* Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Snowflake with a target price of $210.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Snowflake with a target price of $203.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snowflake with Benzinga Pro for real-time alerts.

Momentum86.62

Growth73.32

Quality–

Value8.93

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.